Get the free LEGISLATIVE BULLETIN TAX REFORM BILL PASSES HOUSE - HEADED TO ...

Show details

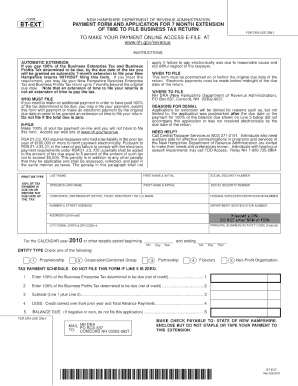

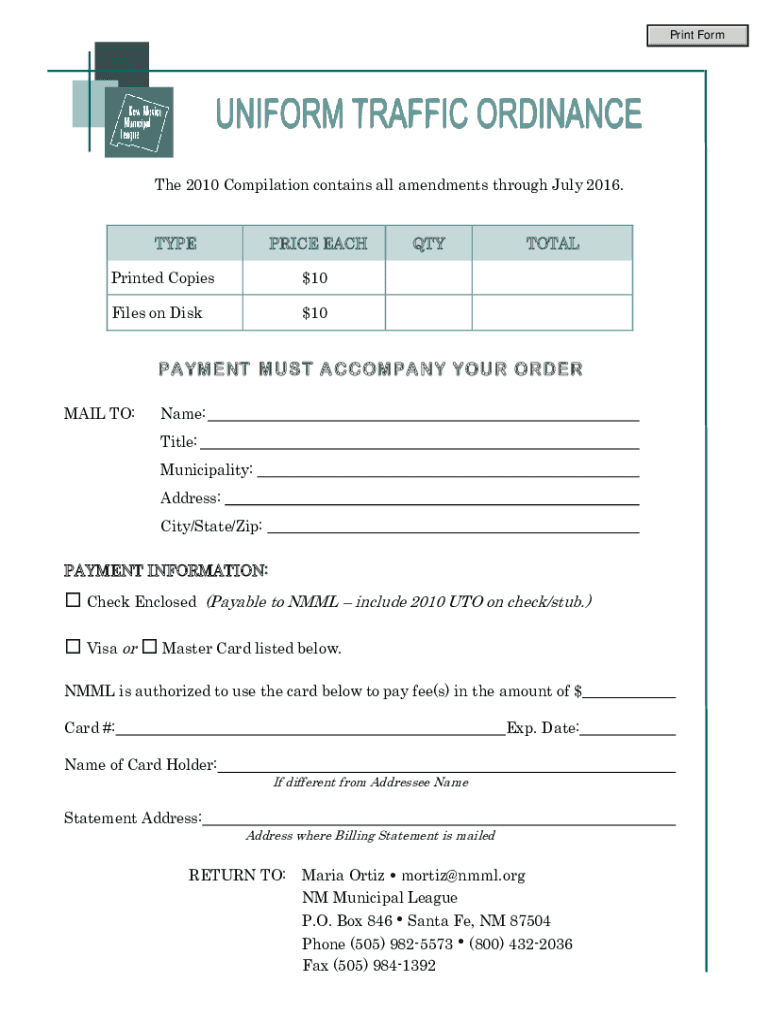

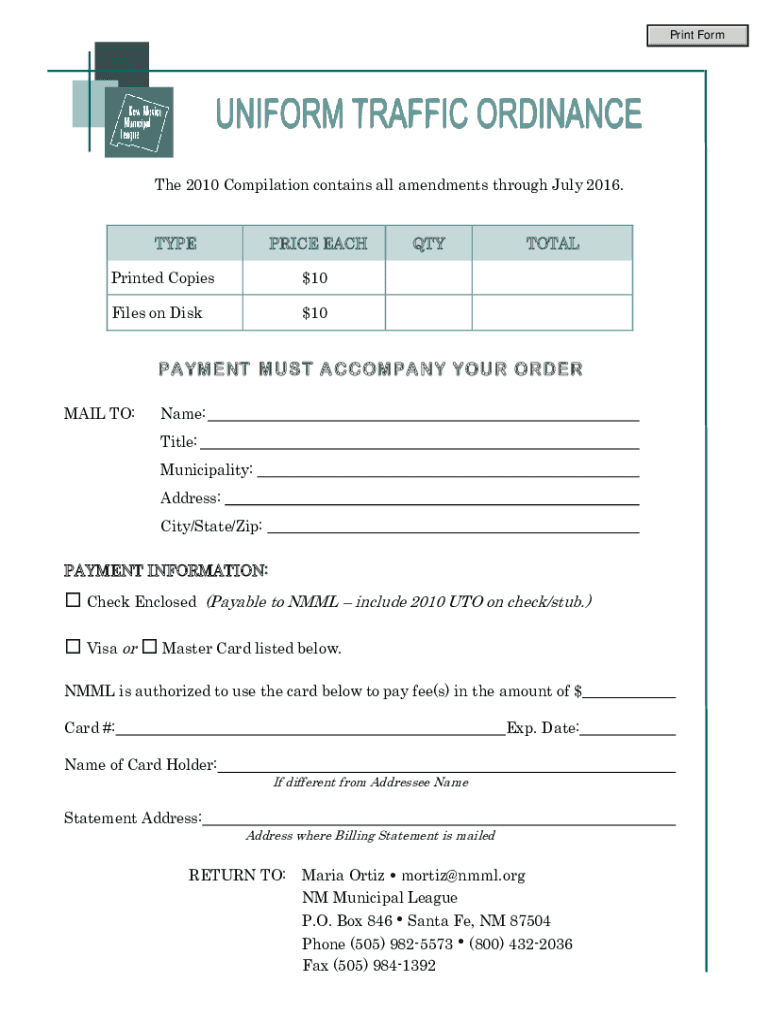

Print Forth 2010 Compilation contains all amendments through July 2016.TYPEWRITE EACHPrinted Copies$10Files on Disk$10QTYTOTALPAYMENT MUST ACCOMPANY YOUR ORDER MAIL TO:Name: Title: Municipality: Address:

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign legislative bulletin tax reform

Edit your legislative bulletin tax reform form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your legislative bulletin tax reform form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing legislative bulletin tax reform online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit legislative bulletin tax reform. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out legislative bulletin tax reform

How to fill out legislative bulletin tax reform

01

To fill out a legislative bulletin tax reform, follow these steps:

02

Start by gathering all the necessary information and documents related to the tax reform.

03

Identify the specific sections or provisions of the tax reform that you want to address in the bulletin.

04

Write a brief introduction explaining the purpose and background of the tax reform.

05

Divide the bulletin into clear and concise sections, each focusing on a specific aspect of the tax reform.

06

For each section, provide a detailed explanation of the proposed changes or amendments.

07

Support your explanations with relevant facts, data, and examples.

08

Use clear and logical arguments to justify the need for the tax reform.

09

Conclude the bulletin by summarizing the key points and emphasizing the potential benefits of the tax reform.

10

Proofread the bulletin for any grammatical or spelling errors.

11

Submit the completed bulletin to the appropriate authorities or stakeholders for review and consideration.

Who needs legislative bulletin tax reform?

01

Legislative bulletin tax reform is required by various individuals and organizations including:

02

- Government agencies or departments responsible for tax policy and legislation.

03

- Legislative bodies and committees responsible for reviewing and approving tax reforms.

04

- Tax experts, economists, and researchers who need information on tax reforms.

05

- Advocacy groups and organizations involved in tax reform advocacy or lobbying.

06

- Corporate entities and business leaders concerned about the impact of tax reforms.

07

The specific audience may vary depending on the jurisdiction and scope of the tax reform.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify legislative bulletin tax reform without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your legislative bulletin tax reform into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit legislative bulletin tax reform straight from my smartphone?

The pdfFiller apps for iOS and Android smartphones are available in the Apple Store and Google Play Store. You may also get the program at https://edit-pdf-ios-android.pdffiller.com/. Open the web app, sign in, and start editing legislative bulletin tax reform.

Can I edit legislative bulletin tax reform on an Android device?

You can make any changes to PDF files, such as legislative bulletin tax reform, with the help of the pdfFiller mobile app for Android. Edit, sign, and send documents right from your mobile device. Install the app and streamline your document management wherever you are.

What is legislative bulletin tax reform?

Legislative bulletin tax reform refers to changes made to tax laws and regulations that are communicated through official documents, detailing updates to tax policies, rates, and compliance requirements.

Who is required to file legislative bulletin tax reform?

Businesses, organizations, and individuals who are impacted by the changes in tax laws specified in the legislative bulletin are required to file the necessary documentation.

How to fill out legislative bulletin tax reform?

To fill out legislative bulletin tax reform, you should carefully review the specific instructions provided in the bulletin, gather the necessary financial information, and complete the forms accurately while ensuring all required supporting documents are attached.

What is the purpose of legislative bulletin tax reform?

The purpose of legislative bulletin tax reform is to provide clear guidelines for compliance with updated tax laws, improve tax administration efficiency, and ensure that taxpayers understand their obligations.

What information must be reported on legislative bulletin tax reform?

The information that must be reported typically includes income, deductions, credits, and any other relevant financial data as specified in the legislative bulletin.

Fill out your legislative bulletin tax reform online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Legislative Bulletin Tax Reform is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.