Get the free STANDARD 203(k) REFINANCE TRANSACTION

Show details

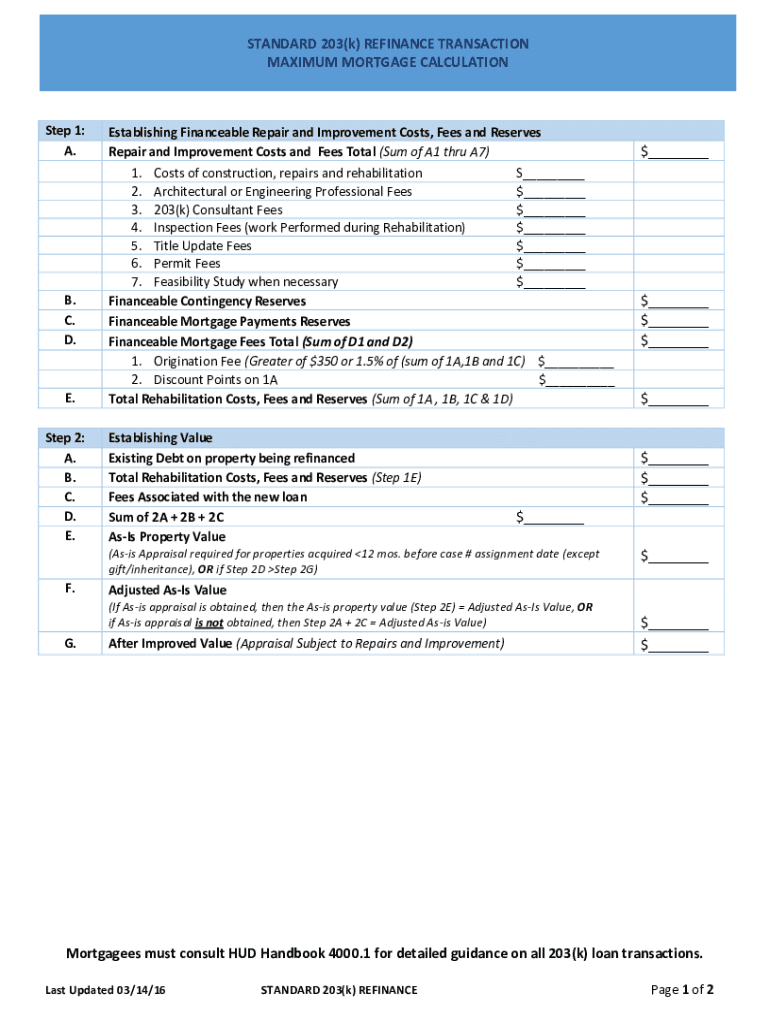

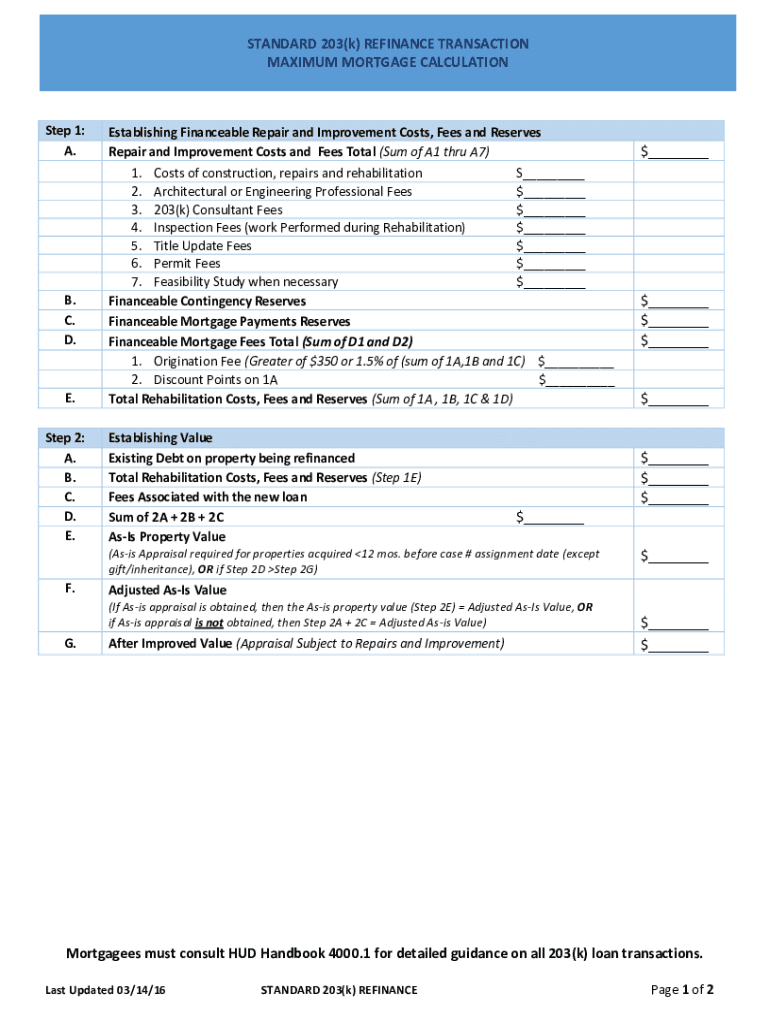

STANDARD 203(k) REFINANCE TRANSACTION MAXIMUM MORTGAGE Calculations 1: A.B. C. D.E. Step 2: A. B. C. D. E. Establishing Financeable Repair and Improvement Costs, Fees and Reserves Repair and Improvement

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign standard 203k refinance transaction

Edit your standard 203k refinance transaction form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your standard 203k refinance transaction form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit standard 203k refinance transaction online

To use the professional PDF editor, follow these steps below:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit standard 203k refinance transaction. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out standard 203k refinance transaction

How to fill out standard 203k refinance transaction

01

To fill out a standard 203k refinance transaction, follow these steps:

02

Begin by gathering all the necessary documents, including proof of income, bank statements, and proof of homeownership.

03

Contact a mortgage lender who is experienced in handling 203k loans.

04

Complete a loan application with the lender, providing all the required information.

05

Provide the lender with the details of the property you wish to refinance, including its current value and the proposed improvements.

06

Prepare a detailed cost estimate for the planned renovations and repairs.

07

Obtain bids from licensed contractors for the proposed work.

08

Once your loan application is approved, proceed to close the loan.

09

The lender will set up an escrow account to hold the funds for the renovations.

10

As the work progresses, the contractor you hired will be paid from the escrow account.

11

After the renovations are complete, the lender will conduct a final inspection to ensure all repairs meet the required standards.

12

The lender will release the remaining funds from the escrow account to cover the costs of the completed work.

13

You can now enjoy your newly renovated property with a refinanced loan!

Who needs standard 203k refinance transaction?

01

Standard 203k refinance transactions are typically needed by homeowners who want to refinance their existing mortgage and finance home improvements or repairs at the same time.

02

People who are looking to purchase a property that requires significant renovations may also need a standard 203k refinance transaction in order to finance both the purchase and the renovation costs.

03

Additionally, individuals who already own a property and plan to make substantial upgrades or repairs may opt for a standard 203k refinance transaction to cover the costs.

04

Ultimately, anyone looking to refinance their mortgage and fund home improvements or repairs can benefit from a standard 203k refinance transaction.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I create an electronic signature for the standard 203k refinance transaction in Chrome?

Yes, you can. With pdfFiller, you not only get a feature-rich PDF editor and fillable form builder but a powerful e-signature solution that you can add directly to your Chrome browser. Using our extension, you can create your legally-binding eSignature by typing, drawing, or capturing a photo of your signature using your webcam. Choose whichever method you prefer and eSign your standard 203k refinance transaction in minutes.

Can I create an eSignature for the standard 203k refinance transaction in Gmail?

Upload, type, or draw a signature in Gmail with the help of pdfFiller’s add-on. pdfFiller enables you to eSign your standard 203k refinance transaction and other documents right in your inbox. Register your account in order to save signed documents and your personal signatures.

How do I edit standard 203k refinance transaction straight from my smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing standard 203k refinance transaction right away.

What is standard 203k refinance transaction?

A standard 203k refinance transaction is a type of loan that allows borrowers to refinance an existing mortgage and simultaneously finance the costs of certain home improvements or repairs.

Who is required to file standard 203k refinance transaction?

Homeowners seeking to refinance their mortgage and include renovation costs in the same loan are required to file a standard 203k refinance transaction.

How to fill out standard 203k refinance transaction?

To fill out a standard 203k refinance transaction, borrowers need to complete the necessary application forms, provide required documentation regarding their current mortgage, detail the proposed improvements, and submit a signed agreement with a licensed contractor.

What is the purpose of standard 203k refinance transaction?

The purpose of the standard 203k refinance transaction is to provide homeowners with a means to access funds for home improvements while refinancing their existing mortgage at potentially better terms.

What information must be reported on standard 203k refinance transaction?

Information that must be reported includes the current mortgage details, property information, proposed improvements, contractor details, and cost estimates for the renovations.

Fill out your standard 203k refinance transaction online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Standard 203k Refinance Transaction is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.