Get the free Practical Insolvency

Show details

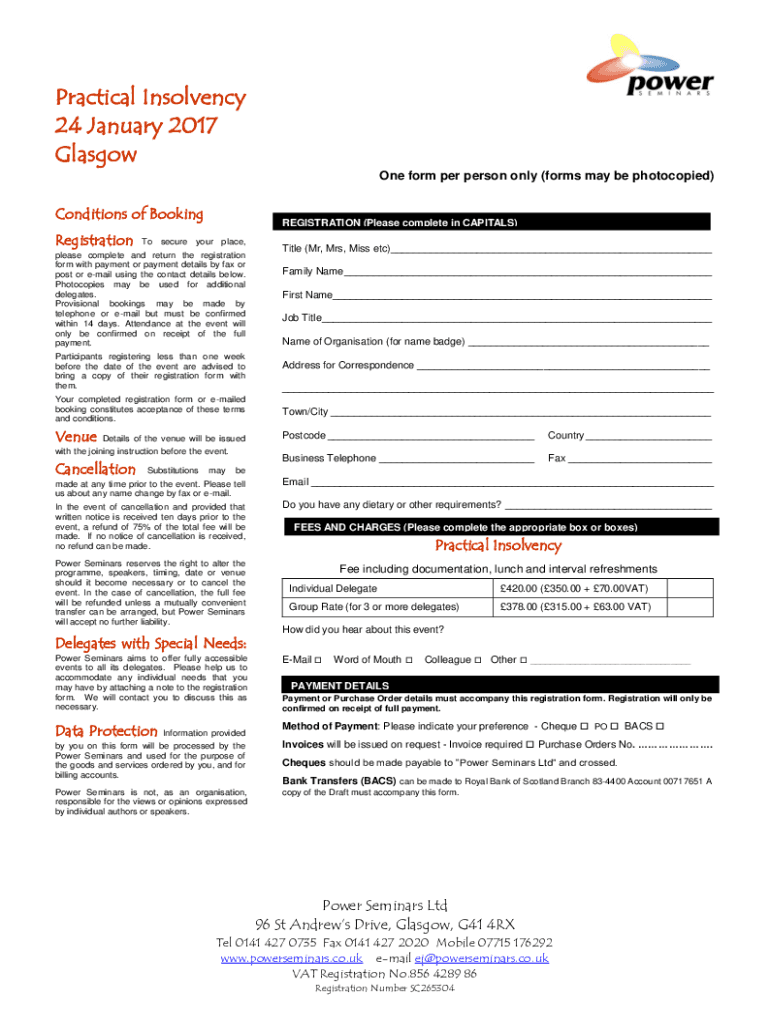

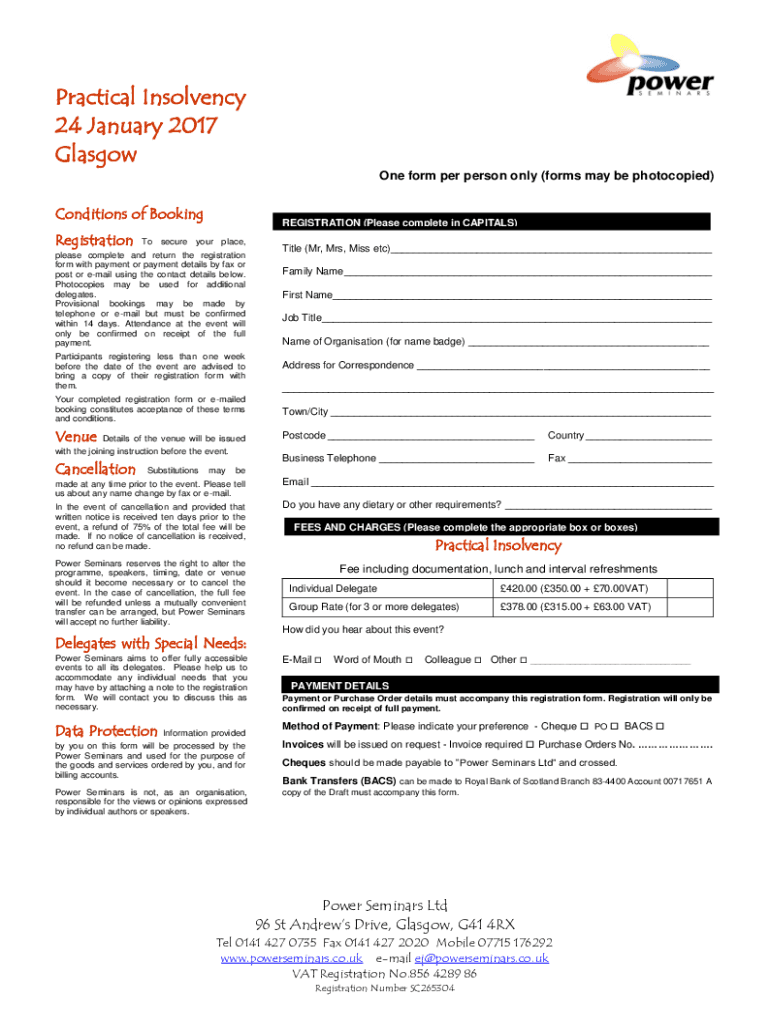

Practical Insolvency

24 January 2017

Glasgow

One form per person only (forms may be photocopied)Conditions of Booking

RegistrationREGISTRATION (Please complete in CAPITALS)To secure your place, please

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign practical insolvency

Edit your practical insolvency form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your practical insolvency form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit practical insolvency online

Follow the guidelines below to benefit from the PDF editor's expertise:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit practical insolvency. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out practical insolvency

How to fill out practical insolvency

01

Gather all relevant financial information and documents, such as income statements, balance sheets, and debt statements.

02

Assess your current financial situation and determine if insolvency is the best option for you. Consult with a financial advisor or insolvency practitioner if necessary.

03

Determine the type of insolvency procedure that is most suitable for your situation, such as liquidation or administration.

04

Fill out the necessary forms and submit them to the relevant insolvency authority. Provide accurate and complete information to avoid any delays or complications.

05

Cooperate with the appointed insolvency practitioner and provide any additional information or documentation as requested.

06

Attend any meetings or hearings related to the insolvency process and comply with any obligations or requirements given by the insolvency practitioner.

07

Follow any instructions or recommendations provided by the insolvency practitioner to maximize the chances of a successful resolution.

08

Keep track of the progress of the insolvency process and stay informed about any changes or developments.

09

Stay proactive in managing your finances and seek professional guidance if needed to prevent future insolvency situations.

Who needs practical insolvency?

01

Practical insolvency is needed by individuals or businesses facing severe financial difficulties that cannot be resolved through conventional means.

02

This may include individuals who are unable to meet their debt obligations and are at risk of bankruptcy, or businesses that are struggling to pay their creditors and need a structured process to address their financial issues.

03

Practical insolvency provides a legal framework for debt restructuring, asset liquidation, or financial rehabilitation, offering a chance for debtors to regain control of their finances and overcome insolvency.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send practical insolvency to be eSigned by others?

When your practical insolvency is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I execute practical insolvency online?

pdfFiller has made filling out and eSigning practical insolvency easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

Can I edit practical insolvency on an Android device?

You can make any changes to PDF files, like practical insolvency, with the help of the pdfFiller Android app. Edit, sign, and send documents right from your phone or tablet. You can use the app to make document management easier wherever you are.

What is practical insolvency?

Practical insolvency refers to a situation where an individual or business is unable to meet their financial obligations, particularly when their liabilities exceed their assets, or when they cannot pay debts as they come due.

Who is required to file practical insolvency?

Typically, individuals, partnerships, or corporations that are unable to pay their debts or whose liabilities exceed their assets are required to file for practical insolvency.

How to fill out practical insolvency?

To fill out practical insolvency, one must complete the necessary forms provided by relevant authorities, providing details about assets, liabilities, income, and expenses, along with supporting documentation.

What is the purpose of practical insolvency?

The purpose of practical insolvency is to provide a legal framework for individuals or entities that are unable to pay their debts, allowing for restructuring or liquidation of assets in an organized manner.

What information must be reported on practical insolvency?

Information required includes personal or business details, a complete list of assets and liabilities, income and expense statements, and any relevant financial transactions.

Fill out your practical insolvency online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Practical Insolvency is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.