Get the free (UK) Ltd - Fuel card application form - Fuel Cards

Show details

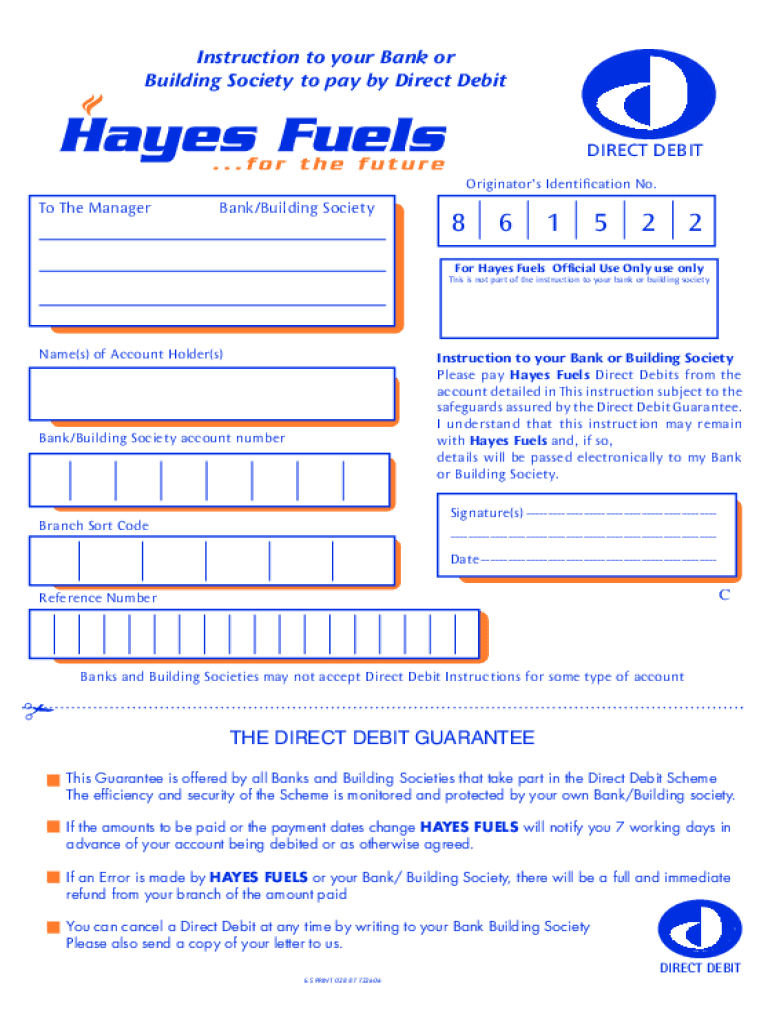

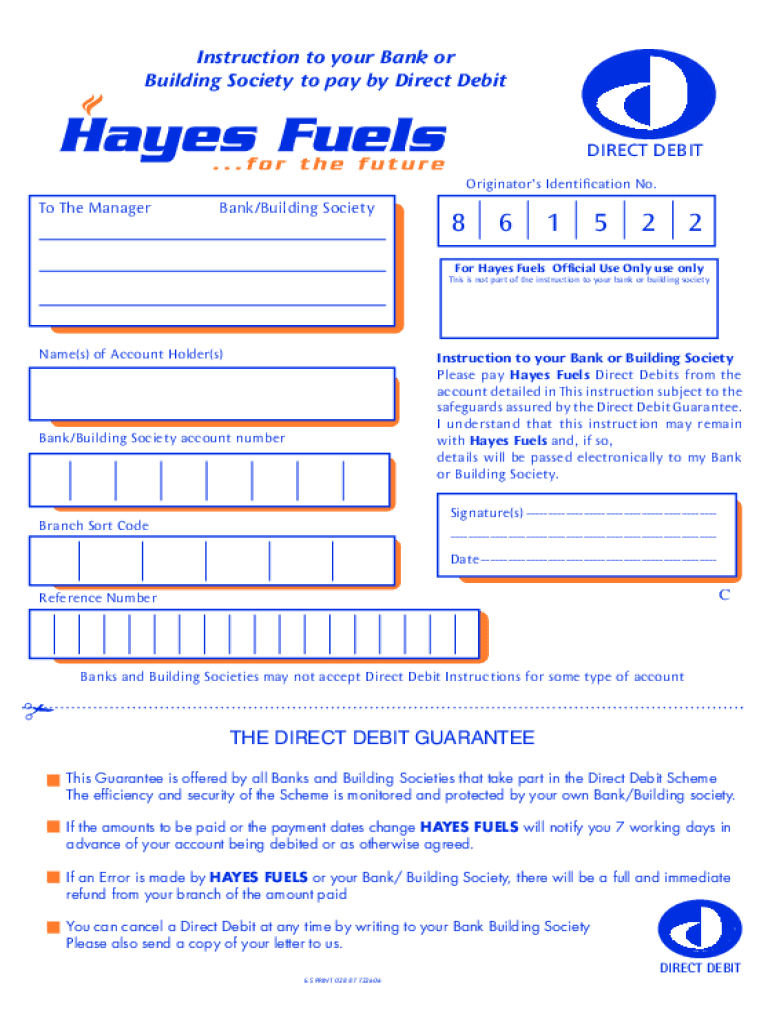

Instruction to your Bank or

Building Society to pay by Direct DebitDIRECT DEBIT

Originators Identification No. To The Managerial/Building Society861522For Hayes Fuels Official Use Only

This is not

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign uk ltd - fuel

Edit your uk ltd - fuel form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your uk ltd - fuel form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit uk ltd - fuel online

To use our professional PDF editor, follow these steps:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit uk ltd - fuel. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out uk ltd - fuel

How to fill out uk ltd - fuel

01

Start by obtaining the necessary forms, such as the CT600 (Corporation Tax Return) and the Form CT41G (New Company Details). These forms can be found on the official website of HM Revenue & Customs.

02

Fill out the Form CT41G with the relevant information about your company, including its registered name, registered office address, nature of business, and details of directors and shareholders.

03

Fill out the CT600 form with information about your company's income, expenses, and profits. Be sure to include any fuel-related expenses accurately.

04

Attach any supporting documents, such as fuel receipts or invoices, to the CT600 form to validate your fuel expenses.

05

Review the completed forms and ensure all information is accurate and up-to-date.

06

Submit the completed forms to HM Revenue & Customs either through their online platform or by post.

07

Pay any applicable taxes and await confirmation of your submission from HM Revenue & Customs.

Who needs uk ltd - fuel?

01

UK Limited companies that engage in fuel-related activities, such as transportation or energy production, may need to fill out the UK Ltd - Fuel forms. These forms help companies report their fuel-related expenses and calculate any associated tax liabilities accurately. It is essential for these companies to comply with HM Revenue & Customs regulations and fulfill their tax obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I modify my uk ltd - fuel in Gmail?

uk ltd - fuel and other documents can be changed, filled out, and signed right in your Gmail inbox. You can use pdfFiller's add-on to do this, as well as other things. When you go to Google Workspace, you can find pdfFiller for Gmail. You should use the time you spend dealing with your documents and eSignatures for more important things, like going to the gym or going to the dentist.

How can I get uk ltd - fuel?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific uk ltd - fuel and other forms. Find the template you want and tweak it with powerful editing tools.

How do I complete uk ltd - fuel online?

pdfFiller has made it easy to fill out and sign uk ltd - fuel. You can use the solution to change and move PDF content, add fields that can be filled in, and sign the document electronically. Start a free trial of pdfFiller, the best tool for editing and filling in documents.

What is uk ltd - fuel?

UK Ltd - Fuel is a form that UK companies use to report their fuel usage and related information for tax purposes.

Who is required to file uk ltd - fuel?

Any limited company (Ltd) in the UK that uses fuel for business purposes is required to file the UK Ltd - Fuel form.

How to fill out uk ltd - fuel?

To fill out the UK Ltd - Fuel form, companies need to gather information on their fuel purchases, usage, and any exemptions, then complete the form following HMRC guidelines.

What is the purpose of uk ltd - fuel?

The purpose of UK Ltd - Fuel is to ensure accurate reporting of fuel usage for tax assessments and to allow companies to claim back any tax entitled on fuel expenses.

What information must be reported on uk ltd - fuel?

The UK Ltd - Fuel form requires reporting of total fuel purchased, usage details, vehicle registrations, and any personal use of vehicles.

Fill out your uk ltd - fuel online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Uk Ltd - Fuel is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.