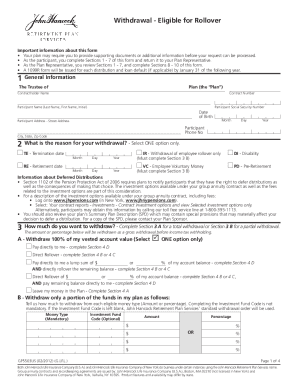

CO DR 0104AD 2020 free printable template

Show details

Lifeline Instructions for the DR 0104AD Subtractions from Income Scheduling 4 Spouse Pension and Annuity Subtraction Page 1Line 1 State Income Tax RefundRefer to your federal income tax return to

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign CO DR 0104AD

Edit your CO DR 0104AD form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your CO DR 0104AD form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit CO DR 0104AD online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit CO DR 0104AD. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CO DR 0104AD Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out CO DR 0104AD

How to fill out CO DR 0104AD

01

Download the CO DR 0104AD form from the official website.

02

Fill out your personal information, including name, address, and contact details.

03

Provide the reason for the application in the designated section.

04

Include any necessary documentation or evidence to support your application.

05

Review the form for completeness and accuracy.

06

Sign and date the form at the bottom.

07

Submit the completed form to the appropriate office as instructed.

Who needs CO DR 0104AD?

01

Individuals or entities who need to request a specific action related to the Colorado Department of Revenue.

02

Taxpayers seeking to amend their tax filings or correct errors.

03

Anyone involved in administrative processes requiring formal documentation with the Department of Revenue.

Fill

form

: Try Risk Free

People Also Ask about

What qualifies for the Colorado pension and annuity exclusion?

Colorado allows a pension/annuity subtraction for: Taxpayers who are at least 55 years of age as of the last day of the tax year. Beneficiaries of any age (such as a widowed spouse or orphan child) who are receiving a pension or annuity because of the death of the person who earned the pension.

What is a DR 0100 form Colorado?

The Colorado Retail Sales Tax Return (DR 0100) is used to report not only Colorado sales tax, but also sales taxes administered by the Colorado Department of Revenue for various cities, counties, and special districts in the state.

What is a 104PN tax form?

This form apportions your gross income so that Colorado tax is calculated for only your Colorado income. Complete this form after you have filled out lines 1 through 9 of the DR 0104. If you filed federal form 1040NR, see the instructions.

Is there a Colorado state tax form?

These 2021 forms and more are available: Colorado Form 104 – Personal Income Tax Return for Residents. Colorado Form 104PN – Personal Income Tax Return for Nonresidents and Part-Year Residents. Colorado Form 104CR – Individual Credit Schedule.

What is a form 104 in Colorado?

Colorado Individual Income Tax Return. Colorado form 104 is designed for state individuals to report their annual income.

What is Colorado Form dr 0104ad?

If claiming a subtraction and filing by paper, you must submit this schedule with your return. Use this schedule to report any subtractions from your Federal Taxable Income.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify CO DR 0104AD without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your CO DR 0104AD into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit CO DR 0104AD in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing CO DR 0104AD and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out CO DR 0104AD using my mobile device?

Use the pdfFiller mobile app to complete and sign CO DR 0104AD on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is CO DR 0104AD?

CO DR 0104AD is a form used for reporting Colorado income tax credits for businesses.

Who is required to file CO DR 0104AD?

Businesses and organizations that qualify for specific tax credits in Colorado are required to file CO DR 0104AD.

How to fill out CO DR 0104AD?

To fill out CO DR 0104AD, provide the necessary business information, indicate the applicable tax credits, and attach any required supporting documentation.

What is the purpose of CO DR 0104AD?

The purpose of CO DR 0104AD is to help businesses claim eligible tax credits and to provide the state with essential information for tax administration.

What information must be reported on CO DR 0104AD?

The information that must be reported includes the business name, tax identification number, types of credits being claimed, and any relevant financial details.

Fill out your CO DR 0104AD online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

CO DR 0104ad is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.