Get the free Your secure tax-deductible donation to Mayas Hope

Show details

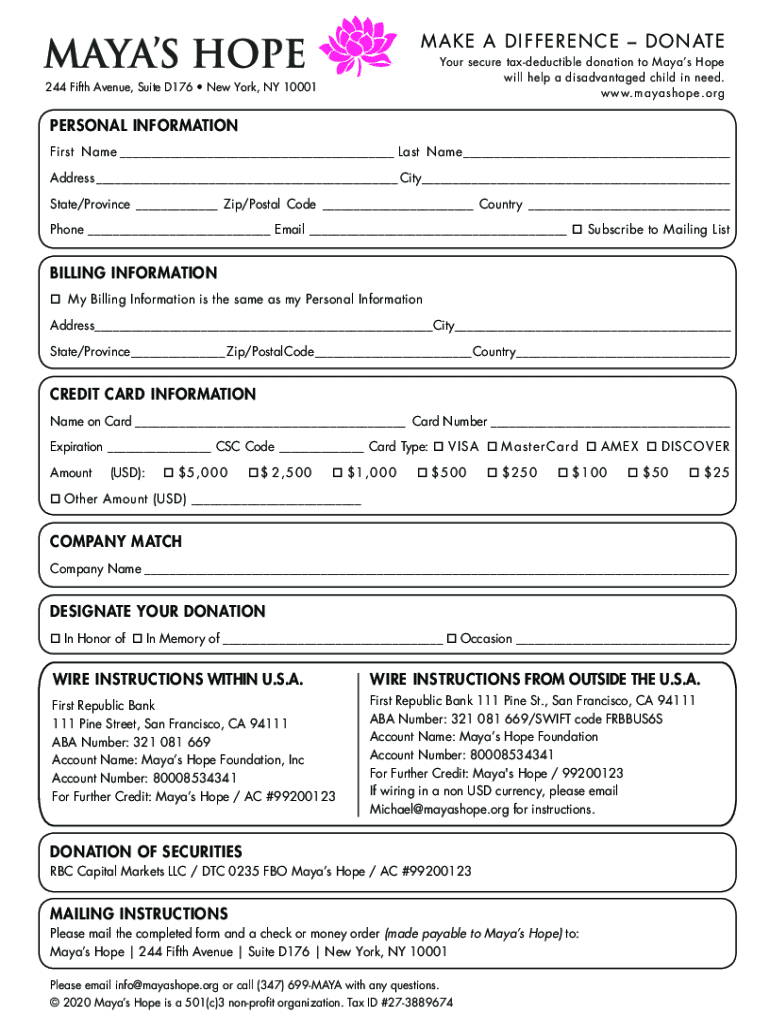

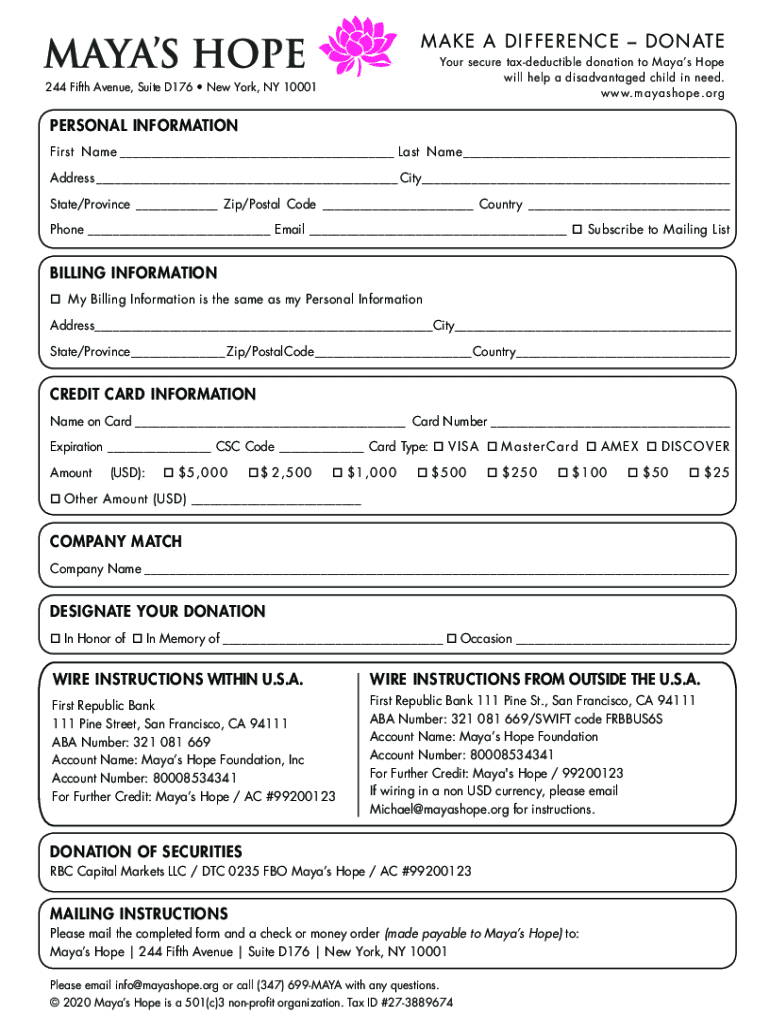

MAK E A DIF TERENCE DONATE Your secure tax-deductible donation to Mayas Hope will help a disadvantaged child in need. W WW. m ashore.org244 Fifth Avenue, Suite D176 New York, NY 10001PERSONAL INFORMATION

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign your secure tax-deductible donation

Edit your your secure tax-deductible donation form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your your secure tax-deductible donation form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing your secure tax-deductible donation online

Follow the steps below to benefit from a competent PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit your secure tax-deductible donation. Text may be added and replaced, new objects can be included, pages can be rearranged, watermarks and page numbers can be added, and so on. When you're done editing, click Done and then go to the Documents tab to combine, divide, lock, or unlock the file.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out your secure tax-deductible donation

How to fill out your secure tax-deductible donation

01

Start by gathering all the necessary documents to support your tax-deductible donation, such as receipts or acknowledgment letters from the charitable organization.

02

Determine the amount you wish to donate and ensure that it is within the allowable limits for tax deductions. Consult the latest tax regulations or seek advice from a tax professional if needed.

03

Identify a reputable charitable organization that qualifies for tax-deductible donations. Research their mission, financial transparency, and impact to ensure your donation is being used effectively.

04

Visit the website or contact the charitable organization directly to find out their preferred method of receiving donations. Common options include online platforms, mailing a check, or making a direct bank transfer.

05

Follow the instructions provided by the charitable organization to complete the donation process securely. Ensure that personal and financial information is protected, especially when donating online.

06

Keep detailed records of your donation, including the amount, date, and method of donation. These records will be necessary when filing your tax return and claiming the deduction.

07

Consult with a tax advisor or utilize tax software to accurately report your tax-deductible donation on your tax return. Provide all required information and documentation to support your deduction.

08

Submit your tax return, including the claimed tax deduction for your secure tax-deductible donation, within the designated deadline set by the tax authorities.

Who needs your secure tax-deductible donation?

01

Various individuals and organizations can benefit from your secure tax-deductible donation. Some examples include:

02

- Charitable organizations that work towards improving education and healthcare access for underprivileged communities.

03

- Homeless shelters and organizations providing support to individuals experiencing homelessness.

04

- Non-profit organizations focused on environmental conservation and addressing climate change.

05

- Animal shelters and rescue organizations caring for abandoned or mistreated animals.

06

- Research institutions conducting studies and developing new treatments for diseases.

07

- Community development organizations promoting economic empowerment and entrepreneurship.

08

- Arts and cultural organizations preserving heritage and promoting creative expression.

09

- Humanitarian and disaster relief organizations providing aid to affected areas and communities in crisis.

10

Your secure tax-deductible donation can play a crucial role in supporting these causes and making a positive impact on the lives of those in need.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my your secure tax-deductible donation in Gmail?

pdfFiller’s add-on for Gmail enables you to create, edit, fill out and eSign your your secure tax-deductible donation and any other documents you receive right in your inbox. Visit Google Workspace Marketplace and install pdfFiller for Gmail. Get rid of time-consuming steps and manage your documents and eSignatures effortlessly.

How can I send your secure tax-deductible donation for eSignature?

When your your secure tax-deductible donation is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How can I fill out your secure tax-deductible donation on an iOS device?

In order to fill out documents on your iOS device, install the pdfFiller app. Create an account or log in to an existing one if you have a subscription to the service. Once the registration process is complete, upload your your secure tax-deductible donation. You now can take advantage of pdfFiller's advanced functionalities: adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is your secure tax-deductible donation?

A secure tax-deductible donation refers to contributions made to qualifying organizations that reduce your taxable income, typically used for charitable purposes.

Who is required to file your secure tax-deductible donation?

Individuals and businesses who wish to claim a tax deduction for their charitable contributions are required to file their secure tax-deductible donations.

How to fill out your secure tax-deductible donation?

To fill out your secure tax-deductible donation, you need to complete the appropriate tax forms, usually the IRS Form 1040 Schedule A for individuals, and provide details about the donations made, including the amount and the recipient organization.

What is the purpose of your secure tax-deductible donation?

The purpose of making a secure tax-deductible donation is to support charitable organizations while also benefiting from a reduction in taxable income.

What information must be reported on your secure tax-deductible donation?

You must report the amount donated, the date of the donation, the name of the organization, and any additional documentation, such as receipts, if the donation exceeds a certain amount.

Fill out your your secure tax-deductible donation online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Your Secure Tax-Deductible Donation is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.