Get the free Not ready Re Aud

Show details

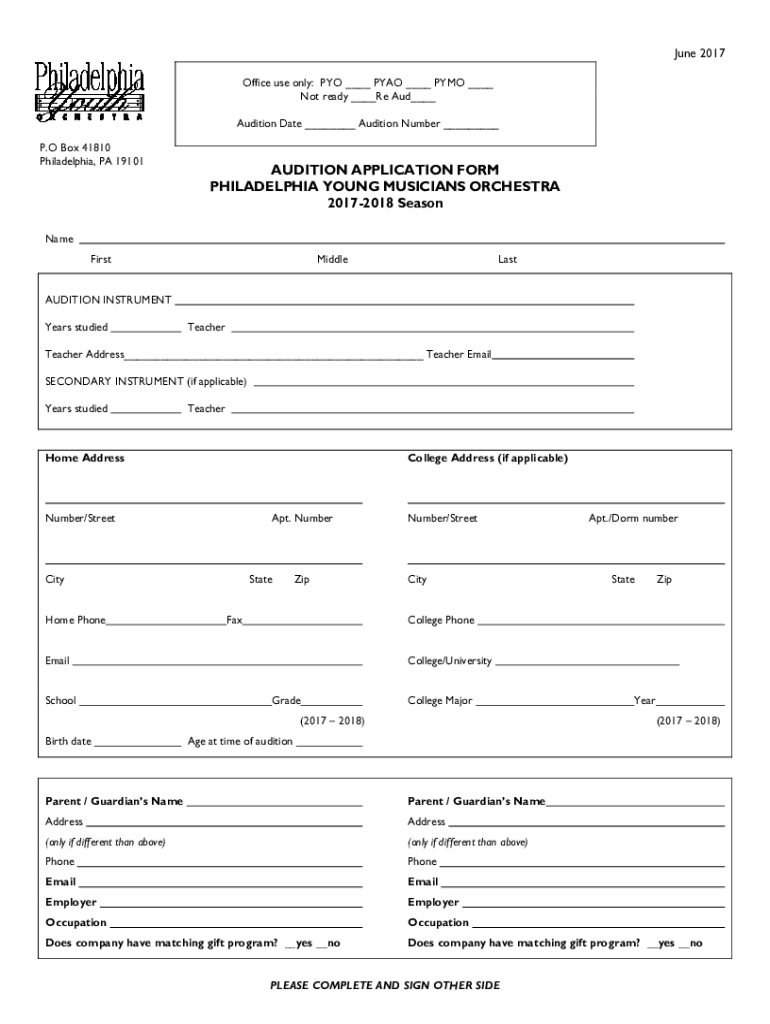

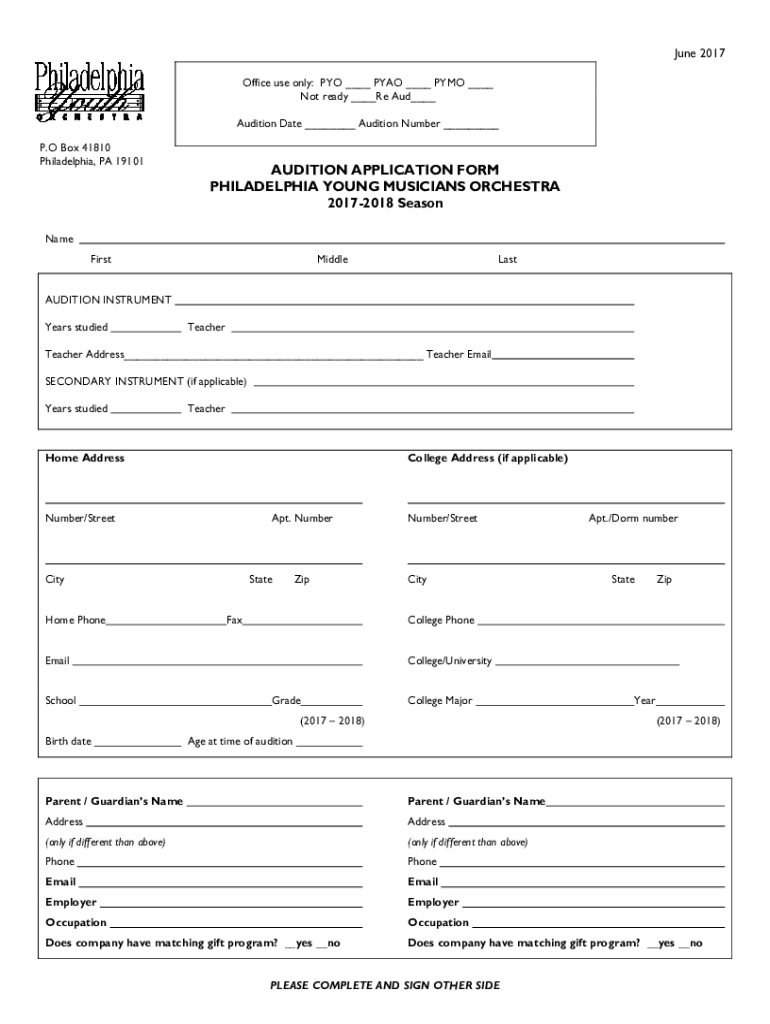

June 2017 Office use only: PRO PAO PMO Not ready Re AUD Audition Date Audition Number P. O Box 41810 Philadelphia, PA 19101AUDITION APPLICATION FORM PHILADELPHIA YOUNG MUSICIANS ORCHESTRA 20172018

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign not ready re aud

Edit your not ready re aud form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your not ready re aud form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing not ready re aud online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit not ready re aud. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out not ready re aud

How to fill out not ready re aud

01

To fill out a not ready RE AUD, follow these steps:

02

Gather all the necessary information and documentation related to the audit.

03

Start with the basic details such as the name of the company or individual being audited, the date of the audit, and the auditor's name.

04

Provide a brief overview of the purpose and objectives of the audit.

05

Describe the scope of the audit and the specific areas or processes that will be examined.

06

Clearly outline the audit criteria or standards that will be used to assess the audit subject.

07

Document the methods and procedures that will be employed during the audit.

08

Include a section for any resources or assistance that will be required to conduct the audit.

09

Provide a timeline for the audit process, including key milestones and deadlines.

10

Mention any potential challenges or risks that may arise during the audit and how they will be addressed.

11

Close the not ready RE AUD document with the auditor's signature and date.

12

It is important to ensure accuracy and completeness when filling out a not ready RE AUD to facilitate a smooth and effective audit process.

Who needs not ready re aud?

01

Not ready RE AUD is typically needed by organizations or individuals who are undergoing an audit.

02

It may be required for compliance purposes, such as meeting regulatory requirements or demonstrating financial accountability.

03

Not ready RE AUD can also be useful for internal purposes, helping organizations identify areas for improvement and ensuring proper record-keeping.

04

Auditors and audit teams may also require not ready RE AUD to document their audit plans and procedures.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send not ready re aud to be eSigned by others?

Once you are ready to share your not ready re aud, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get not ready re aud?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific not ready re aud and other forms. Find the template you need and change it using powerful tools.

How do I edit not ready re aud on an Android device?

Yes, you can. With the pdfFiller mobile app for Android, you can edit, sign, and share not ready re aud on your mobile device from any location; only an internet connection is needed. Get the app and start to streamline your document workflow from anywhere.

What is not ready re aud?

Not ready re aud is a designation used in the context of financial audits to indicate that certain documents or information required for the audit process are incomplete or not yet available.

Who is required to file not ready re aud?

Entities or individuals undergoing a financial audit who do not have all necessary documentation completed by the audit deadline are required to file not ready re aud.

How to fill out not ready re aud?

To fill out a not ready re aud form, provide identifying information, explain the reason for the delay in documentation, and include any supporting details or estimated timelines for when the required documents will be available.

What is the purpose of not ready re aud?

The purpose of not ready re aud is to inform auditors that certain information is still pending and to request additional time for its submission without penalizing the filing entity immediately.

What information must be reported on not ready re aud?

Information that must be reported includes the entity’s identification details, the specific documents that are not ready, reasons for the delay, and any expected completion dates for the outstanding items.

Fill out your not ready re aud online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Not Ready Re Aud is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.