Get the free Debt vs. Equity Financing: What's Best for Your SMB ...

Show details

Funding Alternatives

Introduction

Choosing the most efficient and cost-effective method to fund construction and operation of a

new jail is a complex process. One of the first decisions to be made

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign debt vs equity financing

Edit your debt vs equity financing form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debt vs equity financing form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing debt vs equity financing online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Log in to account. Click Start Free Trial and sign up a profile if you don't have one yet.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit debt vs equity financing. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

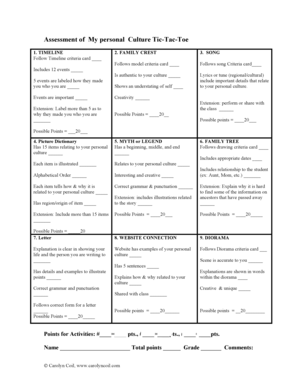

How to fill out debt vs equity financing

How to fill out debt vs equity financing:

01

Evaluate your business needs and financial goals: Determine the purpose of the financing and what type of funding will align with your objectives.

02

Understand the difference between debt and equity financing: Debt financing involves borrowing funds that need to be repaid with interest, while equity financing involves raising capital by selling shares of ownership in your company.

03

Assess your financial situation: Analyze your current financial position, including cash flow, assets, and liabilities, to determine whether you can afford debt repayments or if equity financing would be a more suitable option.

04

Research and compare available options: Explore various lenders or investors who offer debt or equity financing and assess their terms, interest rates, repayment schedules, and potential impact on your ownership and control of the business.

05

Gather necessary documentation: Prepare all required financial records, business plans, projections, and legal documents that may be requested by lenders or investors during the application process.

06

Seek professional advice: Consider consulting with a financial advisor, accountant, or attorney to ensure you understand the implications and legal obligations associated with debt versus equity financing.

07

Make an informed decision: Based on your analysis, goals, and advice received, choose whether debt or equity financing is the most suitable option for your business.

Who needs debt vs equity financing:

01

Startups and early-stage companies: Debt financing may be challenging for new or unproven businesses, making equity financing a more attractive option to raise capital without immediate repayment obligations.

02

Established businesses with stable cash flow: Companies with consistent and predictable cash flow may be more inclined to opt for debt financing as they can comfortably manage repayments and potentially benefit from tax deductions on interest payments.

03

Businesses with a specific project or expansion plan: Debt financing can be ideal for businesses looking to fund a particular project, such as expanding operations, acquiring new assets, or investing in research and development.

04

Entrepreneurs who want to retain ownership and control: Equity financing allows entrepreneurs to raise capital without incurring debt or interest payments but involves sharing ownership and control of the business with investors.

05

Businesses operating in industries with high growth potential: Equity financing can attract investors who are seeking substantial returns on their investment, making it a viable option for businesses in sectors with high growth prospects, such as technology or biotech.

06

Businesses experiencing financial difficulties: Debt financing can be helpful for businesses facing temporary financial challenges, offering a way to bridge gaps in cash flow or fulfill short-term financial obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find debt vs equity financing?

It's simple using pdfFiller, an online document management tool. Use our huge online form collection (over 25M fillable forms) to quickly discover the debt vs equity financing. Open it immediately and start altering it with sophisticated capabilities.

How do I edit debt vs equity financing online?

The editing procedure is simple with pdfFiller. Open your debt vs equity financing in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

Can I edit debt vs equity financing on an Android device?

With the pdfFiller Android app, you can edit, sign, and share debt vs equity financing on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is debt vs equity financing?

Debt financing involves borrowing money that must be repaid over time, typically with interest, while equity financing involves raising capital by selling shares of the company, giving investors ownership stakes.

Who is required to file debt vs equity financing?

Businesses and organizations that engage in debt or equity financing are generally required to file relevant documents with regulatory authorities, such as the SEC for publicly traded companies, as well as maintain compliance with local laws.

How to fill out debt vs equity financing?

To fill out debt vs equity financing, organizations must prepare detailed financial statements, specify terms of the debt or equity being issued, and submit appropriate forms indicating the nature of financing along with supporting documentation.

What is the purpose of debt vs equity financing?

The purpose of debt financing is to obtain immediate capital without sacrificing ownership, while equity financing aims to raise funds for expansion and operations while sharing ownership and potentially reducing financial risk.

What information must be reported on debt vs equity financing?

Information that must be reported includes the total amount of financing, interest rates, repayment terms for debts, ownership percentages, dividends for equity, and any associated covenants or conditions.

Fill out your debt vs equity financing online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debt Vs Equity Financing is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.