Get the free Originator: Uniform Residential Loan Application

Show details

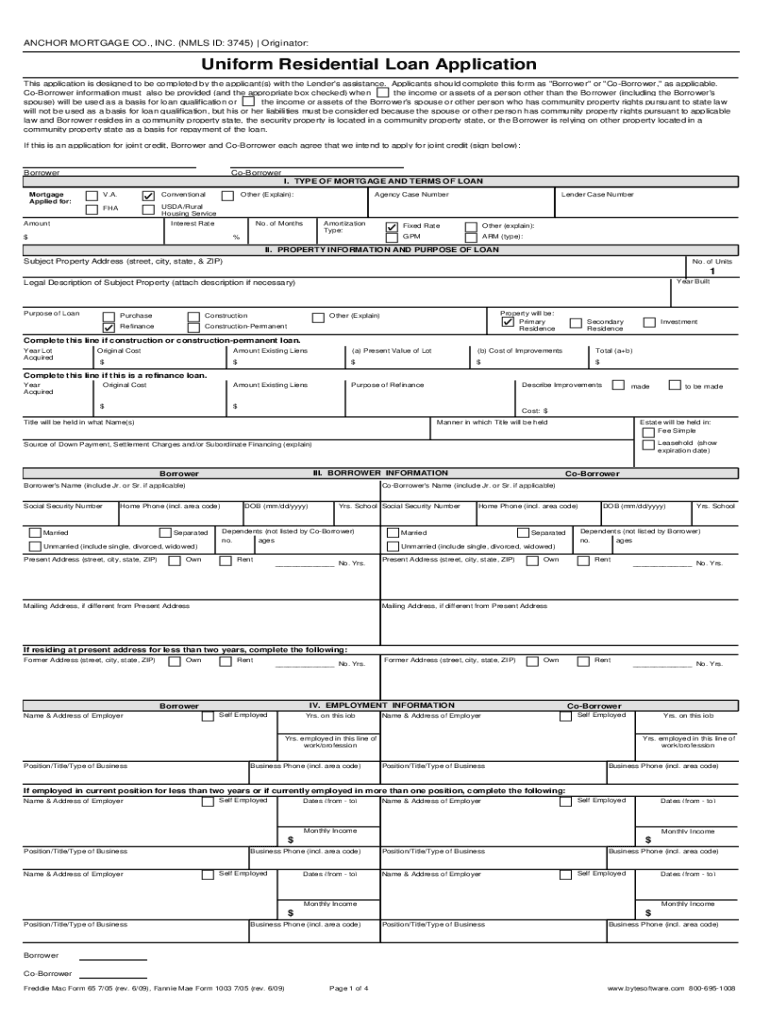

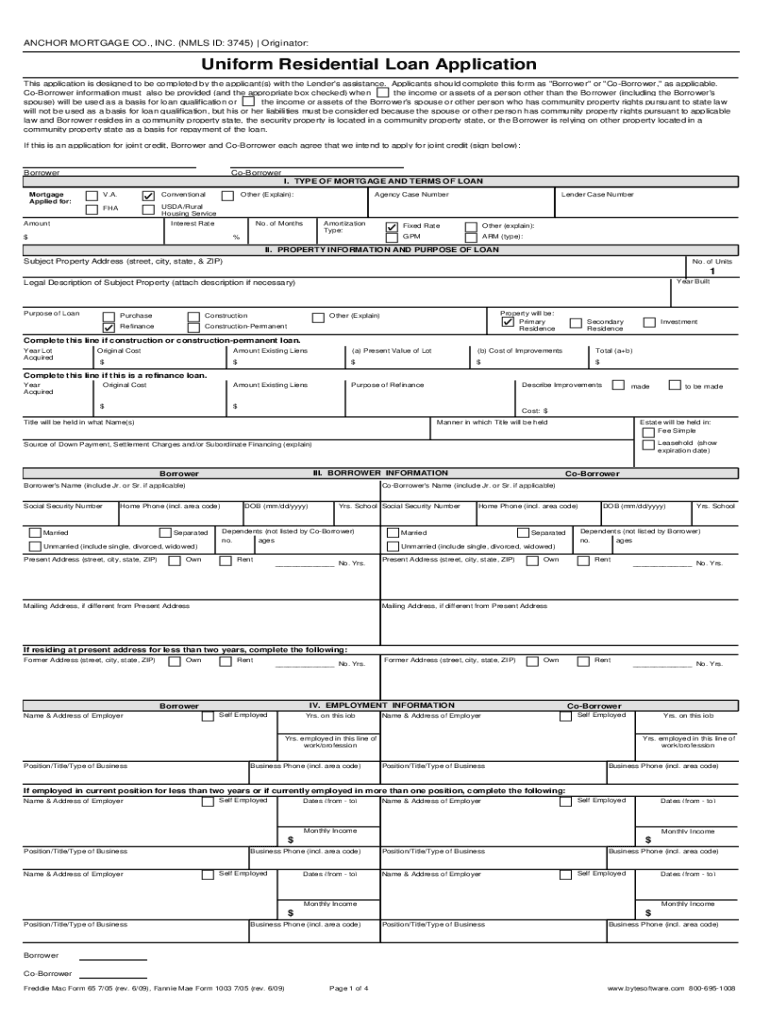

ANCHOR MORTGAGE CO., INC. (NLS ID: 3745) Originator:Uniform Residential Loan Application This application is designed to be completed by the applicant(s) with the Lender's assistance. Applicants should

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign originator uniform residential loan

Edit your originator uniform residential loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your originator uniform residential loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing originator uniform residential loan online

Use the instructions below to start using our professional PDF editor:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit originator uniform residential loan. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out originator uniform residential loan

How to fill out originator uniform residential loan

01

To fill out an originator uniform residential loan, follow these steps:

02

Start by collecting all the necessary documentation, such as income statements, employment history, and credit reports.

03

Open the loan application form provided by the originator and read through the instructions carefully.

04

Begin filling out the personal information section with your full name, contact details, and social security number.

05

Provide information about your current residence, including the address, monthly rent/mortgage payment, and length of occupancy.

06

Move on to the employment history section and list your current and previous employers, along with the dates of employment and salary.

07

Provide details about your income, including any additional sources of revenue or assets.

08

Disclose information about your existing debts and liabilities, such as credit card balances, student loans, or mortgages.

09

Fill out the section pertaining to the property you intend to purchase or refinance, including its address, estimated value, and the loan amount requested.

10

Review the completed form for any errors or omissions before submitting it to the originator.

11

Attach any supporting documents required by the originator, such as proof of income or identification.

12

Finally, sign and date the form, either electronically or manually, as per the originator's instructions.

13

Submit the completed form and supporting documents to the originator via the specified submission method, such as in-person, by mail, or online.

Who needs originator uniform residential loan?

01

Originator uniform residential loan is typically needed by:

02

- Individuals or families planning to purchase a home and requiring financial assistance in the form of a mortgage.

03

- Homeowners looking to refinance their current mortgage to take advantage of lower interest rates or other favorable terms.

04

- Real estate investors seeking financing for rental properties or other investment opportunities.

05

- Individuals looking to access the equity in their homes through a home equity loan or line of credit.

06

- Borrowers with sufficient creditworthiness and financial stability who meet the eligibility criteria set by the originator.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my originator uniform residential loan in Gmail?

originator uniform residential loan and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How do I make edits in originator uniform residential loan without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing originator uniform residential loan and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out originator uniform residential loan on an Android device?

On an Android device, use the pdfFiller mobile app to finish your originator uniform residential loan. The program allows you to execute all necessary document management operations, such as adding, editing, and removing text, signing, annotating, and more. You only need a smartphone and an internet connection.

What is originator uniform residential loan?

The originator uniform residential loan refers to a standardized document used in the residential mortgage lending process that provides detailed information about the loan being originated.

Who is required to file originator uniform residential loan?

Lenders and mortgage brokers involved in originating residential loans are required to file the originator uniform residential loan.

How to fill out originator uniform residential loan?

To fill out the originator uniform residential loan, the lender must provide borrower information, property details, loan terms, and financial disclosures as prescribed in the form.

What is the purpose of originator uniform residential loan?

The purpose of the originator uniform residential loan is to standardize the information provided during the mortgage application process for consistency and compliance.

What information must be reported on originator uniform residential loan?

The originator uniform residential loan must report borrower details, loan amount, interest rate, property address, and any applicable fees and charges.

Fill out your originator uniform residential loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Originator Uniform Residential Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.