Get the free Home LoanApply Housing Loan at Lowest Interest Rate ...

Show details

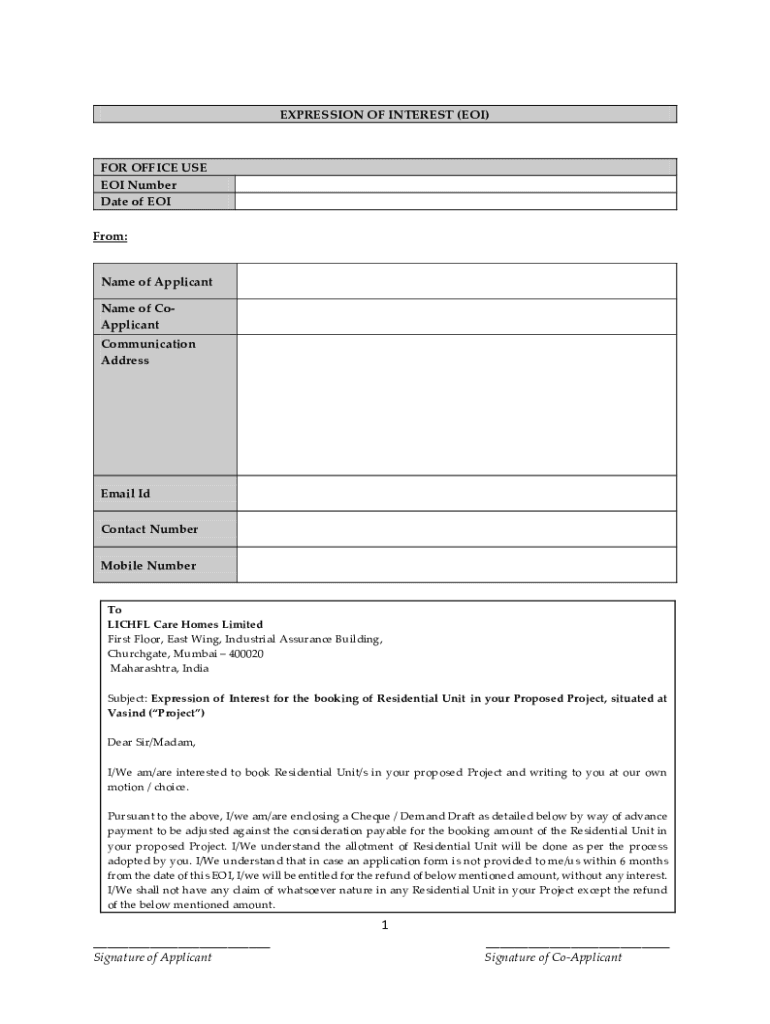

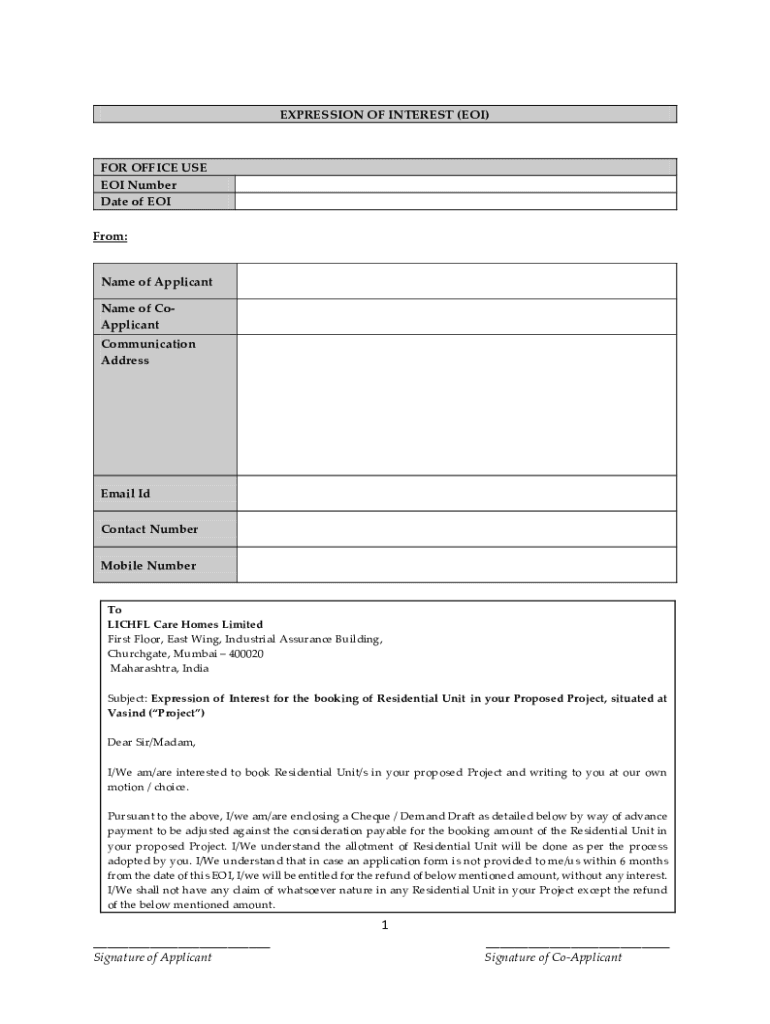

EXPRESSION OF INTEREST (EOI)FOR OFFICE USE EOI Number Date of EOI From:Name of Applicant Name of Applicant Communication AddressEmail I'd Contact Number Mobile Humberto MICHEL Care Homes Limited First

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign home loanapply housing loan

Edit your home loanapply housing loan form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your home loanapply housing loan form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit home loanapply housing loan online

In order to make advantage of the professional PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit home loanapply housing loan. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, dealing with documents is always straightforward.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out home loanapply housing loan

How to fill out home loanapply housing loan

01

Gather all necessary documents such as proof of income, identification, address verification, and property documents.

02

Research and compare different banks or financial institutions offering home loans to find the best interest rates and terms.

03

Contact the chosen bank or financial institution and enquire about the home loan application process.

04

Fill out the application form accurately and provide all required information. Include details about the property you are planning to buy or build.

05

Attach the necessary documents as specified by the bank or financial institution.

06

Submit the completed application form along with the documents to the bank or financial institution.

07

Pay the processing fees and any other charges as applicable.

08

Wait for the bank or financial institution to process your application. They may conduct a credit check and property appraisal.

09

Once approved, review the loan offer and terms provided by the bank or financial institution.

10

If satisfied, sign the loan agreement and complete any additional documentation required.

11

The bank or financial institution will disburse the loan amount as per the agreed terms.

12

Begin repayment according to the loan repayment schedule.

13

Keep track of your loan account, make timely payments, and seek assistance from the bank or financial institution if needed.

Who needs home loanapply housing loan?

01

Anyone who wishes to purchase or construct a home and requires financial assistance can opt for a home loan.

02

Individuals who do not have sufficient savings or funds to purchase a property outright often rely on home loans.

03

First-time homebuyers, as well as existing homeowners looking to upgrade or refinance their homes, may require a housing loan.

04

Self-employed individuals or business owners who need to invest in residential property can also benefit from home loans.

05

Home loans are also availed by those looking to invest in real estate for rental income or future resale.

06

It is important to meet the eligibility criteria set by the bank or financial institution offering the home loan.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my home loanapply housing loan directly from Gmail?

The pdfFiller Gmail add-on lets you create, modify, fill out, and sign home loanapply housing loan and other documents directly in your email. Click here to get pdfFiller for Gmail. Eliminate tedious procedures and handle papers and eSignatures easily.

How do I edit home loanapply housing loan online?

pdfFiller not only allows you to edit the content of your files but fully rearrange them by changing the number and sequence of pages. Upload your home loanapply housing loan to the editor and make any required adjustments in a couple of clicks. The editor enables you to blackout, type, and erase text in PDFs, add images, sticky notes and text boxes, and much more.

How do I make edits in home loanapply housing loan without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing home loanapply housing loan and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

What is home loanapply housing loan?

A home loan, also known as a housing loan, is a type of loan specifically designed for purchasing or renovating a residential property. It typically involves borrowing money from a lender, which is then repaid in installments over a set period of time.

Who is required to file home loanapply housing loan?

Individuals or entities who intend to apply for a home loan to purchase or refinance a residential property are typically required to file a home loan application.

How to fill out home loanapply housing loan?

To fill out a home loan application, gather personal and financial information, including identification, income details, debts, and the property details. Complete the application form provided by the lender, ensuring all information is accurate and comprehensive.

What is the purpose of home loanapply housing loan?

The purpose of a home loan is to provide individuals with the necessary funds to purchase or improve a home, making home ownership more accessible.

What information must be reported on home loanapply housing loan?

The application generally requires personal identification, income and employment information, credit history, existing debts, and details about the property being financed.

Fill out your home loanapply housing loan online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Home Loanapply Housing Loan is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.