Get the free Retirement Savings Plan - APPLICATION - achieva.mb.ca - achieva mb

Show details

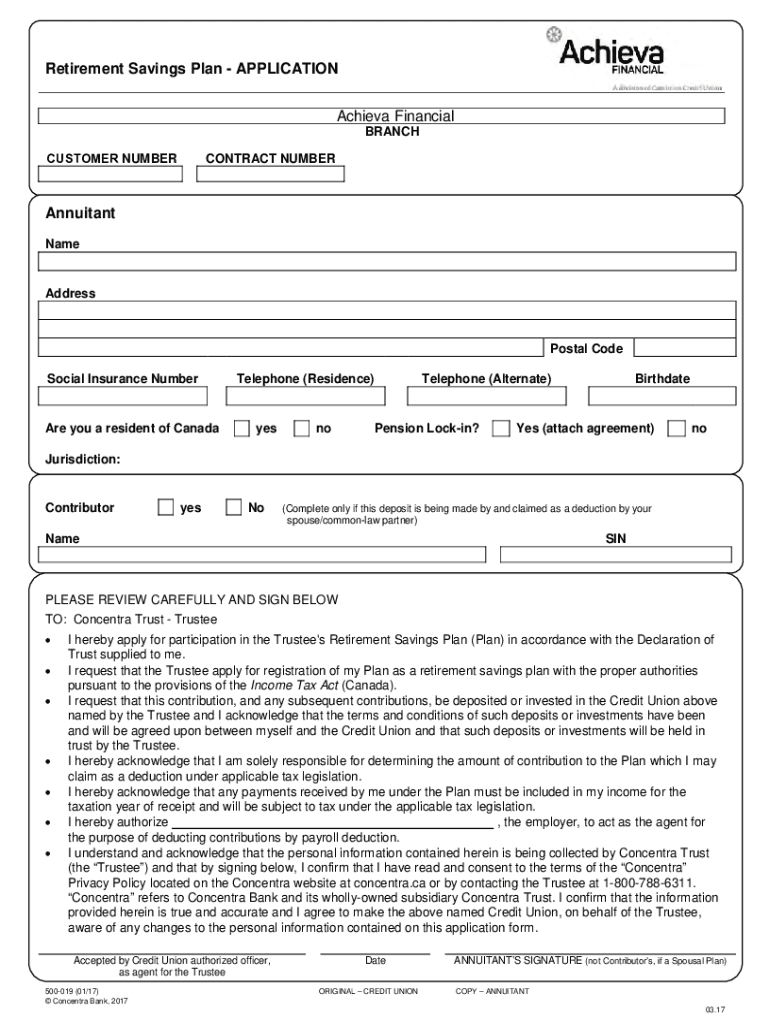

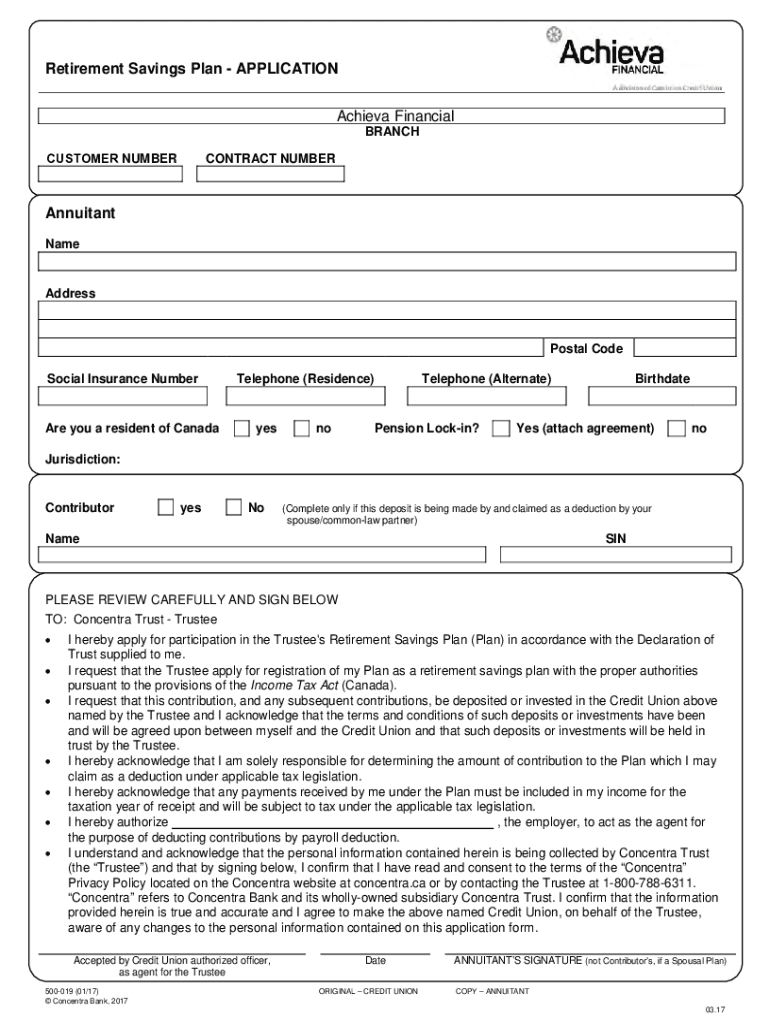

Retirement Savings Plan APPLICATION Achieve Financial BRANCH CUSTOMER NUMBERCONTRACT NUMBERAnnuitant NameAddressPostal Code Social Insurance Numerate you a resident of CanadaTelephone (Residence)yesnoTelephone

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign retirement savings plan

Edit your retirement savings plan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your retirement savings plan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing retirement savings plan online

To use the professional PDF editor, follow these steps:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit retirement savings plan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

Dealing with documents is simple using pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out retirement savings plan

How to fill out retirement savings plan

01

To fill out a retirement savings plan, follow these steps:

02

Determine your retirement goals: Start by determining how much money you will need for your desired lifestyle during retirement.

03

Assess your current financial situation: Take stock of your current savings, investments, and other sources of income that will contribute to your retirement savings.

04

Calculate your retirement savings gap: Subtract your current financial situation from your retirement goals to determine the amount you need to save.

05

Set a timeline: Determine when you want to retire and how many years you have to save. This will help you set realistic savings goals.

06

Choose the appropriate retirement savings account: Research and select the retirement savings account that best suits your needs, such as a 401(k), IRA, or pension plan.

07

Determine your contribution amount: Decide how much you can afford to contribute to your retirement savings plan on a regular basis. Consider your budget and financial obligations.

08

Automate your contributions: Set up automatic transfers or deductions from your paycheck or bank account to ensure consistent contributions to your retirement savings plan.

09

Review your investment options: Research and choose investment options within your retirement savings account that align with your risk tolerance and long-term goals.

10

Monitor and adjust your plan: Regularly review your retirement savings plan and make adjustments as needed based on changes in your financial situation, retirement goals, and market conditions.

11

Seek professional advice if needed: Consider consulting with a financial advisor or retirement specialist for personalized guidance and assistance with your retirement savings plan.

Who needs retirement savings plan?

01

A retirement savings plan is beneficial for anyone who wants to ensure financial security and independence during their retirement years. It is especially important for:

02

- Individuals who do not have access to employer-sponsored retirement plans like a 401(k)

03

- Self-employed individuals who do not have access to traditional employer retirement benefits

04

- Young professionals who want to start saving early and take advantage of compounding interest

05

- Individuals who want to maintain their standard of living and financial well-being after retirement

06

- Individuals who do not want to rely solely on government retirement benefits, which may be insufficient to cover their expenses

07

- Individuals who want to leave a financial legacy for their loved ones

08

- Individuals who want to have the flexibility to pursue their interests and hobbies during retirement without financial constraints

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the retirement savings plan electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you can use pdfFiller to eSign documents and enjoy all of the features of the PDF editor in one place. Use the extension to create a legally-binding eSignature by drawing it, typing it, or uploading a picture of your handwritten signature. Whatever you choose, you will be able to eSign your retirement savings plan in seconds.

How do I fill out retirement savings plan using my mobile device?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign retirement savings plan and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

How do I edit retirement savings plan on an iOS device?

Use the pdfFiller mobile app to create, edit, and share retirement savings plan from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is retirement savings plan?

A retirement savings plan is a financial arrangement designed to help individuals save and invest money for their retirement. It usually allows individuals to contribute a portion of their earnings while providing tax benefits.

Who is required to file retirement savings plan?

Individuals who have contributed to a retirement savings plan and meet specific income criteria are typically required to file these plans. Employers that offer retirement plans also usually need to file certain documents.

How to fill out retirement savings plan?

To fill out a retirement savings plan, individuals need to complete required forms provided by their employer or financial institution, provide necessary personal information, and specify contribution amounts and investment choices.

What is the purpose of retirement savings plan?

The purpose of a retirement savings plan is to provide individuals with a structured way to save money for their retirement, ensuring they have sufficient funds to sustain their living expenses after they stop working.

What information must be reported on retirement savings plan?

Information typically includes participant details, contribution amounts, investment selections, account balances, and other relevant financial information regarding the retirement savings.

Fill out your retirement savings plan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Retirement Savings Plan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.