Get the free Instruction 8857 (Rev. September 2011). Instructions for Form 8857, Request for Inno...

Show details

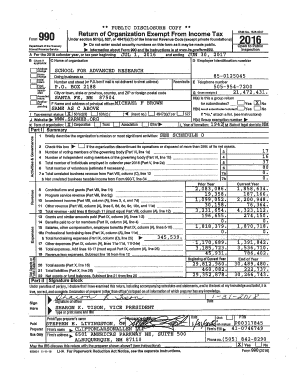

AS 1. . Sh0Yt FOURTH OMB N0 15451150 Fm Return of Organization Exempt From Income Tax Under section 501 (c), 527, or 4947(a)(1) of the Internal Revenue Code, (except organizations of donor advised

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign instruction 8857 rev september

Edit your instruction 8857 rev september form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your instruction 8857 rev september form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing instruction 8857 rev september online

Follow the steps below to use a professional PDF editor:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit instruction 8857 rev september. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out instruction 8857 rev september

Point by point instructions for filling out instruction 8857 rev September:

01

Begin by gathering all necessary information and documentation. This may include personal identification details, tax forms, and any relevant financial records.

02

Review the instructions provided with form 8857 rev September. Familiarize yourself with the different sections and requirements outlined in the form.

03

Start filling out the form by entering your personal information in the appropriate fields. This may include your name, address, social security number, and contact details.

04

Proceed to the next section, where you will need to provide the details of any authorized representative you may have. Include their name, address, and contact information.

05

Carefully read and respond to all the questions and prompts on the form. Ensure that you provide accurate and complete information, as errors or omissions may lead to delays or complications in processing your request.

06

If there are any specific items or concerns you need to address in your request for relief, make sure to provide a clear and concise explanation in the designated section. Back up your claims with supporting documents if required.

07

Double-check all the information you have entered on the form to ensure its accuracy. Review each field and cross-reference it with the provided instructions to minimize any mistakes.

08

Sign and date the form in the designated areas once you have completed filling it out. If you have an authorized representative, ensure they also sign and date the form accordingly.

09

Keep a copy of the filled-out form and any supporting documents for your records. This will be useful in case you need to reference or provide additional information in the future.

Who needs instruction 8857 rev September?

01

Individuals who are seeking relief from specific tax liabilities or hardships may require instruction 8857 rev September. This form is specifically designed for requesting innocent spouse relief or separation of liability.

02

Married individuals who filed a joint return and are experiencing issues related to tax obligations may benefit from understanding and utilizing instruction 8857 rev September.

03

Taxpayers who believe they should not be held liable for certain tax debts due to their spouse's actions or inaccurate reporting on a joint tax return should refer to instruction 8857 rev September for guidance on seeking relief.

Note: It is recommended to consult with a tax professional or the IRS for specific guidance and eligibility requirements related to instruction 8857 rev September.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the instruction 8857 rev september in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How do I fill out instruction 8857 rev september using my mobile device?

On your mobile device, use the pdfFiller mobile app to complete and sign instruction 8857 rev september. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to discover more about our mobile applications, the features you'll have access to, and how to get started.

How do I fill out instruction 8857 rev september on an Android device?

Use the pdfFiller mobile app and complete your instruction 8857 rev september and other documents on your Android device. The app provides you with all essential document management features, such as editing content, eSigning, annotating, sharing files, etc. You will have access to your documents at any time, as long as there is an internet connection.

What is instruction 8857 rev september?

Instruction 8857 rev September is a form used by certain taxpayers to report assets held in foreign accounts.

Who is required to file instruction 8857 rev september?

Taxpayers who meet the threshold for reporting foreign financial accounts must file instruction 8857.

How to fill out instruction 8857 rev september?

Taxpayers must provide detailed information about their foreign financial accounts as required by the form.

What is the purpose of instruction 8857 rev september?

The purpose of instruction 8857 is to provide the IRS with information about foreign financial accounts held by U.S. taxpayers.

What information must be reported on instruction 8857 rev september?

Taxpayers must report the account number, name of financial institution, maximum value during the year, and other pertinent details.

Fill out your instruction 8857 rev september online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Instruction 8857 Rev September is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.