PH Form No 2003 free printable template

Show details

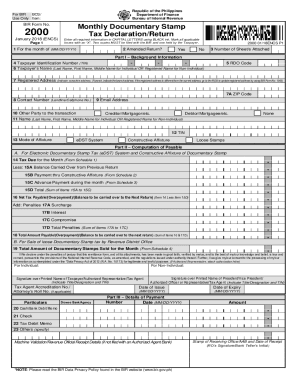

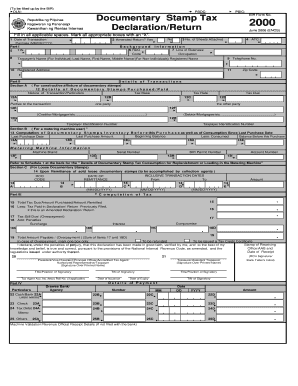

To be filled up by the BIR DLN PSOC Republika ng Pilipinas Kagawaran ng Pananalapi Kawanihan ng Rentas Internas PSIC BIR Form No. Documentary Stamp Tax Declaration/Return September 2003 ENCS Fill in all applicable spaces. Charter parties similar instr. if gross tonnage is 1st 6 months P500 in excess P 50 1 000 tons and below in excess P 100 1 001 to 10 000 tons over than 10 000 tons Note A DST metering machine user should present the details of usage or consumption of documentary stamps in a...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign PH Form No

Edit your PH Form No form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your PH Form No form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing PH Form No online

Use the instructions below to start using our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit PH Form No. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Try it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

PH Form No 2000 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out PH Form No

How to fill out PH Form No

01

Obtain PH Form No from the relevant authority or website.

02

Read the instructions carefully provided on the form.

03

Fill in your personal information accurately in the designated fields.

04

Provide any required supporting documentation as specified.

05

Review the form to ensure all information is complete and accurate.

06

Sign and date the form at the bottom.

Who needs PH Form No?

01

Individuals applying for permits or licenses that require PH Form No.

02

Businesses seeking regulatory compliance that necessitates the submission of PH Form No.

03

Any entity mandated by law to submit PH Form No.

Fill

form

: Try Risk Free

People Also Ask about

What is the documentary stamp tax on sale of real property in the Philippines?

For specific transactions involving sale, delivery, or transfer of stock or property, as per the law, there is a documentary stamp tax of one peso and fifty centavos (Php 1.50) for every two hundred pesos (Php 200) or fractional part of the par value of such property.

What is documentary stamp tax Philippines?

Documentary Stamp Tax is a tax on documents, instruments, loan agreements and papers evidencing the acceptance, assignment, sale or transfer of an obligation, right or property incident thereto. File BIR Form No.

What is 2000 form?

BIR Form 2000-OT is known as the Monthly Documentary Stamp Tax Declaration Return for One-Time Transactions.

How to fill out Form 2000?

0:34 2:17 Guide on how to fill out BIR Form 2000-OT (Documentary Stamp Tax YouTube Start of suggested clip End of suggested clip The atc nature of transaction. And if this is an amended return the date of transaction. Take noteMoreThe atc nature of transaction. And if this is an amended return the date of transaction. Take note the date of transaction is based on another date of sale or donation.

Who pays the documentary Stamp Tax Philippines?

The tax is paid by the person making, signing, issuing, accepting or transferring the documents.

How do I get a documentary stamp?

Mandatory Photocopy of the document to which the documentary stamp shall be affixed. Proof of exemption under special laws, if applicable; Proof of payment of documentary stamp tax paid upon the original issue of the stock, if applicable.

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete PH Form No online?

pdfFiller has made filling out and eSigning PH Form No easy. The solution is equipped with a set of features that enable you to edit and rearrange PDF content, add fillable fields, and eSign the document. Start a free trial to explore all the capabilities of pdfFiller, the ultimate document editing solution.

How do I make edits in PH Form No without leaving Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing PH Form No and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I fill out the PH Form No form on my smartphone?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign PH Form No and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is PH Form No?

PH Form No is a specific document or form used for reporting or compliance purposes, typically related to public health or regulatory requirements.

Who is required to file PH Form No?

Entities or individuals who are subject to the regulations governing public health, such as healthcare providers, facilities, or businesses involved in health-related activities, are required to file PH Form No.

How to fill out PH Form No?

To fill out PH Form No, one must carefully read the instructions provided, enter the required information accurately in the designated fields, and ensure all necessary documentation is attached before submission.

What is the purpose of PH Form No?

The purpose of PH Form No is to collect necessary information for monitoring, reporting, or compliance with public health regulations and policies.

What information must be reported on PH Form No?

The information that must be reported on PH Form No typically includes identification details, relevant health data, compliance indicators, and other specifics as required by the regulatory authority.

Fill out your PH Form No online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

PH Form No is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.