Wellmark C-5321 2011-2025 free printable template

Show details

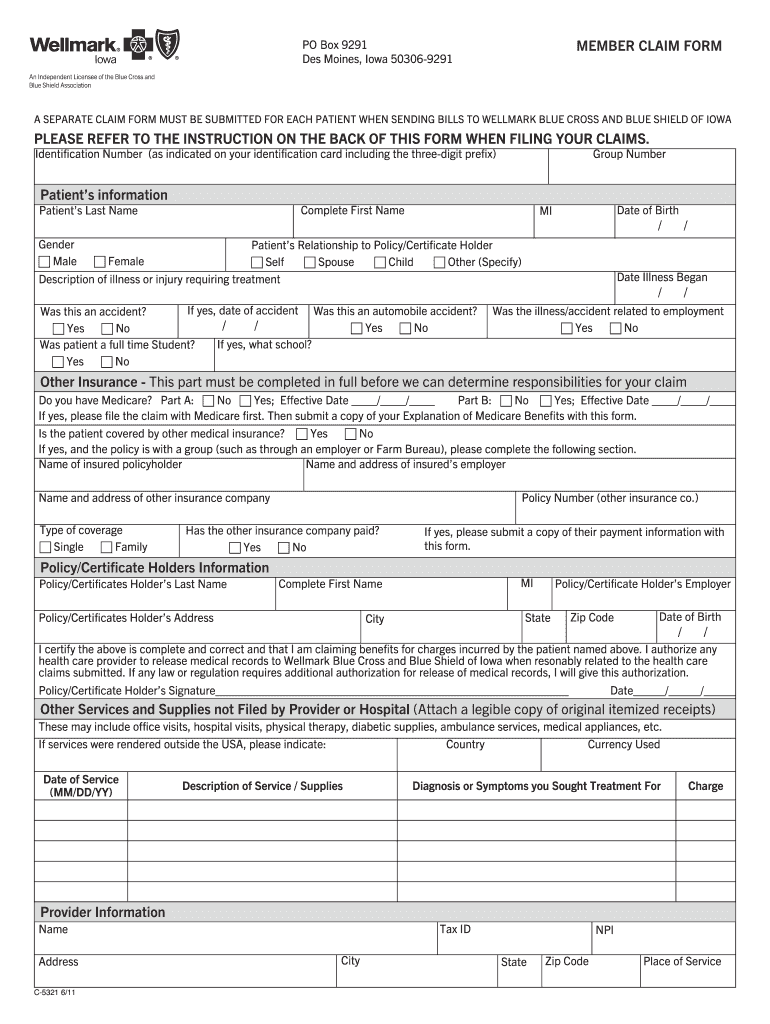

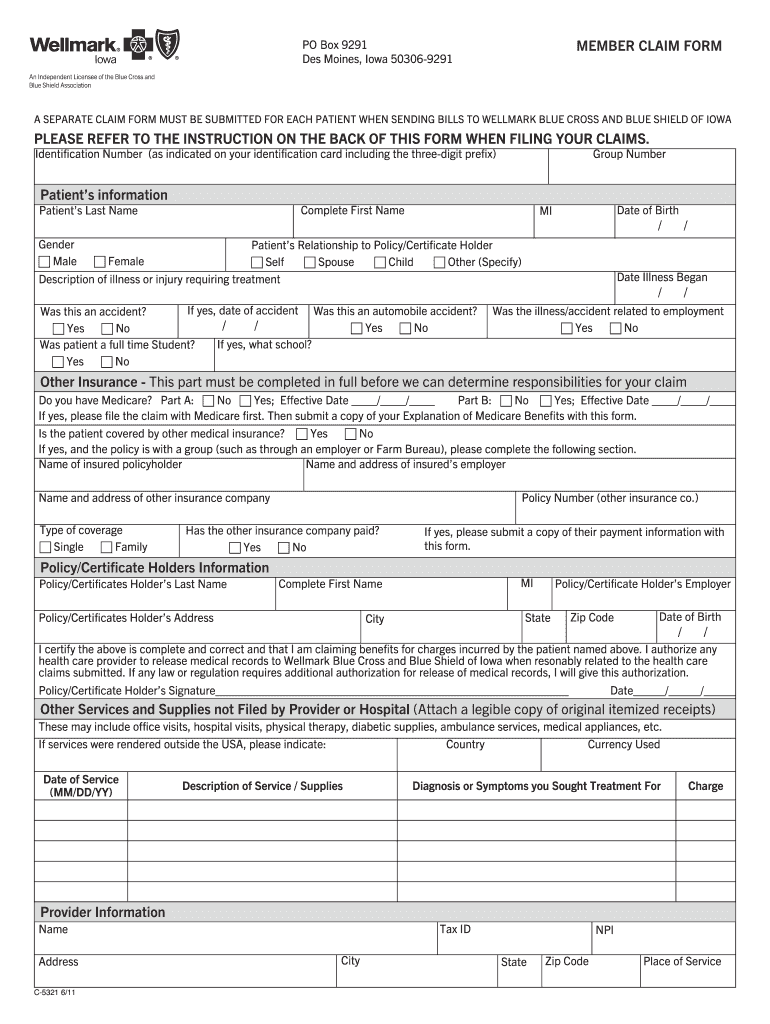

Has the other insurance company paid If yes please submit a copy of their payment information with this form. Policy/Certificate Holders Information State City Zip Code I certify the above is complete and correct and that I am claiming benefits for charges incurred by the patient named above. I authorize any health care provider to release medical records to Wellmark Blue Cross and Blue Shield of Iowa when resonably related to the health care cla...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign Wellmark C-5321

Edit your Wellmark C-5321 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your Wellmark C-5321 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing Wellmark C-5321 online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit Wellmark C-5321. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out Wellmark C-5321

How to fill out Wellmark C-5321

01

Obtain a blank Wellmark C-5321 form from the Wellmark website or your insurance representative.

02

Fill in the patient’s personal information including their full name, date of birth, and contact information at the top of the form.

03

Provide the insurance information of the patient, including their policy number and group number.

04

Complete the section regarding the services received, including the dates of service, the description of services, and the provider’s details.

05

If applicable, include any additional information related to the claim in the designated section.

06

Review the completed form for accuracy, ensuring all necessary fields are filled out.

07

Sign and date the form in the designated area to confirm the information is accurate.

08

Submit the form to Wellmark via the specified submission method (mail, fax, or electronic submission).

Who needs Wellmark C-5321?

01

Individuals receiving medical services that are covered under Wellmark insurance plans.

02

Patients who need to file a claim for reimbursement of healthcare expenses.

03

Providers submitting claims on behalf of their patients for services rendered under Wellmark insurance.

Fill

form

: Try Risk Free

People Also Ask about

Who needs to file a Detroit City tax return?

File a return if you owe tax, are due a refund, or your AGI exceeds your exemption allowance. unnecessary correspondence from Treasury. If your AGI is less than your personal exemption allowance and City income tax was withheld from your earnings, you must file a return to claim a refund of the tax withheld.

What is the City tax withholding form for Detroit?

Only one Form 5527 is required for each employee, even though the employee may be subject to withholding for two cities. When properly filled out, Form 5527 provides the employee's city of residence and the two cities or communities in which the employee earns the greatest percentage of compensation from the employer.

Do I have to pay Michigan income tax if I work remotely?

Yes. Michigan residents owe tax on all income from wages, salary, or guaranteed payments, no matter where it is earned.

Do I have to pay Detroit City tax if I work from home?

Yes. If you are a Detroit resident, all of your income is subject to Detroit tax, no matter where it is earned. See line-by-line Instructions for Form 5118, 2021 City of Detroit Resident Income Tax Return.

What is the city of Detroit income tax withholding?

Income Tax Rates The City of Detroit income tax rate for residents is 2.4% (multiply by 0.024). The City of Detroit income tax rate for nonresidents is 1.2% (multiply by 0.012).

What is a 5321 form in Detroit Michigan?

This form is for use by a taxpayer filing a City of Detroit Income Tax Withholding Annual Reconciliation for 2022. This tax is administered by the Michigan Department of Treasury on behalf of the City of Detroit. Only report income tax withholding attributable to the City of Detroit.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for signing my Wellmark C-5321 in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your Wellmark C-5321 and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I edit Wellmark C-5321 on an iOS device?

Create, edit, and share Wellmark C-5321 from your iOS smartphone with the pdfFiller mobile app. Installing it from the Apple Store takes only a few seconds. You may take advantage of a free trial and select a subscription that meets your needs.

How do I edit Wellmark C-5321 on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share Wellmark C-5321 on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is Wellmark C-5321?

Wellmark C-5321 is a specific form used in the healthcare industry, typically associated with insurance claims or reporting.

Who is required to file Wellmark C-5321?

Health care providers, insurance agents, or organizations involved in billing or claims submissions to Wellmark are typically required to file Wellmark C-5321.

How to fill out Wellmark C-5321?

To fill out Wellmark C-5321, you must provide accurate and complete information as required on the form, including patient details, billing codes, and service dates. Refer to the instructions provided with the form for guidance.

What is the purpose of Wellmark C-5321?

The purpose of Wellmark C-5321 is to facilitate the processing of claims or reporting of healthcare services by providing necessary details for evaluation by the insurance provider.

What information must be reported on Wellmark C-5321?

The information that must be reported on Wellmark C-5321 includes but is not limited to patient information, provider details, service dates, billing codes, and any other information requested by Wellmark.

Fill out your Wellmark C-5321 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Wellmark C-5321 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.