Get the free Clay County Personal Property Assessment List - claycountymo

Show details

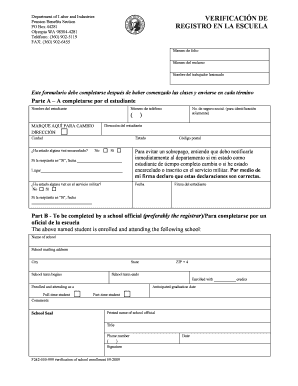

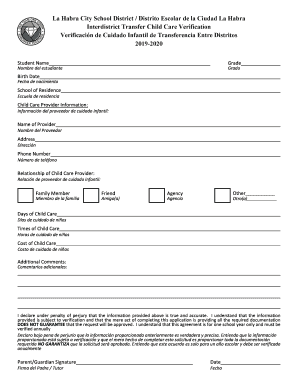

This document serves as a personal property assessment list for residents of Clay County, Missouri, detailing the requirements for reporting personal property owned as of January 1, 2011. It outlines

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign clay county personal property

Edit your clay county personal property form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your clay county personal property form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit clay county personal property online

To use the professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit clay county personal property. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out clay county personal property

How to fill out Clay County Personal Property Assessment List

01

Obtain a copy of the Clay County Personal Property Assessment List from your local assessor's office or online.

02

Fill in your personal information, including name, address, and contact details.

03

List all personal property items you own in the county, such as vehicles, boats, and business equipment.

04

Provide the serial numbers or identification numbers for each item, if applicable.

05

Indicate the estimated value of each item based on current market rates.

06

Review the form for accuracy and completeness.

07

Sign and date the assessment list before submitting it.

08

Submit the completed form to the Clay County Assessor's Office by the designated deadline.

Who needs Clay County Personal Property Assessment List?

01

Residents and property owners in Clay County who possess personal property that is taxable.

02

Business owners who need to report their personal property for tax assessment purposes.

03

Individuals who have vehicles, equipment, or other personal property that must be declared for property tax.

Fill

form

: Try Risk Free

People Also Ask about

What is the new property tax law for seniors in Missouri?

Under the new rules, all homeowners over the age of 62 are eligible to have their property taxes frozen at 2024 levels starting in 2025 — and their tax amount will automatically decrease if home values drop in the future.

What is involved in a property assessment?

Sometimes referred to as the cost approach, this property tax assessment considers how much it would cost to rebuild the property based on the current market for materials and labor. Depreciation can be included, and the cost of the land is considered as well.

At what age do seniors stop paying personal property taxes in Missouri?

The program now allows those taxpayers who are 62 years of age or older to receive a credit on future years tax bills that essentially freezes their property taxes on their primary residence to the tax bill amount from the year of application/eligibility.

Is Missouri getting rid of personal property tax?

Senate Bill 24 gradually reduces personal property tax assessment rates each year until 2026, when the assessment rate would be 0.001%. Throughout his time in the Missouri Senate, Sen. Eigel has filed legislation to eliminate personal property tax, as well as reduce the percentage of income tax collected.

How old do you have to be to be exempt from property taxes?

Most senior property tax exemption programs require applicants to be at least 65 years old. However, some jurisdictions offer benefits to those as young as 61, while others may require applicants to be 67 or older.

Do seniors get a discount on personal property tax in Missouri?

The Missouri Property Tax Credit Claim is a program that allows certain senior citizens and 100 percent disabled individuals to apply for a credit based on the real estate taxes or rent they have paid for the year. The credit is for a maximum of $750.00 for renters and $1,100.00 for owners.

How do I estimate my personal property taxes in Missouri?

Personal Property Tax Calculation Formula To determine how much you owe, perform the following two-part calculation: Estimated Market Value of the Property X Assessment Rate (33 1/3%) = Estimated Assessed Value. Estimated Assessed Value / 100 X Total Tax Rate = Estimated Tax Bill.

Who qualifies for a personal property tax waiver in Missouri?

A new Missouri resident. First licensed asset you have ever owned. You did not own any personal property on January 1st of the prior year. You are in the military and your home of record is not Missouri (LES papers are required)

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is Clay County Personal Property Assessment List?

The Clay County Personal Property Assessment List is a document that residents must complete to declare personal property for tax assessment purposes within Clay County.

Who is required to file Clay County Personal Property Assessment List?

All residents who own personal property in Clay County, including businesses and individuals, are required to file the Personal Property Assessment List.

How to fill out Clay County Personal Property Assessment List?

To fill out the Clay County Personal Property Assessment List, gather your property details, follow the provided instructions on the form, and report the necessary information accurately.

What is the purpose of Clay County Personal Property Assessment List?

The purpose of the Clay County Personal Property Assessment List is to assess the value of personal property for taxation, ensuring that property taxes are levied fairly based on reported values.

What information must be reported on Clay County Personal Property Assessment List?

The information that must be reported includes a description of the personal property, its value, and any relevant ownership details as specified in the assessment guidelines.

Fill out your clay county personal property online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Clay County Personal Property is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.