Get the free Analysis of New Claims

Show details

Analysis of New Claims

for Disability Living

Allowance and

Attendance Allowance

by Main Disabling

Condition: 2011/2012

September 2012Background

Disability Living Allowance (DLA) and Attendance Allowance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign analysis of new claims

Edit your analysis of new claims form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your analysis of new claims form via URL. You can also download, print, or export forms to your preferred cloud storage service.

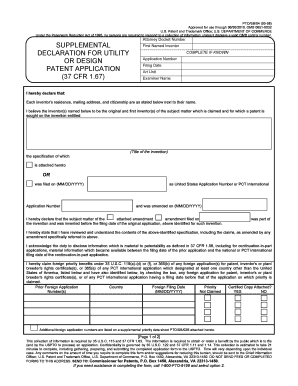

How to edit analysis of new claims online

To use the services of a skilled PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit analysis of new claims. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out analysis of new claims

How to fill out analysis of new claims:

01

Gather all necessary information: Start by collecting all relevant documents and data related to the new claims that need analysis. This may include claim forms, supporting documents, previous claim history, and any other relevant information.

02

Review the claim details: Carefully go through the details of the new claims, ensuring that you understand the nature of the claim, the circumstances surrounding it, and any specific requirements or conditions.

03

Assess the claim validity: Analyze the claim to determine its validity and whether it meets the necessary criteria for approval. This may involve evaluating the evidence provided, verifying the authenticity of documents, and cross-referencing with relevant policies or guidelines.

04

Evaluate the claim amount: Assess the financial aspect of the claim, considering factors such as the coverage limits, deductibles, and any applicable exclusions. Calculate the claim amount accurately, ensuring that it aligns with the policy terms and conditions.

05

Investigate the claim: If necessary, conduct a thorough investigation to gather additional information, such as interviewing involved parties or visiting the claim location. Document all findings and ensure they are appropriately considered in the analysis.

06

Analyze potential fraud: Pay attention to any signs of potential fraud or misrepresentation in the claim. Identify red flags such as inconsistencies, suspicious behavior, or unusual claim patterns. If fraud is suspected, ensure appropriate action is taken following internal protocols.

07

Make a well-supported decision: Based on the analysis of the new claims, determine whether to approve, deny, or request further information. Ensure that the decision is supported by thorough documentation and clear reasoning.

Who needs analysis of new claims:

01

Insurance companies: Insurance companies are responsible for analyzing new claims to determine their validity and assess the coverage based on the policy terms. This analysis helps them make informed decisions on whether to approve or deny claims.

02

Claims adjusters: Claims adjusters are professionals who specialize in analyzing claims. They work on behalf of insurance companies and are responsible for objectively evaluating the claims, verifying details, and determining the appropriate settlements.

03

Risk management departments: Risk management departments within organizations may also perform analysis of new claims to assess potential risks and their impact. This analysis helps in identifying any patterns or trends in claims and supports decision-making for risk mitigation strategies.

04

Legal professionals: Lawyers or legal professionals may require analysis of new claims to provide legal advice and representation to clients. They evaluate the strength of claims and prepare legal strategies accordingly.

05

Customers/claimants: Claimants themselves may analyze new claims to ensure that their rights are protected and to understand the process better. They may seek assistance from professionals or follow guidelines provided by insurance companies.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify analysis of new claims without leaving Google Drive?

pdfFiller and Google Docs can be used together to make your documents easier to work with and to make fillable forms right in your Google Drive. The integration will let you make, change, and sign documents, like analysis of new claims, without leaving Google Drive. Add pdfFiller's features to Google Drive, and you'll be able to do more with your paperwork on any internet-connected device.

How do I execute analysis of new claims online?

Filling out and eSigning analysis of new claims is now simple. The solution allows you to change and reorganize PDF text, add fillable fields, and eSign the document. Start a free trial of pdfFiller, the best document editing solution.

How can I fill out analysis of new claims on an iOS device?

Get and install the pdfFiller application for iOS. Next, open the app and log in or create an account to get access to all of the solution’s editing features. To open your analysis of new claims, upload it from your device or cloud storage, or enter the document URL. After you complete all of the required fields within the document and eSign it (if that is needed), you can save it or share it with others.

What is analysis of new claims?

The analysis of new claims involves evaluating and assessing the validity and relevance of newly submitted claims to determine their impact on the organization.

Who is required to file analysis of new claims?

The claims department or designated employees are usually responsible for filing the analysis of new claims.

How to fill out analysis of new claims?

The analysis of new claims can be filled out by gathering all relevant information about the claims, conducting a thorough review, and documenting the findings.

What is the purpose of analysis of new claims?

The purpose of analysis of new claims is to ensure accurate assessment of potential liabilities, identify trends in claims submissions, and make informed decisions for risk management.

What information must be reported on analysis of new claims?

The analysis of new claims should include details about the nature of the claims, claimants, estimated costs, potential impact on reserves, and any relevant mitigating factors.

Fill out your analysis of new claims online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Analysis Of New Claims is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.