Get the free SURETY BOND Agreement - wwisinc.com

Show details

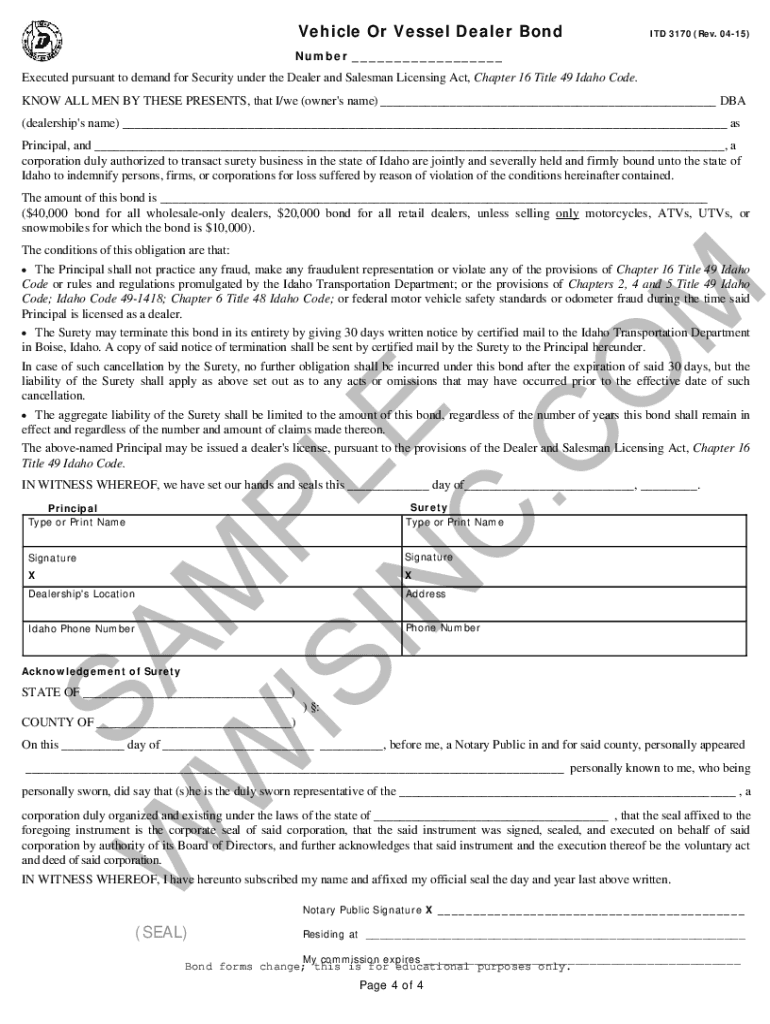

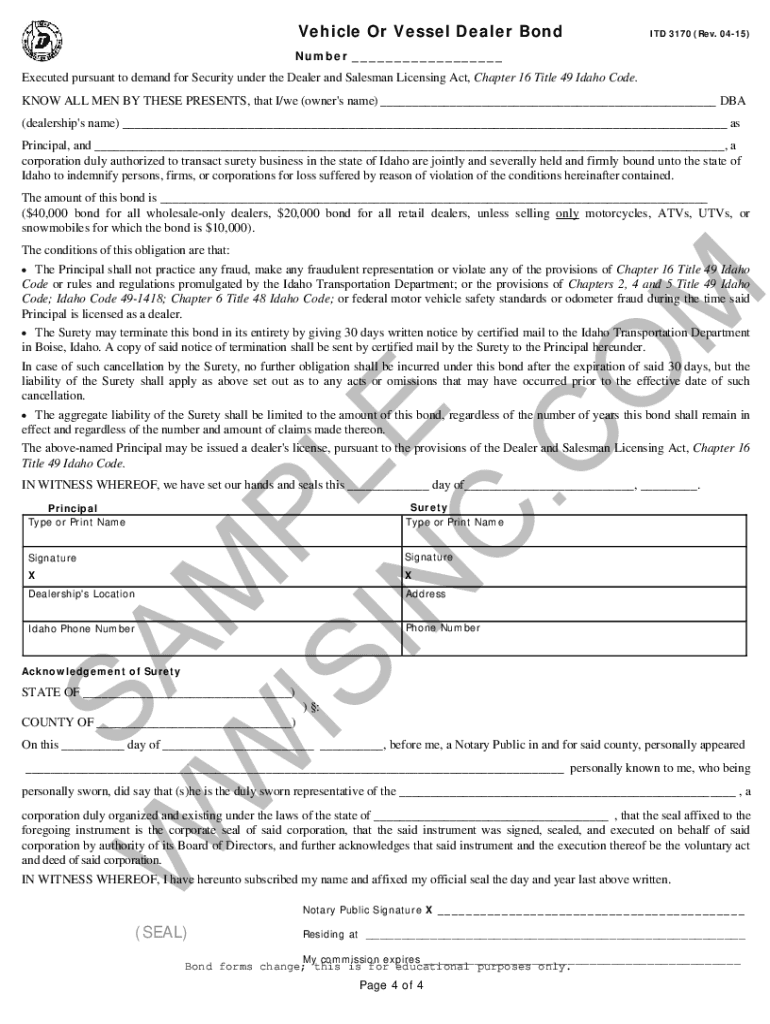

Vehicle Or Vessel Dealer Bodied 3170 (Rev. 0415)Number Executed pursuant to demand for Security under the Dealer and Salesman Licensing Act, Chapter 16 Title 49 Idaho Code. KNOW ALL MEN BY THESE PRESENTS,

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign surety bond agreement

Edit your surety bond agreement form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your surety bond agreement form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit surety bond agreement online

Follow the steps below to benefit from a competent PDF editor:

1

Check your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit surety bond agreement. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out surety bond agreement

How to fill out surety bond agreement

01

Obtain the surety bond agreement form from the surety bond provider or your attorney.

02

Read the entire agreement carefully and make sure you understand all the terms and conditions.

03

Fill in the required information accurately, such as your name, contact details, and business information.

04

Provide details about the project or obligation for which the surety bond is required.

05

Specify the amount of the surety bond and the term or duration of coverage.

06

Attach any supporting documents or references as required.

07

Review the completed agreement for any errors or omissions.

08

Sign and date the surety bond agreement.

09

Make copies of the signed agreement for your records.

10

Submit the original signed agreement to the relevant parties, such as the obligee or the surety bond provider.

Who needs surety bond agreement?

01

Various individuals and businesses may require a surety bond agreement, including:

02

- Contractors who want to bid on government contracts

03

- Construction companies involved in large-scale projects

04

- Business owners needing to comply with licensing or permit requirements

05

- Court appointed fiduciaries, such as guardians or trustees

06

- Mortgage brokers and lenders

07

- Car dealerships

08

- Notaries public

09

- Freight brokers or transportation companies

10

- Event organizers or promoters

11

- Individuals working in sensitive positions, such as those handling money or confidential information

12

It is always advisable to consult with a legal professional or surety bond provider to determine if a surety bond agreement is needed for your specific situation.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I fill out the surety bond agreement form on my smartphone?

You can quickly make and fill out legal forms with the help of the pdfFiller app on your phone. Complete and sign surety bond agreement and other documents on your mobile device using the application. If you want to learn more about how the PDF editor works, go to pdfFiller.com.

Can I edit surety bond agreement on an iOS device?

Create, modify, and share surety bond agreement using the pdfFiller iOS app. Easy to install from the Apple Store. You may sign up for a free trial and then purchase a membership.

Can I edit surety bond agreement on an Android device?

The pdfFiller app for Android allows you to edit PDF files like surety bond agreement. Mobile document editing, signing, and sending. Install the app to ease document management anywhere.

What is surety bond agreement?

A surety bond agreement is a legally binding contract among three parties: the obligee (the party requiring the bond), the principal (the party purchasing the bond), and the surety (the party issuing the bond). It guarantees that the principal will fulfill their obligations as specified in the bond, and if they fail to do so, the surety will compensate the obligee.

Who is required to file surety bond agreement?

Typically, individuals or businesses that are required to obtain a license, permit, or contract, which includes obligations to comply with laws or regulations, need to file a surety bond agreement as a condition of being granted that license or contract.

How to fill out surety bond agreement?

To fill out a surety bond agreement, you should provide accurate information including the names and addresses of the principal and obligee, details of the obligation being secured, the bond amount, and any specific terms and conditions that apply. Ensure that all required signatures are in place.

What is the purpose of surety bond agreement?

The purpose of a surety bond agreement is to protect the obligee from financial loss if the principal fails to meet their contractual obligations. It ensures compliance with laws and regulations and can provide assurance of performance and payment.

What information must be reported on surety bond agreement?

Information that must be reported includes the names and addresses of all parties involved (principal, obligee, surety), the bond amount, a description of the obligation, the duration of the bond, and any specific requirements outlined by the obligee or governing bodies.

Fill out your surety bond agreement online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Surety Bond Agreement is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.