Get the free How to give to family and friendsand avoid gift taxes ...

Show details

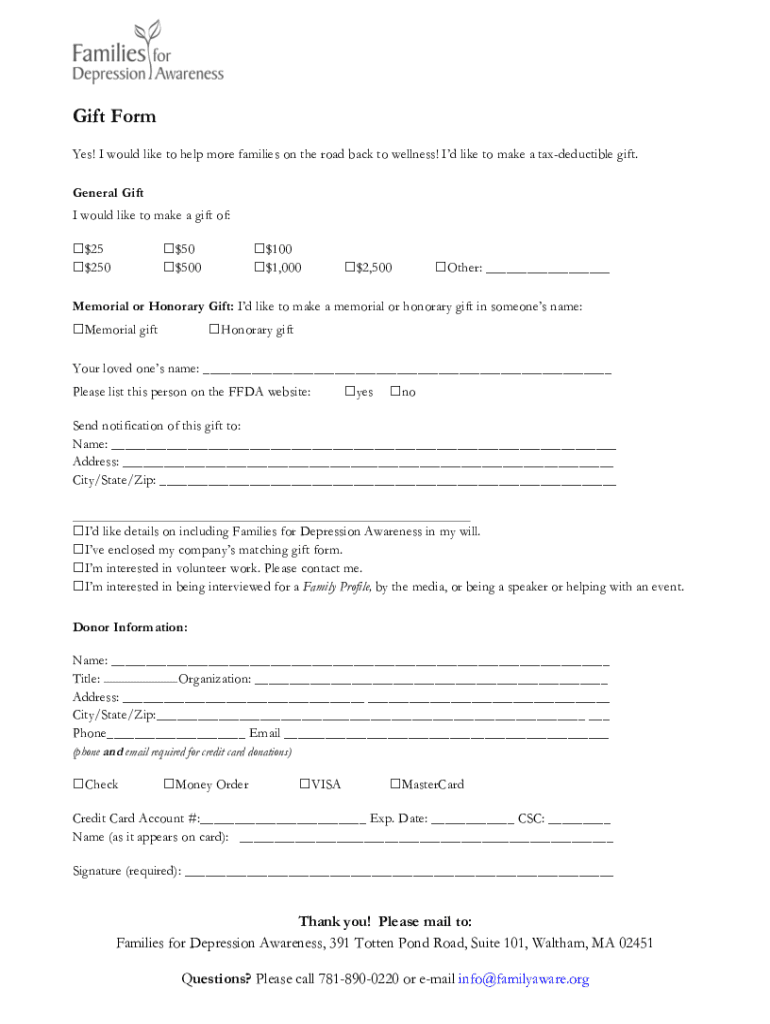

Gift Form Yes! I would like to help more families on the road back to wellness! I'd like to make a tax-deductible gift. General Gift I would like to make a gift of: $$$$$$$25250505001001,0002,500Other:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign how to give to

Edit your how to give to form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your how to give to form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing how to give to online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit how to give to. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out how to give to

How to fill out how to give to

01

Begin by collecting all the necessary information about the person you want to give to. This may include their name, age, gender, and any specific preferences they might have.

02

Consider the occasion or reason for giving the gift. This will help you choose a suitable item or experience to present.

03

Take into account the budget you have set for giving the gift. It is important to determine a spending limit to avoid overspending.

04

Research the person's interests, hobbies, or any special needs they might have. This will aid in selecting a gift that they will truly appreciate.

05

Choose a thoughtful and meaningful gift based on the gathered information and budget. It could be something they have mentioned wanting, an item related to their passion, or an experience they have expressed interest in.

06

Wrap the gift nicely or present it in an appealing manner. Aesthetically pleasing packaging adds to the excitement of receiving a gift.

07

Consider including a personal note or card to express your sentiments. Handwritten messages can make the gift more heartfelt.

08

Finally, hand over the gift in a thoughtful and respectful manner. Take into consideration the recipient's preferences for receiving gifts – some people prefer private exchanges, while others enjoy surprises in a group setting.

09

Observe the recipient's reaction and appreciate their response. This will allow you to gauge their satisfaction and ensure that the gift was well-received.

10

Remember to follow up with a thank-you note or message after giving the gift. Showing gratitude for their appreciation further enhances the gesture.

Who needs how to give to?

01

Anyone who wants to express their appreciation or celebrate a special occasion can benefit from knowing how to give a gift.

02

Individuals who want to show affection, gratitude, or support towards someone can use these guidelines for presenting a thoughtful gift.

03

Giving gifts is not limited to personal relationships; professionals, organizations, or businesses can also utilize these instructions when giving gifts to clients, colleagues, or employees.

04

Overall, anyone seeking to make someone else feel valued, loved, or acknowledged can find these instructions useful.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit how to give to online?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your how to give to and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I sign the how to give to electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I fill out how to give to on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your how to give to, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is how to give to?

How to give to refers to the guidelines and processes involved in making charitable contributions or gifts, often including documentation and reporting requirements.

Who is required to file how to give to?

Individuals and organizations that make gifts or charitable contributions above a certain threshold are typically required to file how to give to.

How to fill out how to give to?

To fill out how to give to, one must provide details such as the amount given, the recipient's information, and any relevant identification numbers, often using specific forms provided by tax authorities.

What is the purpose of how to give to?

The purpose of how to give to is to ensure that charitable contributions are properly documented for tax deductions, compliance, and to promote transparency in charitable giving.

What information must be reported on how to give to?

Information typically required includes the date of the gift, the amount, the recipient's name and address, and the relationship to the donor, if applicable.

Fill out your how to give to online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Give To is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.