Get the free Gift of Mutual Funds to Hosanna

Show details

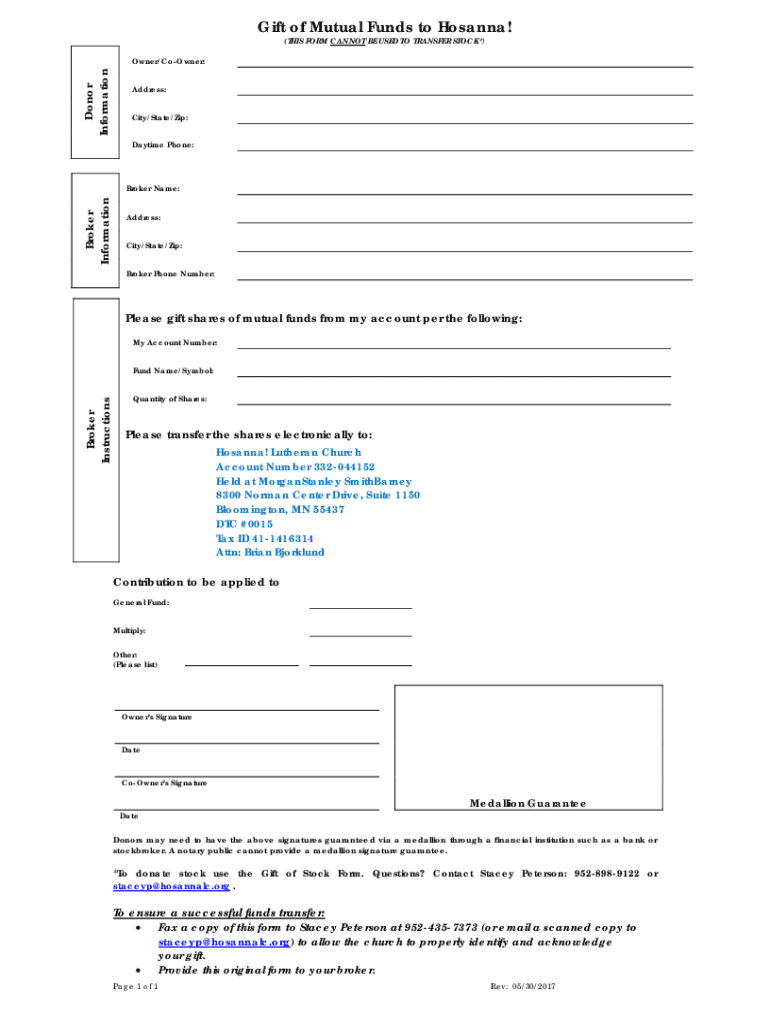

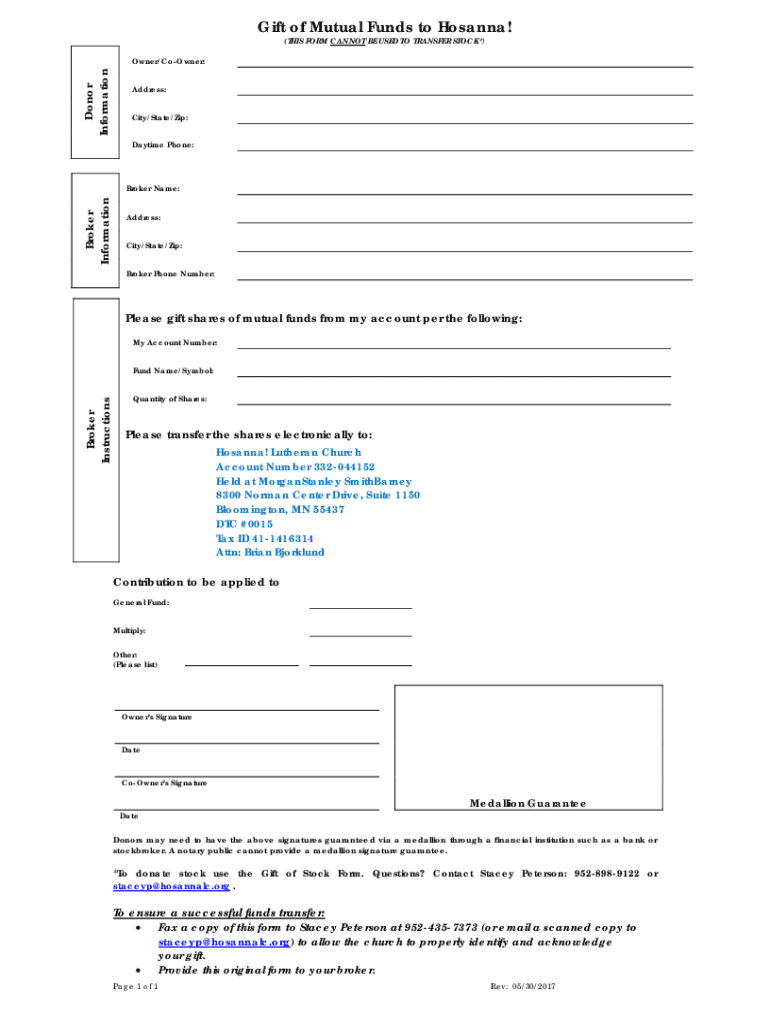

Gift of Mutual Funds to Hosanna!

(THIS FORM CANNOT BE USED TO TRANSFER STOCK*)Donor

InformationOwner/Corner:

Address:

City/State/Zip:

Daytime Phone:Broker

InformationBroker Name:

Address:

City/State/Zip:

Broker

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign gift of mutual funds

Edit your gift of mutual funds form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your gift of mutual funds form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit gift of mutual funds online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit gift of mutual funds. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out gift of mutual funds

How to fill out gift of mutual funds

01

To fill out a gift of mutual funds, follow these steps:

02

Determine the mutual funds you want to gift. Research and select the mutual funds that best suit the recipient's investment goals and risk tolerance.

03

Gather the necessary information. You will need the recipient's full name, contact information, and social security number or tax identification number.

04

Contact the mutual fund company or financial institution where the funds are held. They will provide you with the gift transfer forms or guide you through the process.

05

Fill out the gift transfer forms accurately and provide all required information. Be careful to fill in the recipient's information correctly to ensure there are no delays or issues.

06

Include any additional documentation required by the mutual fund company or institution, such as proof of identification or a letter of instruction.

07

Review the completed forms and documentation to ensure everything is complete and accurate.

08

Submit the gift transfer forms and any additional documentation to the mutual fund company or institution as per their instructions.

09

Follow up with the mutual fund company or institution to confirm that the gift transfer has been processed successfully.

10

Keep copies of all the completed forms and documentation for your records and for future reference.

Who needs gift of mutual funds?

01

Gifts of mutual funds are suitable for various individuals or entities, including:

02

- Family members: It can be a thoughtful gift for your children, parents, or other family members to help them start investing or diversify their investment portfolio.

03

- Friends: Mutual fund gifts can be a good option for close friends on special occasions or as a way to introduce them to the world of investing.

04

- Charities: Non-profit organizations often appreciate receiving gifts of mutual funds as a way to support their mission and potentially benefit from potential growth.

05

- Educational institutions: Universities, colleges, or schools can also benefit from receiving gifts of mutual funds as a way to fund scholarships or educational programs.

06

- Employees: Employers may choose to offer mutual fund gifts as part of their reward or recognition program for employees.

07

- Business partners: Mutual fund gifts can also be given to business partners or clients as a gesture of goodwill or appreciation.

08

Before gifting mutual funds, it's important to consider the recipient's financial goals, risk tolerance, and any potential tax implications. It may be advisable to consult with a financial advisor or tax professional for personalized advice.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my gift of mutual funds directly from Gmail?

In your inbox, you may use pdfFiller's add-on for Gmail to generate, modify, fill out, and eSign your gift of mutual funds and any other papers you receive, all without leaving the program. Install pdfFiller for Gmail from the Google Workspace Marketplace by visiting this link. Take away the need for time-consuming procedures and handle your papers and eSignatures with ease.

How can I modify gift of mutual funds without leaving Google Drive?

Simplify your document workflows and create fillable forms right in Google Drive by integrating pdfFiller with Google Docs. The integration will allow you to create, modify, and eSign documents, including gift of mutual funds, without leaving Google Drive. Add pdfFiller’s functionalities to Google Drive and manage your paperwork more efficiently on any internet-connected device.

How do I fill out gift of mutual funds using my mobile device?

Use the pdfFiller mobile app to complete and sign gift of mutual funds on your mobile device. Visit our web page (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, the capabilities you’ll have access to, and the steps to take to get up and running.

What is gift of mutual funds?

The gift of mutual funds refers to the act of transferring ownership of mutual fund shares from one individual to another as a gift, which may have tax implications under gift tax laws.

Who is required to file gift of mutual funds?

Individuals who gift mutual funds worth more than the annual exclusion amount set by the IRS are required to file a gift tax return (Form 709) to report the gift.

How to fill out gift of mutual funds?

To fill out the gift tax return for mutual funds, you need to complete IRS Form 709, providing details such as the names of the donor and recipient, the value of the gift, and any applicable deductions or exclusions.

What is the purpose of gift of mutual funds?

The purpose of gifting mutual funds is to transfer wealth, provide financial support, and potentially reduce the taxable estate of the donor while allowing recipients to benefit from investment growth.

What information must be reported on gift of mutual funds?

The information that must be reported includes the names and addresses of both the donor and recipient, the date of the gift, the fair market value of the mutual fund shares, and any deductions or exemptions claimed.

Fill out your gift of mutual funds online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Gift Of Mutual Funds is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.