Get the free Your annual gift in loving memory 2 - CAFOD - cafod org

Show details

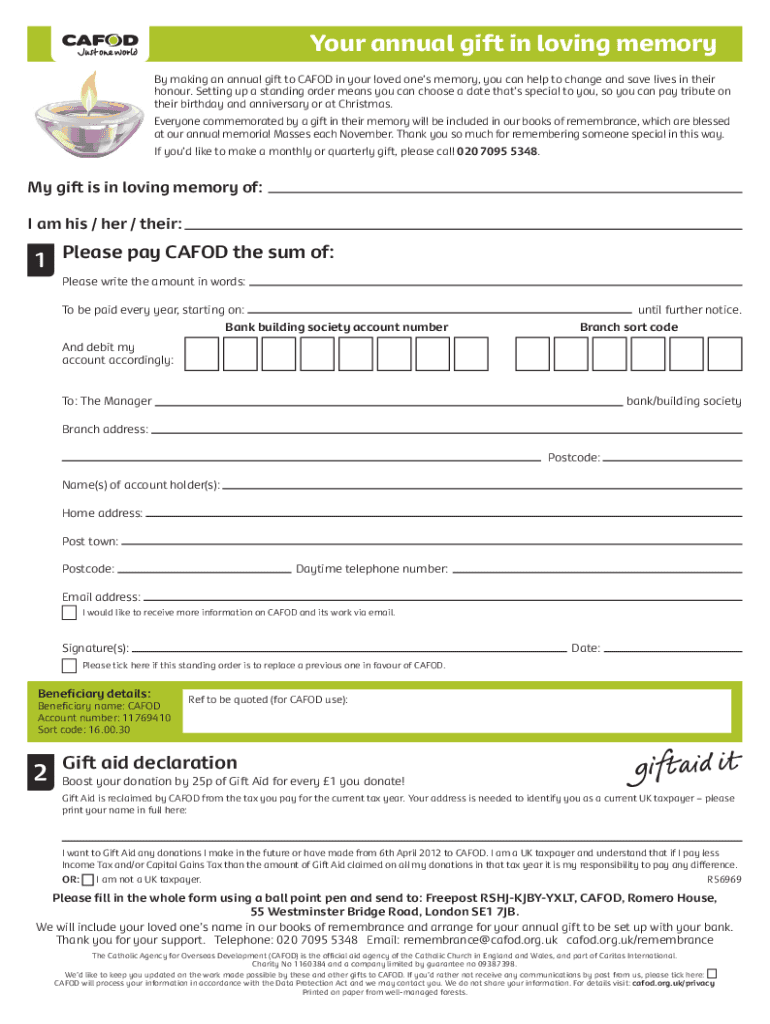

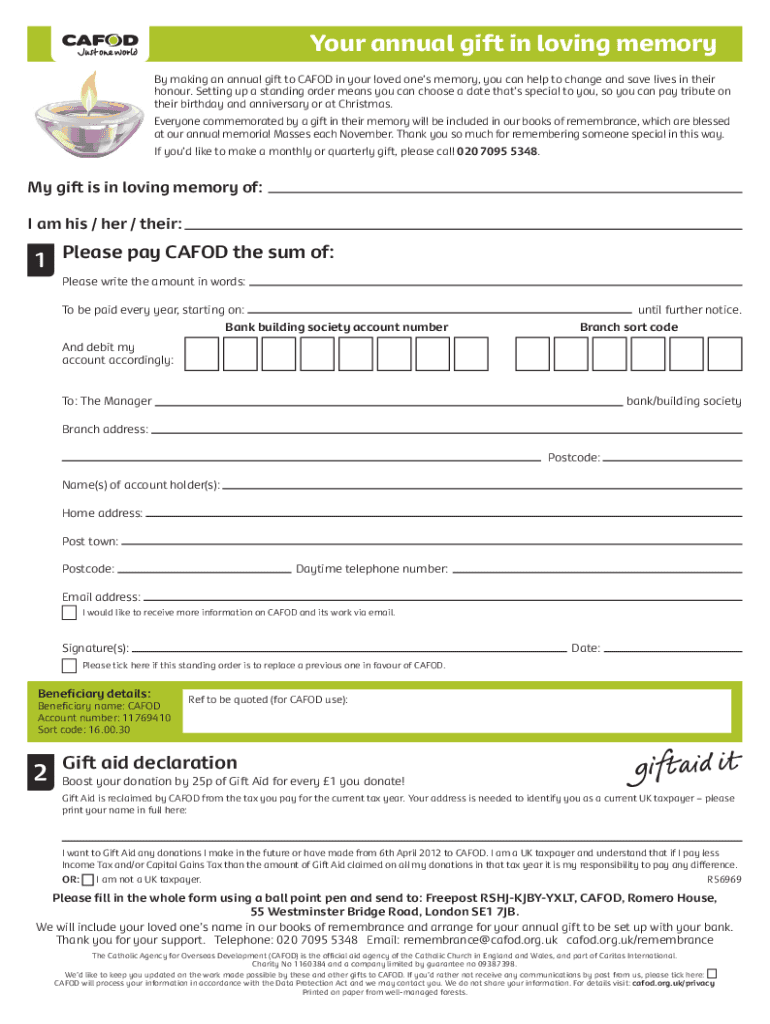

Your annual gift in loving memory

By making an annual gift to CA FOD in your loved one's memory, you can help to change and save lives in their

honor. Setting up a standing order means you can choose

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your annual gift in

Edit your your annual gift in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your annual gift in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit your annual gift in online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit your annual gift in. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out your annual gift in

How to fill out your annual gift in

01

To fill out your annual gift in, follow these steps:

02

Gather all the necessary information, such as the recipient's name and contact information, the value of the gift, and any additional details required for reporting.

03

Determine the appropriate form or method for reporting your gift. This may depend on your location and the specific guidelines set by the tax authorities.

04

Complete the required fields or sections on the form, providing accurate and detailed information about your gift.

05

Double-check the information you have provided to ensure its accuracy and completeness.

06

Submit the filled-out form or report the gift through the designated method as instructed by the tax authorities.

07

Keep a copy of the completed form or documentation for your records, as it may be required for future reference or audits.

08

It is always advisable to consult with a tax professional or seek guidance from the relevant tax authorities to ensure compliance with any specific rules or regulations related to annual gifts in your jurisdiction.

Who needs your annual gift in?

01

Your annual gift can be beneficial for various individuals or organizations, including:

02

- Family members or loved ones who may appreciate financial assistance or substantial gifts.

03

- Charitable organizations or non-profit entities that rely on donations to support their causes and initiatives.

04

- Educational institutions that provide scholarships or financial aid to students in need.

05

- Research institutions or medical centers that rely on funding for scientific research and medical advancements.

06

- Community projects or initiatives aimed at improving the quality of life for individuals in specific areas or demographics.

07

- Cultural or arts organizations that promote creativity and expression through financial support.

08

Ultimately, the choice of who needs your annual gift depends on your personal values, interests, and the impact you wish to make with your generosity.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get your annual gift in?

It’s easy with pdfFiller, a comprehensive online solution for professional document management. Access our extensive library of online forms (over 25M fillable forms are available) and locate the your annual gift in in a matter of seconds. Open it right away and start customizing it using advanced editing features.

How do I edit your annual gift in in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing your annual gift in and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit your annual gift in straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing your annual gift in.

What is your annual gift in?

The annual gift is the maximum amount an individual can give to another person each year without incurring gift tax. For 2024, the annual exclusion is $17,000.

Who is required to file your annual gift in?

The donor, or the person giving the gift, is required to file an annual gift tax return if the gifts exceed the annual exclusion amount.

How to fill out your annual gift in?

To fill out the annual gift tax return (Form 709), you need to provide your name, Social Security number, details of the gifts given including amounts and recipients, and any deductions or exclusions applicable.

What is the purpose of your annual gift in?

The purpose of the annual gift tax return is to report gifts that exceed the annual exclusion limit, ensuring compliance with tax laws and proper tracking of lifetime gift limits.

What information must be reported on your annual gift in?

The form must include the donor's identification information, the total gifts given, recipient details, dates of the gifts, and any applicable exclusions or deductions.

Fill out your your annual gift in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your Annual Gift In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.