Get the free Understanding In-Kind Contributions: What US Nonprofits Need to ...

Show details

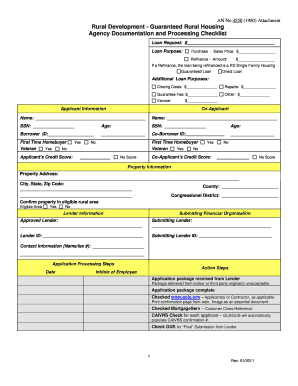

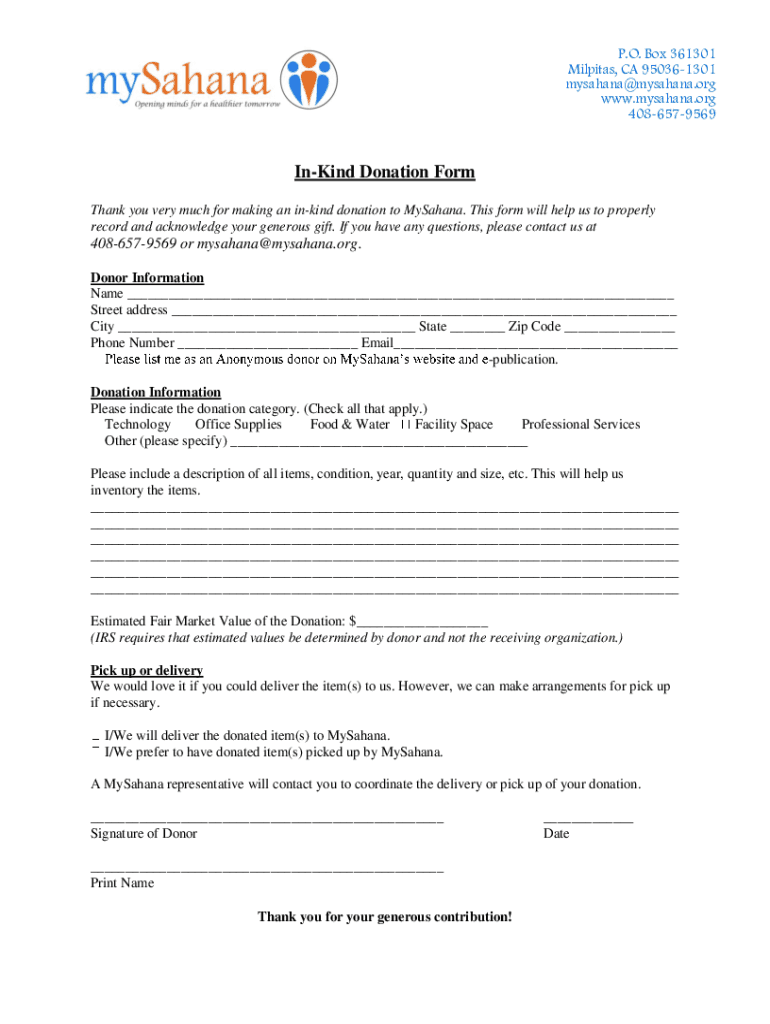

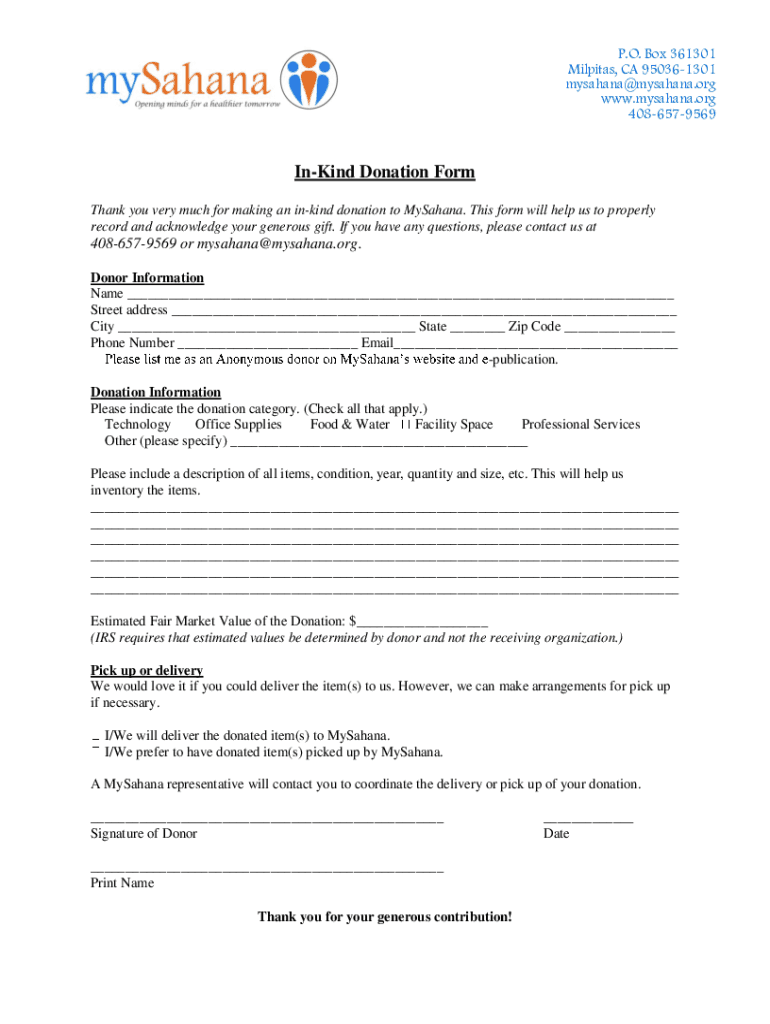

P.O. Box 361301 Milpitas, CA 950361301 Sahara.org www.mysahana.org 4086579569InKind Donation Form Thank you very much for making an inking donation to the Sahara. This form will help us to properly

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign understanding in-kind contributions what

Edit your understanding in-kind contributions what form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your understanding in-kind contributions what form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit understanding in-kind contributions what online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Click on Start Free Trial and sign up a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit understanding in-kind contributions what. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

With pdfFiller, dealing with documents is always straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out understanding in-kind contributions what

How to fill out understanding in-kind contributions what

01

Start by gathering all the necessary information about the in-kind contributions you want to track. This includes details such as the type of contribution, the value of the contribution, and any relevant supporting documentation.

02

Create a template or form to record the in-kind contribution details. This can be a spreadsheet, a digital form, or any other method that allows you to easily capture and organize the information.

03

Provide instructions or guidelines to the individuals or organizations making the in-kind contributions on how to fill out the understanding. This may include explaining the required information, providing examples, and specifying any deadlines or submission processes.

04

Regularly review and verify the information provided in the understanding to ensure accuracy and completeness. This may involve cross-checking with supporting documentation or reaching out to contributors for clarification if needed.

05

Keep a record of all the in-kind contributions received, along with their corresponding values and any associated documentation. This will help with reporting, auditing, and tracking the impact of these contributions.

06

Finally, analyze and report on the in-kind contributions as needed. This can involve summarizing the total value of contributions, categorizing them by type or donor, and highlighting any noteworthy contributions or trends.

Who needs understanding in-kind contributions what?

01

Understanding in-kind contributions is useful for organizations, non-profits, and charities that rely on non-monetary support from individuals, businesses, or other entities.

02

Non-profit organizations can benefit from understanding in-kind contributions as it helps them track their resources, determine the value of volunteer work or donated goods and services, and report these contributions to stakeholders.

03

Charities often rely on in-kind contributions to support their operations or deliver services. By understanding these contributions, they can effectively manage and allocate resources, measure the impact of donations, and demonstrate accountability and transparency to their donors.

04

Even businesses may need to understand in-kind contributions if they engage in corporate social responsibility initiatives or have programs that involve donating goods, services, or employee time to charitable causes. This understanding helps them track and report their contributions, communicate their social impact, and make informed decisions regarding their support.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get understanding in-kind contributions what?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the understanding in-kind contributions what in a matter of seconds. Open it right away and start customizing it using advanced editing features.

Can I sign the understanding in-kind contributions what electronically in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your understanding in-kind contributions what.

How do I edit understanding in-kind contributions what on an iOS device?

Create, modify, and share understanding in-kind contributions what using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

What is understanding in-kind contributions what?

In-kind contributions refer to non-monetary donations made to an organization, which can include goods or services provided for free or at a reduced cost.

Who is required to file understanding in-kind contributions what?

Organizations that receive in-kind contributions may be required to file reports to document and disclose these donations, especially if they are subject to regulations or oversight.

How to fill out understanding in-kind contributions what?

To fill out a report on in-kind contributions, organizations should accurately list the value, description, and nature of the contributions received and provide any required documentation.

What is the purpose of understanding in-kind contributions what?

The purpose of reporting in-kind contributions is to provide transparency about the resources received by an organization and to comply with legal and regulatory requirements.

What information must be reported on understanding in-kind contributions what?

Organizations must report the date of the contribution, a description of the goods or services, the estimated or actual value, and the name of the donor.

Fill out your understanding in-kind contributions what online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Understanding In-Kind Contributions What is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.