Get the free stock gift - how to form 2016

Show details

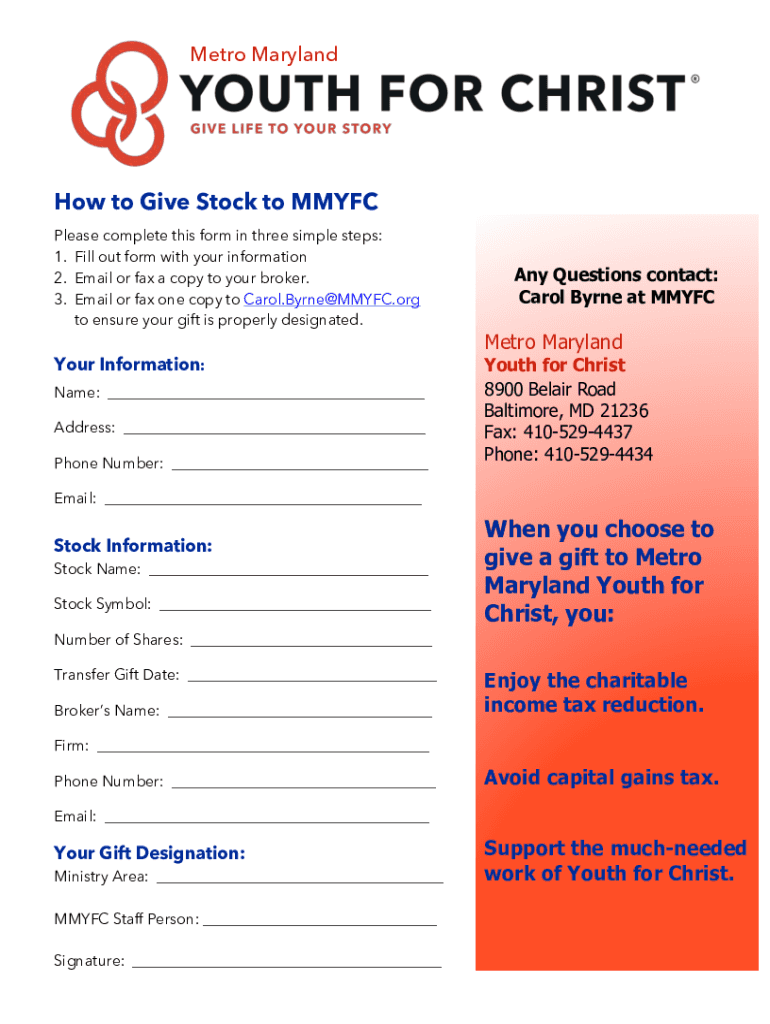

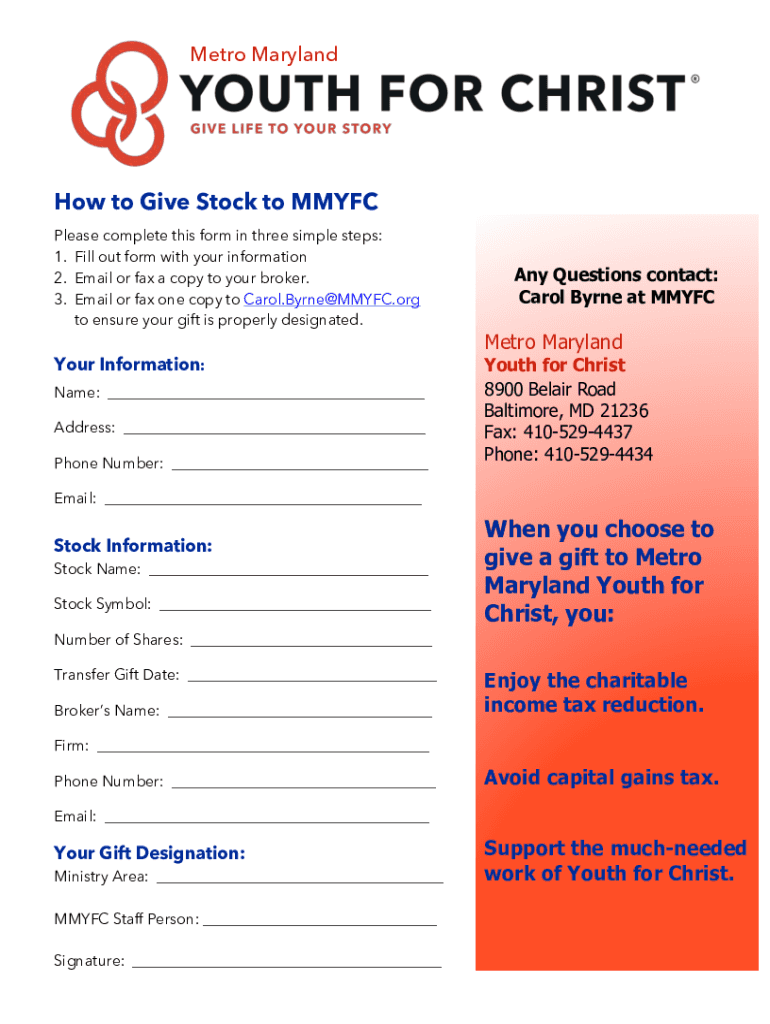

Metro Maryland to Give Stock to MMYFCPlease complete this form in three simple steps: 1. Fill out form with your information 2. Email or fax a copy to your broker. 3. Email or fax one copy to Carol.

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign stock gift - how

Edit your stock gift - how form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your stock gift - how form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing stock gift - how online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit stock gift - how. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out stock gift - how

How to fill out stock gift - how

01

Gather all necessary information about the stock gift, including the name of the stock, number of shares, and the date the gift was transferred.

02

Determine the fair market value of the stock on the date of the transfer.

03

Complete a stock power form, which may be obtained from the transfer agent or brokerage firm that handled the transfer of the stock.

04

Obtain a letter from the charity acknowledging the stock gift. This is important for tax purposes.

05

Provide the necessary information to your brokerage firm or transfer agent to initiate the transfer of the stock gift.

06

Keep copies of all relevant documents, including the stock power form, letter from the charity, and any confirmation or receipt from the transfer agent or brokerage firm.

07

Consult with a tax professional to ensure you properly report the stock gift on your tax return, if required.

Who needs stock gift - how?

01

Anyone who wishes to make a charitable donation and has stocks or securities that they would like to gift can consider making a stock gift. It can be beneficial for individuals who have appreciated stocks and want to avoid capital gains tax or those who simply want to support a charity they believe in. Additionally, individuals who have reached the age for required minimum distributions (RMDs) from their retirement accounts can fulfill their RMD obligations by making a stock gift instead of a cash donation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get stock gift - how?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the stock gift - how in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I execute stock gift - how online?

pdfFiller has made it simple to fill out and eSign stock gift - how. The application has capabilities that allow you to modify and rearrange PDF content, add fillable fields, and eSign the document. Begin a free trial to discover all of the features of pdfFiller, the best document editing solution.

Can I sign the stock gift - how electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your stock gift - how in seconds.

What is stock gift - how?

A stock gift refers to the transfer of ownership of shares from one individual to another without receiving any payment in return. This is typically done to provide support to family members, friends, or charitable organizations.

Who is required to file stock gift - how?

Individuals who give stock gifts that exceed the annual exclusion limit set by the IRS must file a gift tax return (Form 709). This includes any person who transfers property or shares valued above the limit for a single year.

How to fill out stock gift - how?

To fill out a stock gift, you'll need to complete IRS Form 709, reporting the fair market value of the stock at the time of the gift, the recipient's information, and any applicable deductions or exclusions.

What is the purpose of stock gift - how?

The purpose of a stock gift can vary, including estate planning, reducing taxable estate value, providing financial support to loved ones, or charitable donations. It allows the giver to transfer wealth efficiently.

What information must be reported on stock gift - how?

When reporting a stock gift, you must provide details such as the fair market value of the stock at the time of the gift, the date of the gift, the recipient's name and address, and any prior gifts given to the same recipient.

Fill out your stock gift - how online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Stock Gift - How is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.