Get the free blank beneficiary forms

Show details

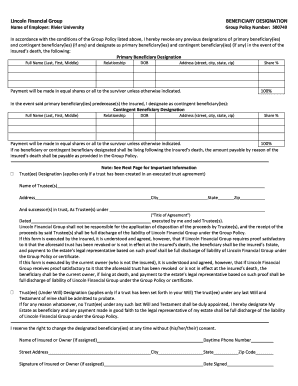

P.O. Box 10343 Des Moines, IA 50306-0343 888-221-1234 Fax 515-226-3129 CHANGE OF BENEFICIARY FORM INSTRUCTIONS for completing the Change of Beneficiary Form 1. Please indicate your full legal name

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign blank beneficiary forms

Edit your blank beneficiary forms form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your blank beneficiary forms form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing blank beneficiary forms online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit blank beneficiary forms. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

The use of pdfFiller makes dealing with documents straightforward. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out blank beneficiary forms

How to fill out change of beneficiary form:

01

Obtain the form: Contact the organization or institution that manages the policy or account to request the change of beneficiary form.

02

Read the instructions: Carefully go through the instructions provided with the form to understand the requirements and procedures for filling it out.

03

Fill out personal information: Provide your full legal name, address, contact information, and any other details required to identify yourself.

04

Specify the policy or account details: Indicate the policy number, account number, or any other identifying information related to the policy or account for which you want to change the beneficiary.

05

Select the beneficiary: Clearly state the full legal name, relationship to you, and contact information of the new beneficiary you wish to designate.

06

Witness or notarize if required: Some forms may require a witness or a notarized signature. Follow the instructions to ensure the form is properly endorsed if necessary.

07

Review and submit: Read through the completed form carefully to ensure all the information is accurate and complete. Make a copy before submitting the original form to the relevant organization or institution.

Who needs change of beneficiary form:

01

Individuals with life insurance policies: If you have a life insurance policy and want to update the beneficiary, you will need to fill out a change of beneficiary form.

02

Retirement account holders: Individuals who have retirement accounts, such as IRAs or 401(k)s, may need to complete a change of beneficiary form if they wish to modify the designated beneficiary.

03

Trust or estate administrators: Those responsible for managing trusts or estates may need to fill out a change of beneficiary form to update beneficiaries for various assets held within these structures.

04

Other types of financial accounts: Certain types of financial accounts, like investment accounts or annuities, may also require a change of beneficiary form to update the designated beneficiary.

Fill

form

: Try Risk Free

People Also Ask about

What does beneficiary form mean?

A designation of beneficiary form outlines your desire to have the funds due upon your death paid out in a particular way. There are four types: Type. Form link.

What is a change of beneficiary form?

Completing this form replaces your existing Beneficiary designations. This form must reflect all Beneficiaries, both Primary and Contingent, who should receive the proceeds of the policy(ies) listed below.

What is the change of beneficiary?

CHANGE OF BENEFICIARY means the act of changing a Beneficiary on a Change of Beneficiary Designation form to another individual, trust or estate of the Participant using a form acceptable to the Insurer and Administrator. The consent of a Beneficiary to change a Beneficiary shall not be required.

How do I fill out a beneficiary change form?

7:26 10:00 How to Complete the Beneficiary Change Form - YouTube YouTube Start of suggested clip End of suggested clip But you should contact the pensions and benefits office for the correct. Form. After you haveMoreBut you should contact the pensions and benefits office for the correct. Form. After you have completed this section all that's left is to sign your name and date. The form in the designated. Space.

How do I change my CPP beneficiary?

To name a beneficiary, you must complete the Naming or Substitution of a Beneficiary form. You may, at any time, change your designated beneficiary by completing a new form and submitting it to the Pension Centre at the address on the form.

What is needed to change beneficiary?

Generally, you will need to fill out a change of beneficiary form which includes information such as the policyholder's name, the new beneficiary's name, and the reason for the change. You may also need to provide a copy of the policyholder's death certificate if the beneficiary is being changed due to their death.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find blank beneficiary forms?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the blank beneficiary forms. Open it immediately and start altering it with sophisticated capabilities.

How do I execute blank beneficiary forms online?

Easy online blank beneficiary forms completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How can I fill out blank beneficiary forms on an iOS device?

Make sure you get and install the pdfFiller iOS app. Next, open the app and log in or set up an account to use all of the solution's editing tools. If you want to open your blank beneficiary forms, you can upload it from your device or cloud storage, or you can type the document's URL into the box on the right. After you fill in all of the required fields in the document and eSign it, if that is required, you can save or share it with other people.

What is blank beneficiary forms?

Blank beneficiary forms are documents that allow individuals to name a beneficiary for accounts, insurance policies, or assets. These forms typically remain unsigned and are used to designate beneficiaries who will receive assets upon the account holder's death.

Who is required to file blank beneficiary forms?

Individuals who own assets such as life insurance policies, retirement accounts, and certain financial accounts may be required to file blank beneficiary forms to designate who will inherit those assets upon their passing.

How to fill out blank beneficiary forms?

To fill out blank beneficiary forms, the account holder should provide their personal information, including name and contact details, and list the beneficiaries by name, relationship, and the percentage of assets they will receive. It's important to review the form for accuracy and compliance with applicable laws.

What is the purpose of blank beneficiary forms?

The purpose of blank beneficiary forms is to ensure that an individual's assets are distributed according to their wishes after death. These forms help avoid probate issues and establish clear directives for the transfer of assets.

What information must be reported on blank beneficiary forms?

Information that must be reported on blank beneficiary forms typically includes the full name of the beneficiary, their relationship to the account owner, the percentage of assets they will receive, and any alternate beneficiaries if the primary beneficiary is unavailable.

Fill out your blank beneficiary forms online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Blank Beneficiary Forms is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.