PA DCED CLGS-32-2 2019-2026 free printable template

Show details

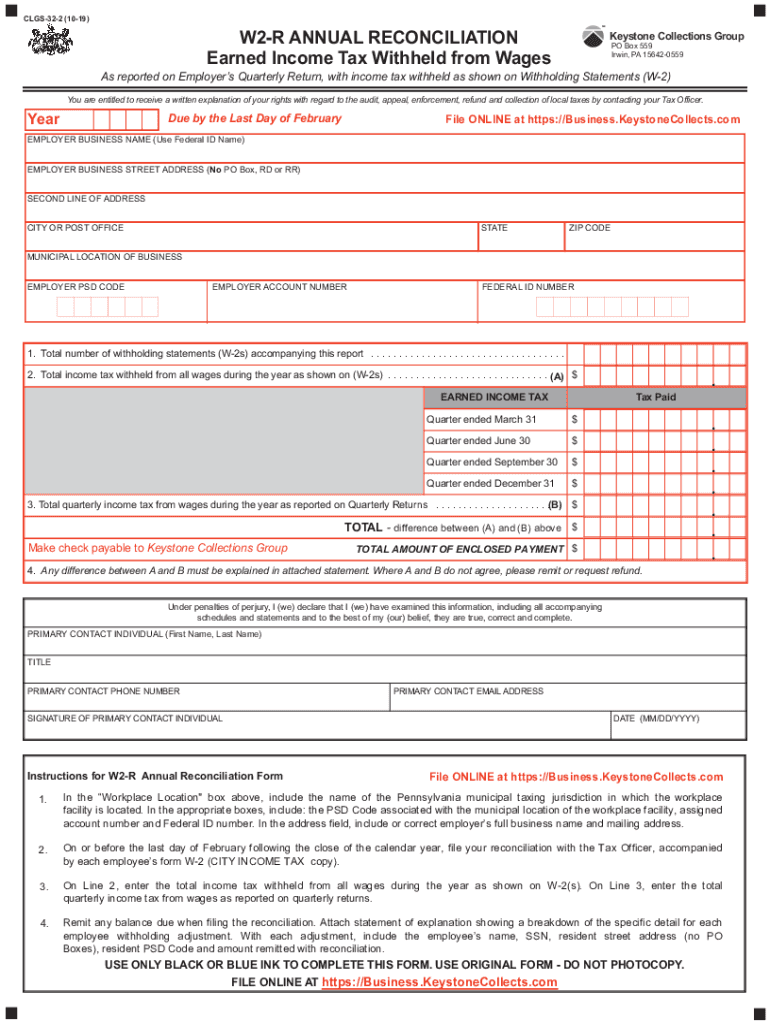

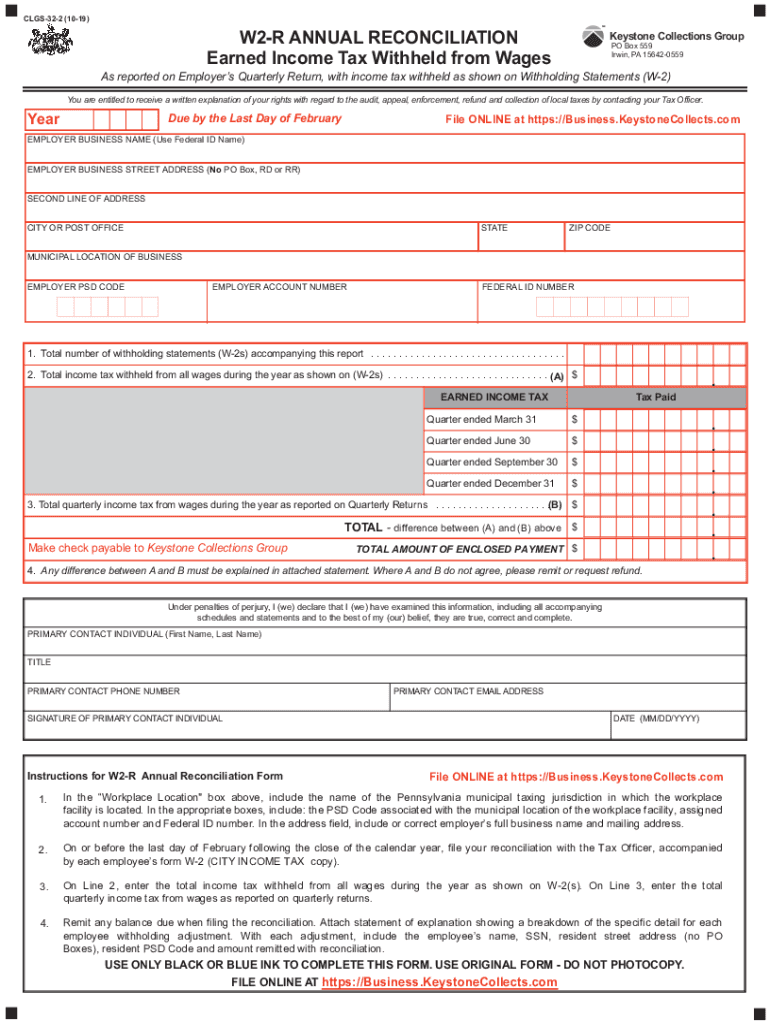

PRIMARY CONTACT INDIVIDUAL First Name Last Name TITLE SIGNATURE OF PRIMARY CONTACT INDIVIDUAL DATE MM/DD/YYYY Instructions for W2-R Annual Reconciliation Form Include municipal location of business in PA assigned account number and Federal ID number. CLGS-32-2 11-12 W2-R ANNUAL RECONCILIATION Earned Income Tax Withheld from Wages As reported on Employer s Quarterly Return Form E-1 with income tax withheld as shown on Withholding Statements W-2 You are entitled to receive a written explanation...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign PA DCED CLGS-32-2

Edit your PA DCED CLGS-32-2 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PA DCED CLGS-32-2 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit PA DCED CLGS-32-2 online

Follow the steps down below to benefit from a competent PDF editor:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit PA DCED CLGS-32-2. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PA DCED CLGS-32-2 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PA DCED CLGS-32-2

How to fill out PA DCED CLGS-32-2

01

Obtain the PA DCED CLGS-32-2 form from the Pennsylvania Department of Community and Economic Development website.

02

Fill in the entity's name and contact information at the top of the form.

03

Indicate the type of program or funding being applied for in the designated section.

04

Provide detailed project descriptions including goals, timelines, and expected outcomes.

05

Complete the budget section, itemizing all costs associated with the project.

06

Include any required documentation, such as proof of eligibility or previous funding.

07

Review the application for accuracy and completeness.

08

Submit the form as per the instructions provided by the department.

Who needs PA DCED CLGS-32-2?

01

Organizations or entities seeking funding or assistance from the Pennsylvania Department of Community and Economic Development.

02

Non-profits, municipalities, and businesses involved in community development projects.

Fill

form

: Try Risk Free

People Also Ask about

What is annual reconciliation statement?

The annual reconciliation gives employers the opportunity to review their tax paid for the financial year, make any necessary adjustments to correct overpayments or underpayments made during the year and confirm a registered employer's status.

Is there an annual reconciliation for Form 941?

Annual amounts from payroll records should match the total amounts reported on all Forms 941 for the year. Total amounts reported on all Forms 941 for the year should match the sum of the same data fields shown in W-2/W-3 totals. If these amounts do not match, recheck records and identify necessary adjustments.

What is Form DE 7?

Annual Reconciliation Statement (DE 7)

What is a de7 form?

Annual Reconciliation Statement (DE 7)

How do I get an employer identification number in California?

Log in to e-Services for Business. Select New Employer, then select Next. Select Register for Employer Payroll Tax Account Number. Complete the online registration application. Select Submit.

What is a rev 1667 form?

The Annual Withholding Reconciliation Statement (REV-1667) along with an individual Wage and Tax Statement/Information Statement (W-2/1099) for each employee/distribution recipient must be submitted annually on or before Jan. 31 following the year in which wages were paid or distributions occurred.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit PA DCED CLGS-32-2 from Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your PA DCED CLGS-32-2 into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit PA DCED CLGS-32-2 in Chrome?

PA DCED CLGS-32-2 can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How do I fill out PA DCED CLGS-32-2 on an Android device?

Use the pdfFiller app for Android to finish your PA DCED CLGS-32-2. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is PA DCED CLGS-32-2?

PA DCED CLGS-32-2 is a form used in Pennsylvania for reporting specific information related to local governments and their financial statuses.

Who is required to file PA DCED CLGS-32-2?

Local government entities, including municipalities and authorities in Pennsylvania, are required to file PA DCED CLGS-32-2.

How to fill out PA DCED CLGS-32-2?

To fill out PA DCED CLGS-32-2, entities need to provide financial details, revenue sources, expenditures, and other relevant fiscal information as outlined in the form instructions.

What is the purpose of PA DCED CLGS-32-2?

The purpose of PA DCED CLGS-32-2 is to ensure transparency and accountability in local government financial reporting, allowing for analysis and oversight by state agencies.

What information must be reported on PA DCED CLGS-32-2?

The report must include information such as total revenues, total expenditures, fund balances, and any other financial metrics as required by the form's guidelines.

Fill out your PA DCED CLGS-32-2 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PA DCED CLGS-32-2 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.