Get the free Charitable Contributions - Gift Tax Reporting EssentialsWealth ...

Show details

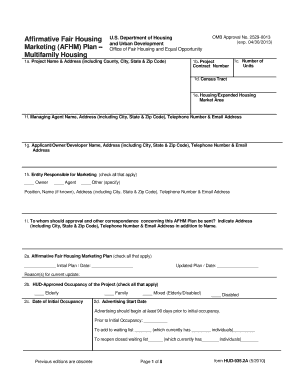

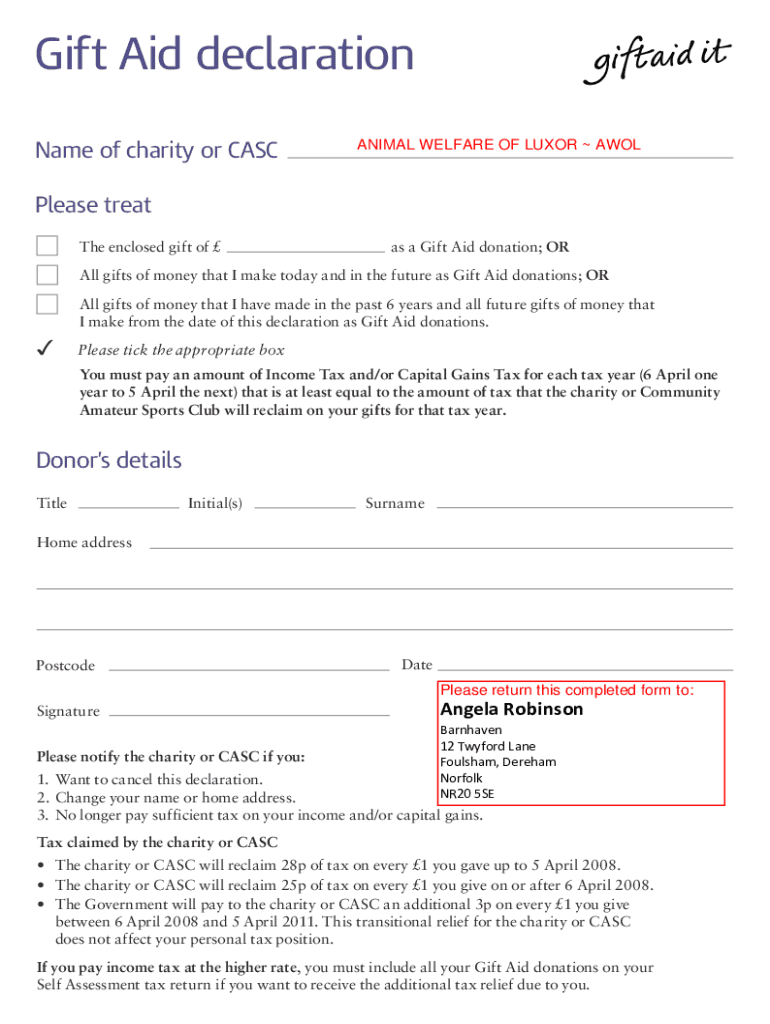

Gift Aid declaration Name of charity or CASCADIA WELFARE OF LUXOR AWOLPlease treat The enclosed gift of as a Gift Aid donation; Oral gifts of money that I make today and in the future as Gift Aid

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign charitable contributions - gift

Edit your charitable contributions - gift form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your charitable contributions - gift form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing charitable contributions - gift online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit charitable contributions - gift. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You may try it out for yourself by signing up for an account.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out charitable contributions - gift

How to fill out charitable contributions - gift

01

To fill out charitable contributions - gift, follow these steps:

02

Start by gathering all necessary documentation, such as receipts or acknowledgement letters from the charity.

03

Determine the total amount of your charitable contributions made during the tax year.

04

Identify which category your contributions fall into, such as cash donations, property donations, or donations of securities.

05

For cash donations, keep track of the date, amount, and name of the charity for each donation.

06

For property donations, make a list of the items donated, their fair market value, and whether any goods or services were received in exchange for the donation.

07

If you donated securities, record the name of the security, the date donated, and its fair market value on the date of the donation.

08

Fill out Schedule A of your tax return, specifically Section A for cash contributions and Section B for non-cash contributions.

09

Enter the total amount of your charitable contributions on the appropriate line of your tax return.

10

Keep all supporting documentation with your tax records in case of audit or verification by the IRS.

11

Consult with a tax professional or refer to IRS guidelines for further guidance or specific situations.

Who needs charitable contributions - gift?

01

Charitable contributions - gift are beneficial for individuals or organizations who:

02

- Want to support charitable causes and make a positive impact on society.

03

- Seek to reduce their taxable income by deducting donations on their tax return.

04

- Wish to contribute to recognized charitable organizations and receive potential tax benefits.

05

- Are interested in creating a legacy through charitable giving.

06

- Want to support causes they are passionate about, such as education, healthcare, poverty alleviation, environmental conservation, etc.

07

- Are involved in philanthropy and want to make a difference in their community or globally.

08

- Are willing to donate assets, property, or securities to qualified charities and receive tax incentives.

09

- Believe in the power of giving back and want to inspire others to do the same.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit charitable contributions - gift from Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like charitable contributions - gift, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I fill out the charitable contributions - gift form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign charitable contributions - gift and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

How do I complete charitable contributions - gift on an Android device?

Use the pdfFiller app for Android to finish your charitable contributions - gift. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is charitable contributions - gift?

Charitable contributions - gift refers to donations made to qualifying nonprofit organizations for which the donor may be eligible for a tax deduction.

Who is required to file charitable contributions - gift?

Individuals who make charitable contributions and wish to claim tax deductions for those contributions must file charitable contributions - gift.

How to fill out charitable contributions - gift?

To fill out charitable contributions - gift, individuals must itemize their deductions on their tax return and report the amount donated to qualifying charities, providing any necessary documentation.

What is the purpose of charitable contributions - gift?

The purpose of charitable contributions - gift is to encourage philanthropy by allowing donors to receive tax deductions for their altruistic donations to nonprofit organizations.

What information must be reported on charitable contributions - gift?

Contributors must report the amount donated, the name of the receiving organization, and any required documentation such as receipts or acknowledgment letters.

Fill out your charitable contributions - gift online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Charitable Contributions - Gift is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.