Get the free Internal Revenue Service Number: 200336032 Release Date: 09/05 ...

Show details

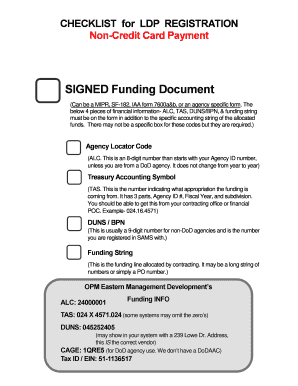

Attachments Consolidated Plan Budget 196 ATTACHMENTS Municipal Programs: 108 Debt Service Code Enforcement Total $ $ $$$3,780,627.3222,465,822.34 × $$9,928,000.00370,622.00 ×5,131,235.00 12,750,495.00

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign internal revenue service number

Edit your internal revenue service number form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your internal revenue service number form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit internal revenue service number online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit internal revenue service number. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out internal revenue service number

01

To fill out an Internal Revenue Service (IRS) number, you will need to follow these steps:

1.1

Step 1: Determine if you are eligible for an IRS number. The IRS issues taxpayer identification numbers, such as Social Security Numbers (SSN) or Individual Taxpayer Identification Numbers (ITIN), to individuals who are required to file taxes or conduct business in the United States. If you fall into these categories, you will need to apply for an IRS number.

1.2

Step 2: Gather the necessary documents. To apply for an IRS number, you will typically need to provide proof of your identity, such as a valid passport or driver's license. If you are a non-U.S. citizen, you may need to provide additional documentation, such as a visa or an I-94 Arrival/Departure Record issued by U.S. Customs and Border Protection.

1.3

Step 3: Complete the appropriate application form. Depending on your eligibility, you will need to fill out either Form SS-5 (Application for a Social Security Card) or Form W-7 (Application for IRS Individual Taxpayer Identification Number). These forms can be obtained from the IRS website or various IRS offices.

1.4

Step 4: Submit your application. Once you have completed the necessary application form and gathered all required documents, you can submit your application to the IRS. This can typically be done by mail or in-person at an IRS office. Be sure to follow the instructions provided by the IRS and include all required documents to avoid any delays or rejections.

02

The individuals who require an Internal Revenue Service (IRS) number include:

2.1

U.S. citizens: All U.S. citizens are required to have an IRS number, usually in the form of a Social Security Number (SSN). This number is necessary for reporting income, filing tax returns, and receiving certain benefits from the government.

2.2

Non-U.S. citizens: Non-U.S. citizens who are required to file U.S. tax returns or engage in business activities in the United States may need an IRS number. In most cases, non-U.S. citizens without eligibility for a SSN will need to apply for an Individual Taxpayer Identification Number (ITIN) by submitting Form W-7 to the IRS.

2.3

Dependent individuals: Dependents, such as children or spouses, who are claimed on someone else's tax return may also need an IRS number. This helps the IRS track dependent information and ensures that tax benefits are allocated correctly.

2.4

Nonresident aliens: Nonresident aliens who earn income in the United States may need an IRS number for tax purposes. This includes individuals who receive income from sources such as investments, employment, or rental properties located in the U.S.

2.5

Foreign individuals conducting business in the U.S.: Foreign individuals who engage in business activities within the United States, such as owning a U.S. company or receiving U.S. income, will need an IRS number for tax reporting and compliance purposes.

It is important to note that the specific requirements for obtaining an IRS number may vary depending on your individual circumstances. It is recommended to consult with the IRS or a qualified tax professional to ensure you meet all the necessary criteria and complete the application accurately.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my internal revenue service number directly from Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your internal revenue service number and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I get internal revenue service number?

The premium pdfFiller subscription gives you access to over 25M fillable templates that you can download, fill out, print, and sign. The library has state-specific internal revenue service number and other forms. Find the template you need and change it using powerful tools.

How do I execute internal revenue service number online?

pdfFiller has made filling out and eSigning internal revenue service number easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Fill out your internal revenue service number online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Internal Revenue Service Number is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.