Get the free NUVEEN TAX EXEMPT UNIT TRUST SERIES 824 (Form: 487, Filing Date: 09/12/1995). Access...

Show details

SECURITIES AND EXCHANGE COMMISSION FORM 487 Pre-effective pricing amendment filed pursuant to Securities Act Rule 487 Filing Date: 1995-09-12 SEC Accession No. 0000883053-95-000159 (HTML Version on

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign nuveen tax exempt unit

Edit your nuveen tax exempt unit form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your nuveen tax exempt unit form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing nuveen tax exempt unit online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit nuveen tax exempt unit. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

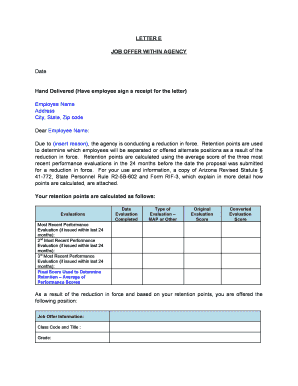

How to fill out nuveen tax exempt unit

How to fill out nuveen tax exempt unit:

01

Obtain the necessary paperwork: Begin by acquiring the nuveen tax exempt unit application form. This can usually be downloaded from the official nuveen website or obtained directly from your financial advisor.

02

Provide personal information: Fill out all the required fields on the form which typically include personal information such as your full name, contact details, social security number, and date of birth. Ensure that all the information provided is accurate and up to date.

03

Determine the investment amount: Choose the amount of money you wish to invest in the nuveen tax exempt unit. Consider your investment goals, risk tolerance, and financial capabilities before deciding on an appropriate investment amount.

04

Understand tax-exempt guidelines: Familiarize yourself with the tax-exempt guidelines in your specific jurisdiction. This will help you determine if the nuveen tax exempt unit is suitable for your investment needs and objectives.

05

Evaluate the fund's prospectus: Carefully read through the fund's prospectus provided by nuveen. The prospectus contains essential information about the fund's objectives, risks, fees, and historical performance. Make sure you understand these details before proceeding.

06

Follow the instructions: Follow the instructions outlined in the application form regarding how to complete it accurately and attach any required supporting documents. Be thorough and double-check all the information provided before submitting.

Who needs nuveen tax exempt unit:

01

Individual investors seeking tax-exempt income: Nuveen tax exempt units are suitable for individuals who are looking for tax-exempt income from their investments. It can be especially beneficial for those in higher tax brackets who want to minimize their tax obligations.

02

Investors seeking diversification: Nuveen tax exempt units can offer investors diversification benefits by providing exposure to a broad range of municipal bonds. This can help spread the investment risk across different sectors and regions.

03

Risk-averse investors: The nuveen tax exempt unit primarily focuses on investing in municipal bonds, which are considered relatively low-risk compared to other investment options. It may appeal to risk-averse investors who prioritize capital preservation over aggressive growth.

04

Investors aiming for steady income: The nuveen tax exempt unit aims to generate regular income distributions by investing in tax-exempt municipal bonds. Individuals who depend on a steady income stream, such as retirees, may find this investment option suitable for their needs.

05

Individuals conscious of tax implications: Investors concerned about the impact of taxes on their investment returns may find the nuveen tax exempt unit attractive. Since the income generated from these bonds is exempt from federal income tax, it can potentially enhance after-tax returns.

Remember to consult with a qualified financial advisor or tax professional to determine if investing in nuveen tax exempt units aligns with your specific financial goals and circumstances.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

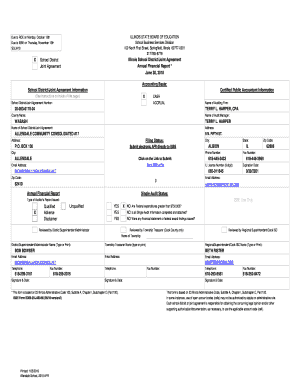

What is nuveen tax exempt unit?

Nuveen Tax Exempt Unit is a tax-exempt investment fund managed by Nuveen, which invests in municipal bonds.

Who is required to file nuveen tax exempt unit?

Investors who own shares in Nuveen Tax Exempt Unit are required to report any income or gains from the fund on their tax returns.

How to fill out nuveen tax exempt unit?

To fill out Nuveen Tax Exempt Unit, investors need to report the dividend income or capital gains distributions received from the fund on their tax returns.

What is the purpose of nuveen tax exempt unit?

The purpose of Nuveen Tax Exempt Unit is to provide investors with tax-exempt income from investments in municipal bonds.

What information must be reported on nuveen tax exempt unit?

Investors must report the dividend income and capital gains distributions received from Nuveen Tax Exempt Unit on their tax returns.

How do I execute nuveen tax exempt unit online?

pdfFiller makes it easy to finish and sign nuveen tax exempt unit online. It lets you make changes to original PDF content, highlight, black out, erase, and write text anywhere on a page, legally eSign your form, and more, all from one place. Create a free account and use the web to keep track of professional documents.

How do I make changes in nuveen tax exempt unit?

With pdfFiller, you may not only alter the content but also rearrange the pages. Upload your nuveen tax exempt unit and modify it with a few clicks. The editor lets you add photos, sticky notes, text boxes, and more to PDFs.

Can I edit nuveen tax exempt unit on an iOS device?

Use the pdfFiller mobile app to create, edit, and share nuveen tax exempt unit from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

Fill out your nuveen tax exempt unit online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Nuveen Tax Exempt Unit is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.