Get the free Property Tax Appraiser Continuing Education Doc Template ...

Show details

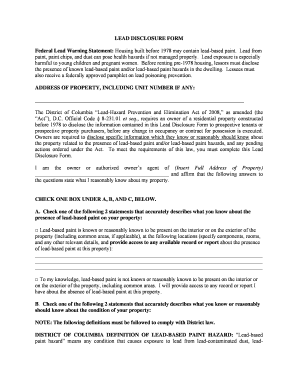

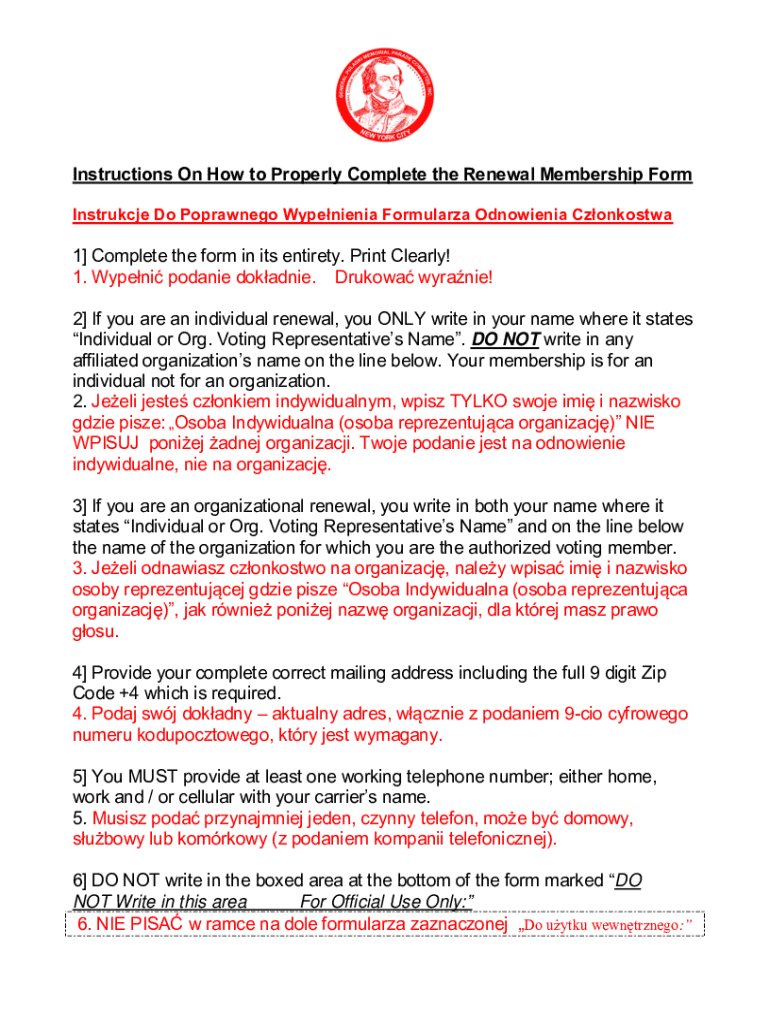

Instructions On How to Properly Complete the Renewal Membership Form Instructed Do Poprawnego Wypenienia Formularize Odnowienia Czonkostwa1 Complete the form in its entirety. Print Clearly! 1. When

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign property tax appraiser continuing

Edit your property tax appraiser continuing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your property tax appraiser continuing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit property tax appraiser continuing online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit property tax appraiser continuing. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out property tax appraiser continuing

How to fill out property tax appraiser continuing

01

Start by gathering all the necessary documents, such as property ownership records, tax assessment notices, and any relevant financial information.

02

Review the guidelines and instructions provided by the property tax appraiser's office to ensure you understand the requirements and criteria for filling out the application.

03

Begin filling out the application form by providing accurate and up-to-date information about the property, such as its address, size, and any recent improvements or renovations.

04

Include details about your ownership or interest in the property, such as whether you own it outright or if there are any other individuals or entities involved.

05

Provide information regarding the property's use, such as whether it is used for residential, commercial, or agricultural purposes.

06

If applicable, include information about any exemptions or special assessments that may affect the property's valuation for tax purposes.

07

Make sure to double-check all the information you have entered before submitting the application to avoid any errors or omissions.

08

Submit the completed application and any supporting documents to the property tax appraiser's office within the specified deadline.

09

Follow up with the appraiser's office to ensure that your application has been received and processed correctly.

10

Keep copies of all submitted documents for your records and retain any acknowledgment or confirmation of your application.

Who needs property tax appraiser continuing?

01

Property owners who want to ensure that their property is assessed accurately for tax purposes may need property tax appraiser continuing.

02

Real estate agents or brokers who deal with property transactions on a regular basis may need property tax appraiser continuing to stay updated with the latest regulations and valuations.

03

Professionals working in the field of property management or development may require property tax appraiser continuing to effectively assess and manage property taxes.

04

Individuals or businesses involved in property investment or rental properties may benefit from property tax appraiser continuing to optimize tax planning and minimize tax liabilities.

05

Government agencies or local authorities responsible for property tax assessment and collection often require their staff to undergo property tax appraiser continuing to maintain proficiency and ensure accurate tax calculations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send property tax appraiser continuing to be eSigned by others?

Once your property tax appraiser continuing is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I edit property tax appraiser continuing in Chrome?

Install the pdfFiller Chrome Extension to modify, fill out, and eSign your property tax appraiser continuing, which you can access right from a Google search page. Fillable documents without leaving Chrome on any internet-connected device.

Can I sign the property tax appraiser continuing electronically in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your property tax appraiser continuing in minutes.

What is property tax appraiser continuing?

Property tax appraiser continuing refers to the ongoing education and training required for property tax appraisers to maintain their certification and stay updated on relevant laws, valuation methods, and appraisal techniques.

Who is required to file property tax appraiser continuing?

Licensed property tax appraisers are required to file for property tax appraiser continuing education as part of the renewal process for their certification.

How to fill out property tax appraiser continuing?

To fill out property tax appraiser continuing, individuals must complete the required continuing education courses, gather documentation of the completed courses, and submit any necessary forms to the appropriate regulatory body.

What is the purpose of property tax appraiser continuing?

The purpose of property tax appraiser continuing is to ensure that appraisers remain knowledgeable about current standards, regulations, and practices in property valuation, which ultimately helps maintain the integrity and accuracy of property assessments.

What information must be reported on property tax appraiser continuing?

When filing for property tax appraiser continuing, individuals must typically report their personal information, details of completed education courses, course duration, and any relevant certification numbers.

Fill out your property tax appraiser continuing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Property Tax Appraiser Continuing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.