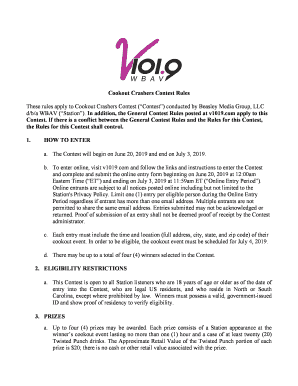

Get the free Generosity in Canada and the United States: The 2012 Generosity Index. The Generosit...

Show details

, Q I, 1 mm Section 4947(a)(1)of Private FoundationTrust N0 1545-0552 Q90-PF Return Nonexempt Charitable OMB, or Depai1men(0HheTrea5ury Treated as a Private lateral Revenue Service Note. The foundation

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign generosity in canada and

Edit your generosity in canada and form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your generosity in canada and form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit generosity in canada and online

To use the professional PDF editor, follow these steps:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit generosity in canada and. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out generosity in canada and

How to fill out generosity in Canada and:

01

Research and gather information about various charitable organizations and initiatives in Canada. Look for ones that align with your values and causes you are passionate about.

02

Determine the form of generosity you want to express, whether it be financial donations, volunteering your time, or providing resources or skills.

03

Understand the specific requirements and processes of each organization you are interested in contributing to. This may include filling out forms, providing personal information, or attending orientation sessions.

04

Set a budget or allocate resources specifically for generosity purposes. This will help you manage your contributions effectively and ensure you are able to support causes consistently.

05

Follow the instructions provided by the organization for making financial donations. This may involve online transactions, mailing checks, or setting up regular contributions.

06

If you are interested in volunteering, reach out directly to organizations and inquire about their volunteer opportunities. Fill out any necessary forms or applications and attend any required training sessions.

07

Keep track of your contributions and any impact they have made. This can help you reflect on your generosity journey and potentially inspire others to join in as well.

Who needs generosity in Canada and:

01

Individuals or families living in poverty or facing financial hardships can greatly benefit from the generosity of others. Donations and support can help them meet their basic needs and improve their quality of life.

02

Charitable organizations that rely on the generosity of donors to fulfill their mission and provide assistance to those in need. They require resources, funding, and volunteers to carry out their work effectively.

03

Immigrants and refugees who are settling in Canada often require support to adapt to their new environment and access necessary services. Generosity can help them integrate and establish a sense of belonging in their adopted country.

04

Indigenous communities that face various challenges, including poverty, inadequate healthcare, and limited access to education and employment opportunities. Generosity can contribute to their overall well-being and help address systemic inequalities.

05

Victims of natural disasters or emergencies who require immediate assistance and relief efforts. Generosity can provide them with essential supplies, shelter, and other necessities during times of crisis.

06

Non-profit organizations that focus on healthcare, education, environmental conservation, animal welfare, and other important causes. They rely on generosity to fund their programs, conduct research, and advocate for change.

By filling out generosity in Canada and understanding who needs it, we can make a positive impact on the lives of individuals and communities in need, while also contributing to the betterment of society as a whole.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is generosity in Canada?

Generosity in Canada refers to the act of giving or donating resources, time, or money to those in need.

Who is required to file generosity in Canada?

Individuals or organizations who have made significant charitable donations or contributions may be required to file generosity in Canada for tax purposes.

How to fill out generosity in Canada?

To fill out generosity in Canada, one must report details of the donations or contributions made, including the amount, recipient organization, and date of donation.

What is the purpose of generosity in Canada?

The purpose of generosity in Canada is to track and monitor charitable giving, provide tax incentives for donations, and support organizations that benefit the community.

What information must be reported on generosity in Canada?

Information such as the amount of donation, name of recipient organization, date of donation, and any tax receipts received must be reported on generosity in Canada.

Where do I find generosity in canada and?

The premium version of pdfFiller gives you access to a huge library of fillable forms (more than 25 million fillable templates). You can download, fill out, print, and sign them all. State-specific generosity in canada and and other forms will be easy to find in the library. Find the template you need and use advanced editing tools to make it your own.

Can I create an electronic signature for the generosity in canada and in Chrome?

Yes. You can use pdfFiller to sign documents and use all of the features of the PDF editor in one place if you add this solution to Chrome. In order to use the extension, you can draw or write an electronic signature. You can also upload a picture of your handwritten signature. There is no need to worry about how long it takes to sign your generosity in canada and.

How do I edit generosity in canada and on an Android device?

The pdfFiller app for Android allows you to edit PDF files like generosity in canada and. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

Fill out your generosity in canada and online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Generosity In Canada And is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.