OR Publication OR-40-EXT 2020 free printable template

Show details

2020 Publication OR-40-EXT Page 1 of 2, 150-101-165 (Rev. 08-27-20, very. 01) Oregon Department of Revenue Instructions for Automatic Extension of Time to File Oregon Individual Income Tax Return

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OR Publication OR-40-EXT

Edit your OR Publication OR-40-EXT form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OR Publication OR-40-EXT form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OR Publication OR-40-EXT online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OR Publication OR-40-EXT. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OR Publication OR-40-EXT Form Versions

Version

Form Popularity

Fillable & printabley

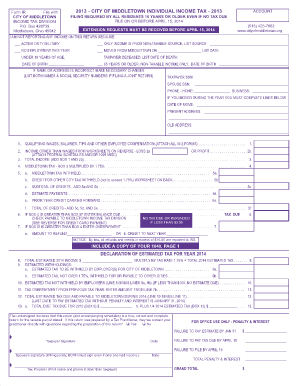

How to fill out OR Publication OR-40-EXT

How to fill out OR Publication OR-40-EXT

01

Gather all necessary personal information, including your name, address, and Social Security number.

02

Obtain your income information from all sources, including W-2 forms and 1099s.

03

Fill out the top section of the OR Publication OR-40-EXT form with your identifying information.

04

In the income section, report your total income as required.

05

Calculate your adjusted gross income (AGI) if necessary.

06

Follow the instructions for any applicable deductions or credits.

07

Review the payment options for any tax due and fill out the appropriate section.

08

Sign and date the form at the bottom before submission.

09

Submit the completed form to the appropriate tax authority by the deadline.

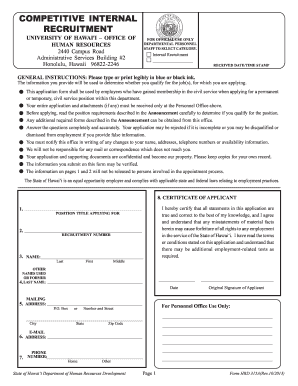

Who needs OR Publication OR-40-EXT?

01

Taxpayers who require an extension on their Oregon state income tax filings.

02

Individuals who are unable to complete their tax return by the original due date.

03

Those anticipating changes in income or needing more time to gather necessary documents.

Fill

form

: Try Risk Free

People Also Ask about

What is a Form 40 in taxes?

The IRS 1040 form is one of the official documents that U.S. taxpayers use to file their annual income tax return. The 1040 form is divided into sections where you report your income and deductions to determine the amount of tax you owe or the refund you can expect to receive.

What is a Form 40 Oregon resident tax return?

Use Form OR-40 if you're a full-year Oregon resident. Use Form OR-40-P if any ONE of the following is true: You're a part-year resident. You're filing jointly and one of you is a full-year Ore- gon resident and the other is a part-year resident.

What is Oregon residency tax purposes?

You're also considered to be an Oregon resident if you maintain an Oregon residence and spend more than 200 days in the state during the tax year. You're still a full-year resident if you temporarily move out of Oregon, and then move back.

Do I need to file Oregon resident tax return?

Full-year resident You need to file if your gross income is more than the amount shown below for your filing status. Even if you don't have a filing requirement, you must file a return if you want to claim a refund of Oregon income tax withheld from your pay or you qualify for a refundable credit.

Why did I get a 1040-ES payment voucher?

You may get these vouchers if you're self-employed or had an uncharacteristic spike in your income this year. For example, you sold stock or took a large distribution from your retirement plan. You're not required to make estimated tax payments; we're just suggesting it based on the info in your return.

What is the Form 40 Oregon resident tax return?

Use Form OR-40 if you're a full-year Oregon resident. Use Form OR-40-P if any ONE of the following is true: You're a part-year resident. You're filing jointly and one of you is a full-year Ore- gon resident and the other is a part-year resident.

How do I pay Oregon or 40 V?

Mailed payments: Make your check, money order, or cashier's check pay- able to the Oregon Department of Revenue. Write “Form OR-40-V,” your daytime phone, the last four digits of your Social Security number (SSN) or individual taxpayer iden- tification number (ITIN), and the tax year on the payment. Don't mail cash.

What is the safe harbor payment for Oregon estimated tax payments?

Your required annual payment is the lesser of: • Ninety percent (90%) of the tax after all credits shown on your 2022 Oregon return; or • One hundred percent (100%) of the tax after all credits shown on your 2021 Oregon return (also known as “safe harbor”).

What is the standard deduction for Oregon state income tax?

For the 2021 tax year, Oregon's standard deduction allows taxpayers to reduce their taxable income by $2,350 for single filers, $4,700 for those married filing jointly, $3,780 for heads of household, and $4,700 for qualifying widowers.

What is the or 40N instruction?

Form OR-40N Instructions requires you to list multiple forms of income, such as wages, interest, or alimony . We last updated the Individual Income Tax Return Instructions for Nonresident / Part-year Resident in January 2023, so this is the latest version of Form OR-40N Instructions, fully updated for tax year 2022.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete OR Publication OR-40-EXT online?

pdfFiller makes it easy to finish and sign OR Publication OR-40-EXT online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make edits in OR Publication OR-40-EXT without leaving Chrome?

OR Publication OR-40-EXT can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I edit OR Publication OR-40-EXT on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing OR Publication OR-40-EXT right away.

What is OR Publication OR-40-EXT?

OR Publication OR-40-EXT is a tax form used by residents of Oregon to apply for an extension of time to file their state income tax returns.

Who is required to file OR Publication OR-40-EXT?

Taxpayers who need additional time to file their Oregon state income tax returns are required to file OR Publication OR-40-EXT.

How to fill out OR Publication OR-40-EXT?

To fill out OR Publication OR-40-EXT, taxpayers must provide their personal information, estimate their tax liability, and indicate the amount of any payment they are submitting with the extension request.

What is the purpose of OR Publication OR-40-EXT?

The purpose of OR Publication OR-40-EXT is to grant taxpayers an extension for filing their Oregon state income tax returns, allowing them additional time to prepare their tax documents.

What information must be reported on OR Publication OR-40-EXT?

Information that must be reported on OR Publication OR-40-EXT includes the taxpayer's name, address, Social Security number, estimated tax liability, and any payments being made with the extension.

Fill out your OR Publication OR-40-EXT online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OR Publication OR-40-EXT is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.