MT CIT (CLT-4) 2020 free printable template

Show details

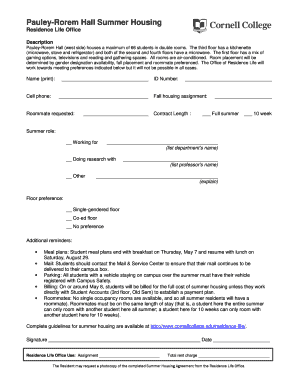

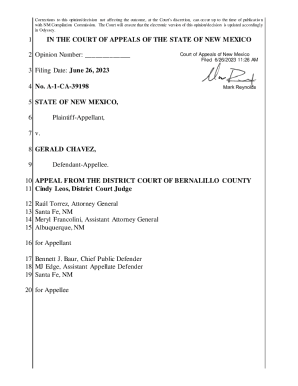

Clear Form C Form CIT 2018 Montana Corporate Income Tax Return No Staples Include a copy of federal Form 1120 as filed with the Internal Revenue Service For calendar year 2018 or tax year beginning M M D D 2 0 1 8 and ending M M D D Y Y Y Y Name - FEIN Mailing Address Federal Business Code/NAICS State Incorporated in City State Zip 4 on M M D D Y Y Y Y Date Qualified in Montana MT Secretary of State ID Mark all that apply Initial Return Final Return q Amended Return Refund Return Part I...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign MT CIT CLT-4

Edit your MT CIT CLT-4 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your MT CIT CLT-4 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing MT CIT CLT-4 online

Use the instructions below to start using our professional PDF editor:

1

Log in to your account. Start Free Trial and register a profile if you don't have one yet.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit MT CIT CLT-4. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you can have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

MT CIT (CLT-4) Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out MT CIT CLT-4

How to fill out MT CIT (CLT-4)

01

Obtain the MT CIT (CLT-4) form from the relevant tax authority or download it from their official website.

02

Fill in your personal information including your name, address, and identification number at the top of the form.

03

Provide details of your income, ensuring you include all sources such as salary, rental income, and investments.

04

Detail any deductions you are claiming, such as expenses related to your business or other allowable deductions.

05

Calculate the total taxable income and the taxes owed based on current tax rates.

06

Sign and date the form to affirm that all the information provided is accurate.

07

Submit the completed form to the relevant tax authority by the specified deadline.

Who needs MT CIT (CLT-4)?

01

Individuals who earn income and are required to declare it for tax purposes.

02

Self-employed individuals and freelancers who need to report their earnings.

03

Businesses that need to file tax returns for their operations.

04

Anyone claiming tax deductions or credits that must be documented.

Fill

form

: Try Risk Free

People Also Ask about

Does Montana have an efile form?

E-File Registration Requirements - Acceptance in the Montana e-file program is automatic with acceptance in the federal e-file program. State Only Return Requirements – The Montana e-file program uses Fed/State Modernized Electronic Filing (MeF) program. Amended Returns - Montana supports e-file for Amended Returns.

Which states do not require tax returns?

Tax-free states Alaska. Florida. Nevada. South Dakota. Texas. Washington. Wyoming.

How much do you have to make in Montana to file taxes?

Do I Have To File a Montana Income Tax Return? Filing StatusUnder 6565 and OlderSingle or Married Filing Separately$5,090$7,800Head of Household$10,180$12,890Married Filing Jointly$10,180One spouse over 65: $12,890 Both spouses over 65: $15,600

Does an LLC have to file a tax return in Montana?

By default, LLCs in Montana are taxed as pass-through entities. Montana LLCs must pay the 15.3% federal self-employment tax (12.4% for social security and 2.9% for Medicare), state income tax, employer-specific taxes, local taxes, and industry taxes.

Where do I send my MT state tax return?

(a) A return may be filed by personal delivery to the Montana Department of Revenue, 3rd Floor, Sam W. Mitchell Building, 125 North Roberts, Helena, Montana.

Does Montana require you to file a tax return?

If you live or work in Montana, you may need to file and pay individual income tax. These resources can help you determine your filing requirements and options.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send MT CIT CLT-4 for eSignature?

Once you are ready to share your MT CIT CLT-4, you can easily send it to others and get the eSigned document back just as quickly. Share your PDF by email, fax, text message, or USPS mail, or notarize it online. You can do all of this without ever leaving your account.

How can I get MT CIT CLT-4?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the MT CIT CLT-4. Open it immediately and start altering it with sophisticated capabilities.

How do I complete MT CIT CLT-4 on an Android device?

Use the pdfFiller app for Android to finish your MT CIT CLT-4. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is MT CIT (CLT-4)?

MT CIT (CLT-4) is a tax declaration form used in the state of Mato Grosso, Brazil, specifically for the collection of the Tax on Circulation of Goods and Services (ICMS) from taxpayers.

Who is required to file MT CIT (CLT-4)?

Taxpayers who engage in commercial activities, such as businesses selling goods or providing services subject to ICMS in the state of Mato Grosso, are required to file the MT CIT (CLT-4).

How to fill out MT CIT (CLT-4)?

To fill out MT CIT (CLT-4), taxpayers must provide detailed information about their business operations, such as sales data, ICMS collected, and other required financial information, following the instructions provided by the state tax authority.

What is the purpose of MT CIT (CLT-4)?

The purpose of MT CIT (CLT-4) is to report ICMS tax liabilities and ensure compliance with state tax regulations, allowing the government to collect taxes effectively.

What information must be reported on MT CIT (CLT-4)?

MT CIT (CLT-4) requires the reporting of information such as taxpayer identification, sales volume, ICMS collected, tax exemptions, and any other relevant financial data related to the taxpayer's activities.

Fill out your MT CIT CLT-4 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

MT CIT CLT-4 is not the form you're looking for?Search for another form here.

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.