Get the free Debtors Rights

Show details

Managing Money. Managing money. Debtor Rights

Protecting yourself from

debt collection lawsuits project of Consumer ActionDebtors Rights

Protecting yourself from debt collection lawsuits

PageSection3

6

7

9

10

10

12

13

16

17

18

21

22Your

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign debtors rights

Edit your debtors rights form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your debtors rights form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit debtors rights online

Use the instructions below to start using our professional PDF editor:

1

Log into your account. In case you're new, it's time to start your free trial.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit debtors rights. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

Dealing with documents is simple using pdfFiller. Now is the time to try it!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out debtors rights

How to fill out debtors rights:

01

Research your rights: Begin by familiarizing yourself with the debtors rights laws in your jurisdiction. This may involve consulting relevant legal resources or seeking advice from a lawyer specializing in consumer rights or debt collection.

02

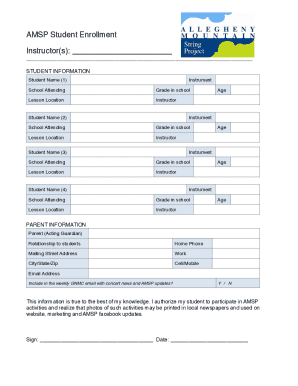

Understand the process: Gain a clear understanding of the steps involved in filling out debtors rights. This typically includes gathering necessary documentation, completing specific forms, and adhering to any deadlines or requirements set by law.

03

Gather documentation: Collect all relevant documents pertaining to your debt, such as loan agreements, invoices, bills, or any correspondence with the creditor or debt collection agencies. These records will serve as evidence of your rights and obligations and may be required during the filling process.

04

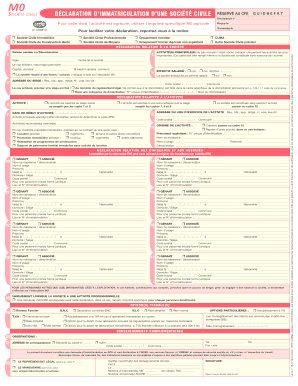

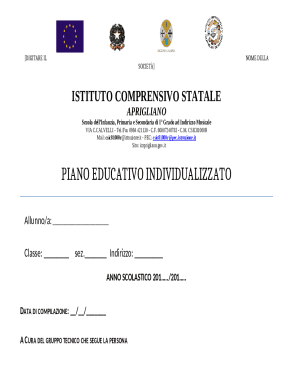

Complete the necessary forms: Obtain the appropriate debtors rights forms from your local court or relevant authority responsible for handling debt-related matters. Fill out the forms accurately and provide all requested information, ensuring clarity and correctness to avoid potential delays or rejection.

05

Seek legal assistance if needed: If you find the debtors rights filing process complex or overwhelming, it may be beneficial to consult with an attorney. They can provide guidance, help you navigate the legal requirements, and ensure your rights are protected throughout the process.

Who needs debtors rights:

01

Individuals in debt: Anyone who owes money to creditors or is facing debt collection activity can benefit from understanding and exercising their debtors rights. These rights grant individuals protection against unfair or deceptive debt collection practices and ensure that they have a fair opportunity to address their debts.

02

Consumers with outstanding loans or credit card debt: Whether you have outstanding student loans, medical bills, mortgage payments, or credit card debt, knowing your debtors rights can empower you to effectively manage repayment and negotiate with creditors or debt collection agencies.

03

Small businesses or entrepreneurs: Business owners who face financial difficulties or have outstanding debts related to their ventures can leverage debtors rights to protect their interests. Understanding the legal framework surrounding debt collection and creditor actions can help businesses navigate challenging financial situations.

04

Individuals facing aggressive debt collection tactics: If you are experiencing harassment, threats, or abusive behavior from debt collectors, asserting your debtors rights can provide a way to stop these actions and potentially seek legal recourse against unlawful practices.

05

Consumers who believe their rights are being violated: If you believe that a debt collection agency or creditor is violating your rights, it is important to educate yourself about debtors rights to protect your interests. By understanding what actions are unacceptable under the law, you can advocate for yourself and potentially take legal action against violators.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify debtors rights without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including debtors rights. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

How can I send debtors rights for eSignature?

When your debtors rights is finished, send it to recipients securely and gather eSignatures with pdfFiller. You may email, text, fax, mail, or notarize a PDF straight from your account. Create an account today to test it.

How do I complete debtors rights online?

pdfFiller has made it easy to fill out and sign debtors rights. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

What is debtors rights?

Debtors rights refer to the legal protections afforded to individuals who owe money to creditors.

Who is required to file debtors rights?

Individuals who owe money to creditors are required to file debtors rights.

How to fill out debtors rights?

Debtors rights can be filled out by providing all necessary information regarding the debt owed and any relevant legal protections.

What is the purpose of debtors rights?

The purpose of debtors rights is to ensure that individuals who owe money are treated fairly by creditors and are aware of their legal rights.

What information must be reported on debtors rights?

Information such as the amount of debt owed, the name of the creditor, and any legal protections that apply must be reported on debtors rights.

Fill out your debtors rights online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Debtors Rights is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.