Get the free A Gift from your Estate will Change Lives

Show details

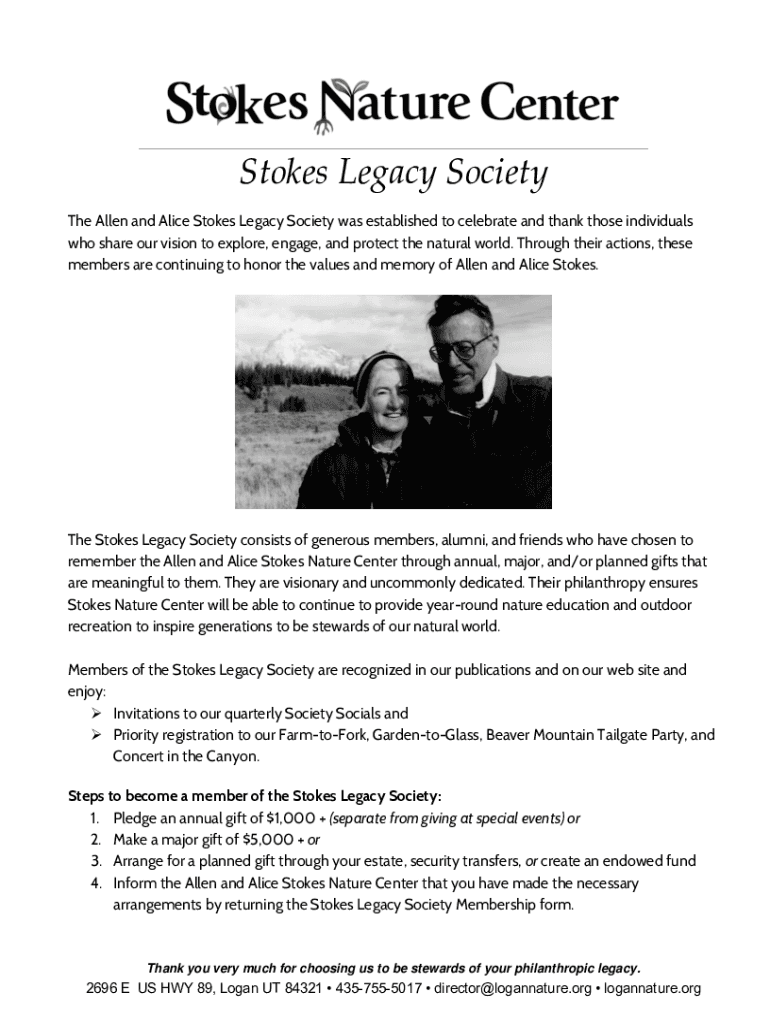

Stokes Legacy Society

The Allen and Alice Stokes Legacy Society was established to celebrate and thank those individuals

who share our vision to explore, engage, and protect the natural world. Through

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign a gift from your

Edit your a gift from your form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your a gift from your form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing a gift from your online

Follow the guidelines below to benefit from a competent PDF editor:

1

Check your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit a gift from your. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Create an account to find out for yourself how it works!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out a gift from your

How to fill out a gift from your

01

Start by choosing a suitable gift for the recipient. Consider their interests, hobbies, and preferences.

02

Purchase the gift from a reputable store or online platform. Make sure to check the quality and authenticity of the product.

03

If necessary, wrap the gift in an attractive and presentable manner. You can use gift wrapping paper, ribbons, or decorative accessories.

04

Write a thoughtful and heartfelt message on a gift tag or card. Express your well wishes and sentiments for the recipient.

05

Present the gift to the recipient with a genuine smile and warm words. Make them feel special and appreciated.

06

If applicable, explain the significance or meaning behind the gift. Share any stories or memories associated with it.

07

Offer assistance in opening or using the gift, if needed. Ensure the recipient knows how to utilize and enjoy it fully.

08

Express gratitude for any previous or future gifts received from the recipient. Show appreciation for their thoughtfulness.

09

Follow up with the recipient after some time to ask about their experience with the gift. Show interest and enthusiasm in their feedback.

10

Remember to keep the gift-giving experience positive and memorable. It's the thought and effort that counts the most!

Who needs a gift from your?

01

Anyone who wants to show appreciation or celebrate a special occasion with someone can give a gift.

02

Gifts can be exchanged between friends, family members, partners, colleagues, and even acquaintances.

03

People may also give gifts as a gesture of thanks, to apologize, or to express love and affection.

04

Gifts can bring joy, strengthen relationships, and make someone feel valued and cherished.

05

Ultimately, anyone who wants to make someone else happy and create a lasting impression can benefit from giving a gift.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Can I sign the a gift from your electronically in Chrome?

You can. With pdfFiller, you get a strong e-signature solution built right into your Chrome browser. Using our addon, you may produce a legally enforceable eSignature by typing, sketching, or photographing it. Choose your preferred method and eSign in minutes.

How can I fill out a gift from your on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. Create an account or log in if you already have one. After registering, upload your a gift from your. You may now use pdfFiller's advanced features like adding fillable fields and eSigning documents from any device, anywhere.

How do I complete a gift from your on an Android device?

Use the pdfFiller mobile app to complete your a gift from your on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is a gift from your?

A gift from your is a legal document used to report the transfer of money or property from one individual to another without receiving something of equal value in return.

Who is required to file a gift from your?

Anyone who gives a gift that exceeds the annual exclusion amount, which is set by the IRS, is required to file a gift tax return.

How to fill out a gift from your?

To fill out a gift from your, you need to provide details such as the names and addresses of the giver and receiver, the value of the gift, and any applicable deductions or exclusions.

What is the purpose of a gift from your?

The purpose of a gift from your is to report gifts that may be subject to gift tax, and to keep track of the lifetime gift tax exemption used by the giver.

What information must be reported on a gift from your?

Information that must be reported includes the date of the gift, description of the property, fair market value at the time of the gift, and any deductions or exclusions claimed.

Fill out your a gift from your online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

A Gift From Your is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.