INSCCU Direct Deposit Information Letter 2007-2026 free printable template

Show details

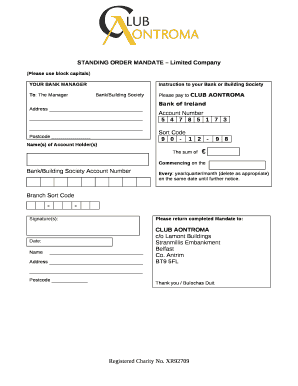

Each deposit will be available in your bank approximately three 3 business days from the posting date if processed by the INSCCU and two 2 business days if processed by the county. FOR A SAVINGS ACCOUNT PROVIDE YOUR FINANCIAL INSTITUTION S ROUTING NUMBER ALONG WITH THE ACCOUNT NUMBER. Deposits will not begin for at least 10 business days after this authorization form is received at the INSCCU. You may choose only one account to which these funds ...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign INSCCU Direct Deposit Information Letter

Edit your INSCCU Direct Deposit Information Letter form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your INSCCU Direct Deposit Information Letter form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit INSCCU Direct Deposit Information Letter online

To use our professional PDF editor, follow these steps:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit INSCCU Direct Deposit Information Letter. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out INSCCU Direct Deposit Information Letter

How to fill out INSCCU Direct Deposit Information Letter

01

Obtain the INSCCU Direct Deposit Information Letter from your employer or INSCCU website.

02

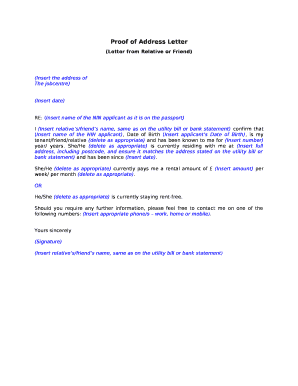

Fill in your personal information including your name, address, and Social Security number.

03

Provide your bank account details, including the bank name, account number, and routing number.

04

Indicate the type of account you are using (checking or savings).

05

Review the filled information for accuracy.

06

Sign and date the form to authorize the direct deposit.

07

Submit the completed letter to your employer or designated representative.

Who needs INSCCU Direct Deposit Information Letter?

01

Employees who want to set up direct deposit for their salary.

02

Individuals receiving benefits or payments that can be directly deposited into their bank account.

03

Anyone who prefers electronic funds transfer instead of receiving a physical check.

Fill

form

: Try Risk Free

People Also Ask about

Does Indiana child support automatically stop at 19?

When a child turns 19 years old, the child is emancipated by operation of law, and the non-custodial parent's obligation to pay current child support terminates. An exception is if the child is incapacitated. In this case, the child support continues during the incapacity or until further order of the court.

What is the standard amount of child support in Indiana?

The court orders a flat percentage of 25% of the non-custodial parent's income to be paid in child support to the custodial parent.

What age does child support end in Indiana?

When a child turns 19 years old, the child is emancipated by operation of law, and the non-custodial parent's obligation to pay current child support terminates. An exception is if the child is incapacitated. In this case, the child support continues during the incapacity or until further order of the court.

How do I avoid paying child support in Indiana?

In Indiana, a parent can emancipate their child after the age of 19 in order to not have to pay child support. A child can also be emancipated at the age of 18 if they are not attending secondary school or post-secondary school and they are financially supporting themselves or are capable of doing so.

What is Indiana State Central Collection Unit?

2 In response to this mandate, the Child Support Bureau (CSB) contracted with a vendor to establish the Indiana State Central Collection Unit (INSCCU). INSCCU receives non-cash payments in the form of personal check, money order, cashier's. check and certified check.

How do I check my child support balance in Indiana?

If you are seeking to obtain information on recent payments, please contact the KIDS Line at 800-840-8757 or visit the Child Support Bureau website.

What happens if you don't pay child support in Indiana?

Initiating contempt proceedings. This means that the paying parent has to go to court and explain to the judge why the parent disobeyed a lawful child support order. Contempts are very serious and can result in jail time.

How far behind in child support before a warrant is issued in Indiana?

To be applied, the support obligation must exceed $5,000 or remain unpaid for more than one (1) year. The penalties under this statute are: 1) for the first offense, not more than 6 months imprisonment and/ or a fine of $5,000; and 2) for the second offense, not more than 2 years imprisonment and/or a fine of $250,000.

How do you receive child support payments in Indiana?

HOW DO I GET MY SUPPORT MONEY? You will receive your payments by direct deposit to your bank account or onto an Indiana Visa Debit Card. If you wish to have direct deposit, you need to pick up a form in the Child Support Office and return it to the Indiana State Central Collection Unit (INSCCU).

How do they calculate child support in Indiana?

In Indiana, child support is calculated based on two main factors: how much money each parent makes, and how much money each parent must spend on other obligations. The court will also factor in how much time each parent spends with the child, and what the child needs.

Where do employers send child support payments to Indiana?

Employers. Indiana Code, Section 31-16-15-16 requires employers with fifty (50) or more employees and more than one child support obligor to process those payments electronically to the State Central Collection Unit. This law went into effect July 1st 2002.

How do I find out if I owe back child support?

Go to the state's child-support enforcement website. Some states post photographs of delinquent parents online, and some local governments do so as well. Go online to the county courthouse. Use your name or the other parent's name to find out if any child-support actions have been filed.

What is the annual support fee in Indiana?

The Annual Support Fee is a once-a-year administrative fee for processing child support payments. The Annual Support Fee is $55.00 per child support case. IS REQUIRED TO PAY THE ANNUAL SUPPORT FEE? Anyone ordered to pay child support in Indiana is required to pay the Annual Support Fee.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send INSCCU Direct Deposit Information Letter to be eSigned by others?

Once your INSCCU Direct Deposit Information Letter is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I make changes in INSCCU Direct Deposit Information Letter?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your INSCCU Direct Deposit Information Letter and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I create an electronic signature for the INSCCU Direct Deposit Information Letter in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your INSCCU Direct Deposit Information Letter in seconds.

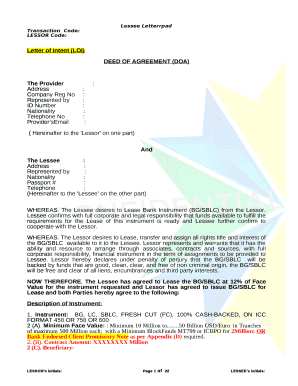

What is INSCCU Direct Deposit Information Letter?

The INSCCU Direct Deposit Information Letter is a document that provides essential information and instructions regarding the setup and management of direct deposits to accounts managed by INSCCU (International and National State Credit Union).

Who is required to file INSCCU Direct Deposit Information Letter?

Individuals who wish to have their payments directly deposited into their INSCCU accounts are required to file the INSCCU Direct Deposit Information Letter, including members receiving government benefits, paychecks, or other recurring payments.

How to fill out INSCCU Direct Deposit Information Letter?

To fill out the INSCCU Direct Deposit Information Letter, you must provide personal identification details, account information, and any required signatures indicating your consent to establish direct deposit.

What is the purpose of INSCCU Direct Deposit Information Letter?

The purpose of the INSCCU Direct Deposit Information Letter is to facilitate the direct deposit process by providing the necessary information and authorization to ensure funds are securely and promptly deposited into the designated account.

What information must be reported on INSCCU Direct Deposit Information Letter?

The information that must be reported on the INSCCU Direct Deposit Information Letter includes the account holder's name, account number, the type of account (checking or savings), and banking institution details, along with the authorization signature.

Fill out your INSCCU Direct Deposit Information Letter online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

INSCCU Direct Deposit Information Letter is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.