NM TRD-41406 2020 free printable template

Show details

TRD41406

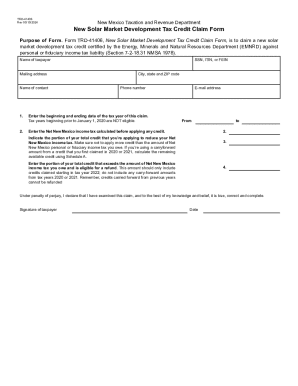

Rev. 09/15/2020New Mexico Taxation and Revenue Department SOLAR MARKET DEVELOPMENT TAX CREDIT CLAIM Repurpose of Form. Form TRD41406, New Solar Market Development Tax Credit Claim Form, is

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign NM TRD-41406

Edit your NM TRD-41406 form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your NM TRD-41406 form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing NM TRD-41406 online

Follow the guidelines below to take advantage of the professional PDF editor:

1

Log in to account. Start Free Trial and sign up a profile if you don't have one.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit NM TRD-41406. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you can have ever thought. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

NM TRD-41406 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out NM TRD-41406

How to fill out NM TRD-41406

01

Begin by downloading the NM TRD-41406 form from the New Mexico Taxation and Revenue Department website.

02

Fill in your personal information, including your name, address, and Social Security number.

03

Indicate the tax year for which you are filing.

04

Provide details regarding your income sources, including wages, interest, and dividends.

05

Fill out any applicable deductions and credits available to you.

06

Calculate your total tax liability using the instructions provided on the form.

07

Review your completed form for accuracy, ensuring all sections are filled appropriately.

08

Sign and date the form before submitting it to the relevant tax authority.

Who needs NM TRD-41406?

01

Individuals or businesses in New Mexico who are reporting income, claiming deductions, or calculating tax liabilities for a specific tax year.

Fill

form

: Try Risk Free

People Also Ask about

How do I get New Mexico tax forms?

At your local library. Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or. You can call 1-866-285-2996 to order forms to be mailed.

What is a TRD 41406 form?

Form TRD-41406, New Solar Market Development Tax Credit Claim Form, is used by a taxpayer who has been certified for a new solar market development tax credit by the Energy, Minerals and Natural Resources Department (EMNRD) and wishes to claim the credit against personal or fiduciary income tax liability (Section 7-2-

How do I get my tax forms from the IRS?

They include: Downloading from IRS Forms & Publications page. Picking up copies at an IRS Taxpayer Assistance Center. Going to the IRS Small Business and Self-Employed Tax Center page. Requesting copies by phone — 800-TAX-FORM (800-829-3676).

Where can I get NM tax forms?

At your local library. Over 100 libraries across the state have ordered supplies of personal income tax forms to make available to the public, or. You can call 1-866-285-2996 to order forms to be mailed.

Can I fill out tax forms online?

Free File Fillable Forms are electronic federal tax forms you can fill out and file online for free, enabling you to: Choose the income tax form you need. Enter your tax information online. Electronically sign and file your return.

How do I claim my New Mexico solar tax credit?

A taxpayer may claim the renewable energy production tax credit by submitting to TRD, a completed Form RPD-41227, New Mexico Renewable Energy Production Tax Credit Claim Form, the certificate of eligibility issued by EMNRD, the notice of allocation approved by EMNRD, if applicable, and documentation of the amount of

How do I contact NM tax and revenue?

1-866-285-2996. Call Center hours are Monday through Friday, 7:30 a.m. to 6:00 p.m, taking new calls from 8 a.m. to 4:30 p.m and returning calls during the extended hours.

What is the solar tax credit for 2023?

The tax credit for solar was originally scheduled to decrease to 22% in 2023. With the recent signing of the Inflation Reduction Act of 2022, not only will the credit still be available, but it will also increase to a 30% credit effective until at least 2032.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my NM TRD-41406 directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your NM TRD-41406 and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How do I edit NM TRD-41406 in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing NM TRD-41406 and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I sign the NM TRD-41406 electronically in Chrome?

Yes. With pdfFiller for Chrome, you can eSign documents and utilize the PDF editor all in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a handwritten signature image. You may eSign your NM TRD-41406 in seconds.

What is NM TRD-41406?

NM TRD-41406 is a form used by taxpayers in New Mexico to report certain tax information related to their business activities and transactions.

Who is required to file NM TRD-41406?

Businesses operating in New Mexico that engage in specific transactions, such as sales or use taxes, are required to file NM TRD-41406.

How to fill out NM TRD-41406?

To fill out NM TRD-41406, gather the necessary financial information, accurately complete each section of the form, and ensure all calculations are correct before submitting it to the New Mexico Taxation and Revenue Department.

What is the purpose of NM TRD-41406?

The purpose of NM TRD-41406 is to collect data for tax assessment and compliance purposes, ensuring that businesses report their taxable activities accurately.

What information must be reported on NM TRD-41406?

NM TRD-41406 requires information such as gross receipts, deductions, exemptions, and tax calculations related to business transactions.

Fill out your NM TRD-41406 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

NM TRD-41406 is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.