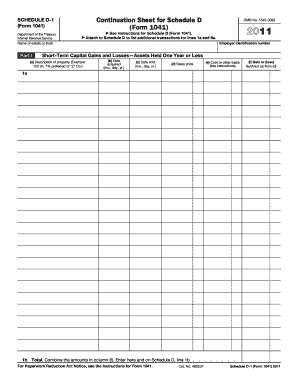

Get the free 2012 Form 1041 Schedule J Accumulation Distribution for Certain Complex Trusts

Instructions and Help about 2012 form 1041 schedule

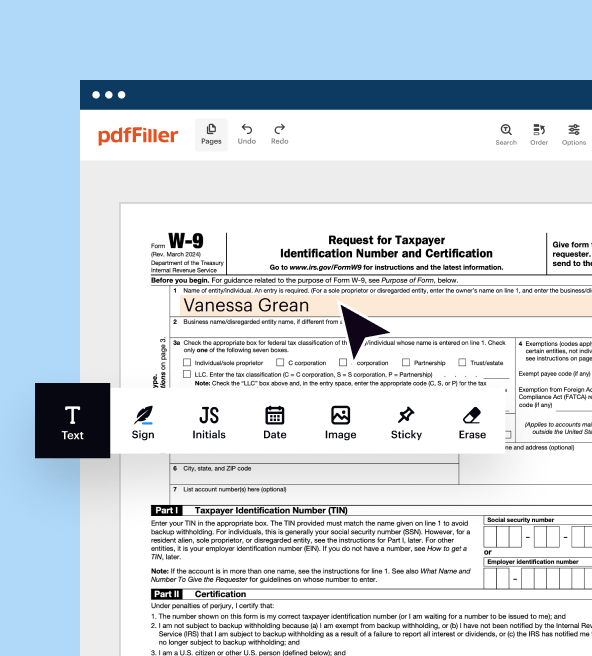

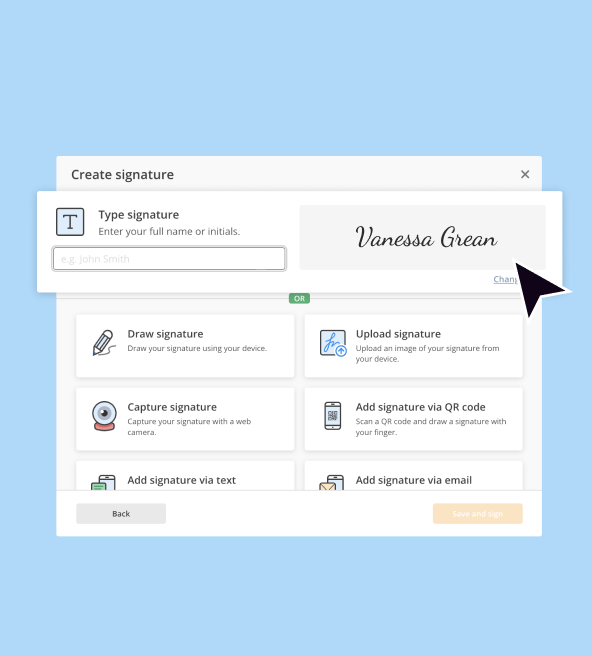

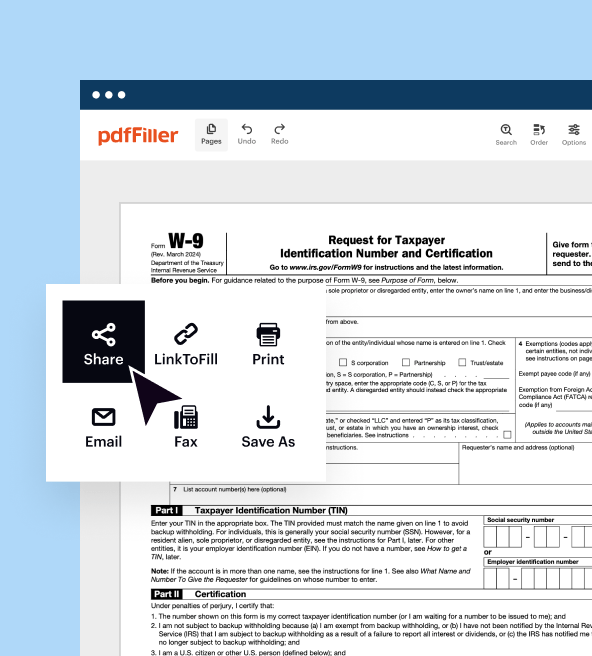

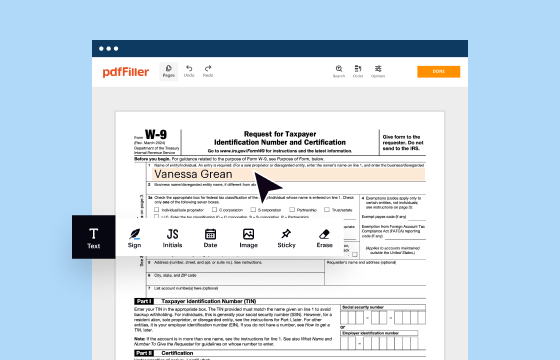

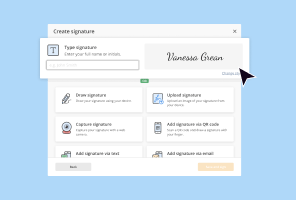

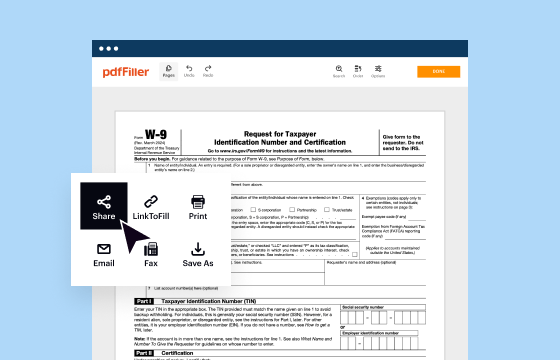

How to edit 2012 form 1041 schedule

How to fill out 2012 form 1041 schedule

Latest updates to 2012 form 1041 schedule

All You Need to Know About 2012 form 1041 schedule

What is 2012 form 1041 schedule?

What is the purpose of this form?

Who needs the form?

When am I exempt from filling out this form?

Components of the form

What are the penalties for not issuing the form?

What information do you need when you file the form?

Is the form accompanied by other forms?

Where do I send the form?

FAQ about 2012 form 1041 schedule

What should I do if I discover errors after submitting my 2012 form 1041 schedule?

If you discover errors on your 2012 form 1041 schedule after submission, you can file an amended return. Make sure to include the corrected information and attach a copy of the original form if required. It's important to notify the IRS about any changes to avoid complications later.

How can I check the status of my filed 2012 form 1041 schedule?

To check the status of your filed 2012 form 1041 schedule, you can use the IRS's online tracking tool or call their service line. Have your details ready, such as your Social Security number, filing status, and the exact amount of your refund, if applicable, to assist with the query.

What privacy measures should I consider when filing the 2012 form 1041 schedule electronically?

When filing the 2012 form 1041 schedule electronically, ensure that the software or platform used complies with IRS data security requirements. Use strong passwords, enable two-factor authentication, and avoid public Wi-Fi for filing to protect your sensitive information.

What common mistakes should I avoid when submitting my 2012 form 1041 schedule?

Common mistakes to avoid when submitting your 2012 form 1041 schedule include leaving out necessary schedules, miscalculating figures, and failing to sign the form. Double-checking all entries and ensuring all required documentation is included can help prevent rejections.