Get the free Modeling asymmetric volatility in the nigerian stock exchange

Show details

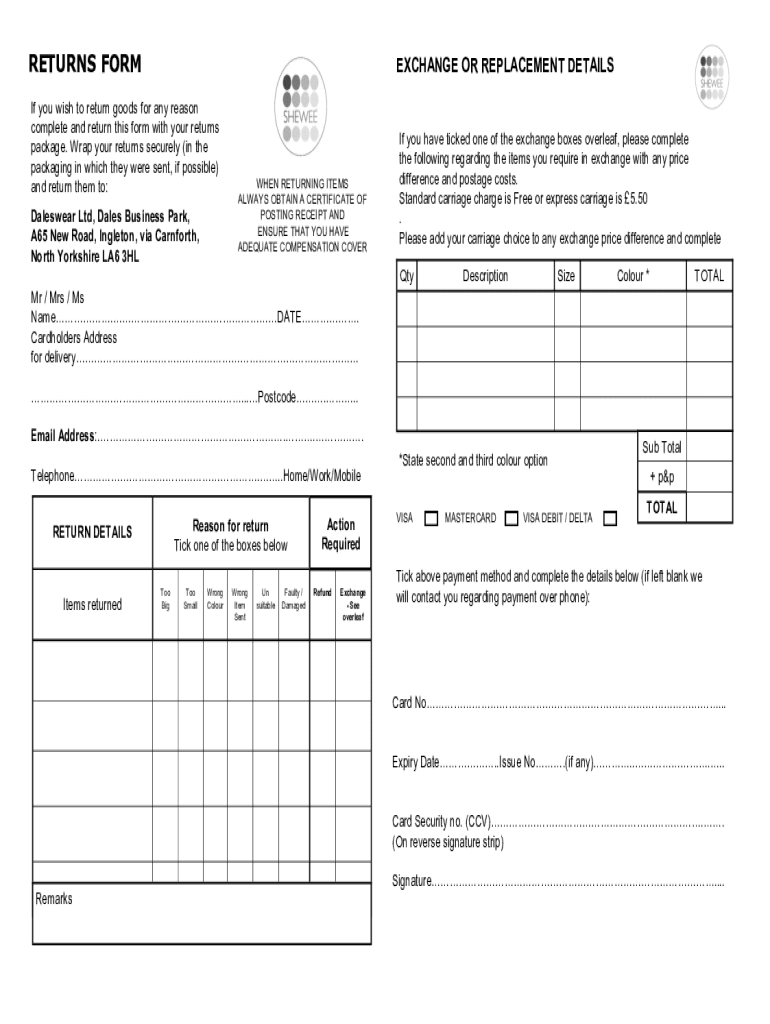

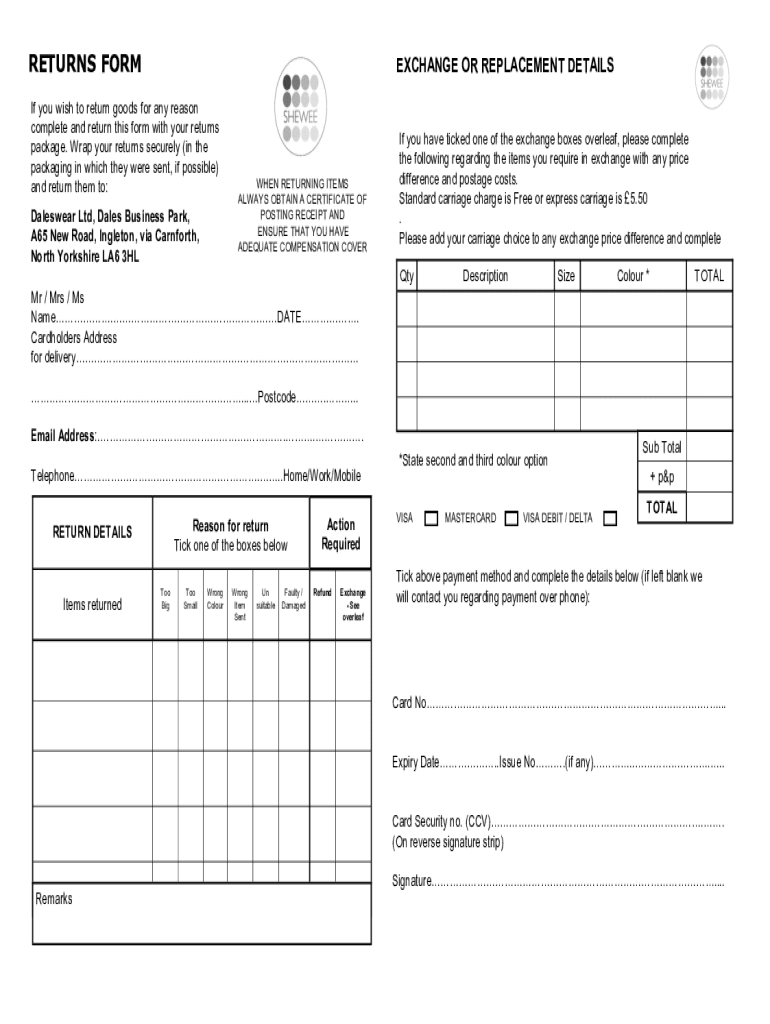

RETURNS FORMEXCHANGE OR REPLACEMENT Details you wish to return goods for any reason

complete and return this form with your returns

package. Wrap your returns securely (in the

packaging in which they

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign modeling asymmetric volatility in

Edit your modeling asymmetric volatility in form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your modeling asymmetric volatility in form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing modeling asymmetric volatility in online

To use the services of a skilled PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit modeling asymmetric volatility in. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it from your records list. Then, click the right toolbar and select one of the various exporting options: save in numerous formats, download as PDF, email, or cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out modeling asymmetric volatility in

How to fill out modeling asymmetric volatility in

01

Define the variables you will use in the model. Asymmetric volatility models typically involve the use of multiple variables, such as stock returns, interest rates, and other financial indicators.

02

Choose an appropriate asymmetric volatility model. There are several different models available, such as the GARCH model or the EGARCH model. Each model has its own assumptions and specifications, so choose the one that best fits your data and research objectives.

03

Estimate the model parameters. Use statistical methods, such as maximum likelihood estimation, to estimate the parameters of the chosen asymmetric volatility model. This will allow you to quantify the relationship between the variables and the volatility.

04

Validate the model. Assess the goodness of fit and statistical significance of the estimated model. You can use various diagnostic tests, such as the Ljung-Box test or the ARCH LM test, to ensure that the model adequately captures the asymmetric volatility dynamics in your data.

05

Interpret the results. Once you have estimated and validated the model, interpret the estimated parameters and their significance. This will provide insights into the asymmetric volatility patterns and their potential implications for risk management or trading strategies.

06

Monitor and update the model. Asymmetric volatility is a dynamic phenomenon that may change over time. Continuously monitor the model's performance and update the parameters if necessary, to ensure its relevance and accuracy.

Who needs modeling asymmetric volatility in?

01

Financial analysts and researchers: Modeling asymmetric volatility in financial markets can help analysts and researchers understand and predict market conditions, assess risk, and design investment strategies.

02

Risk managers: Modeling asymmetric volatility is essential for risk managers who need to accurately quantify and manage the downside risk in their portfolios or financial instruments.

03

Options traders: Asymmetric volatility plays a crucial role in pricing and trading options. Traders need to incorporate asymmetric volatility models to correctly price and hedge their options positions.

04

Central banks and regulators: Modeling asymmetric volatility can provide insights into financial stability and systemic risk. Central banks and regulators need to understand and monitor asymmetric volatility dynamics to make informed policy decisions and implement effective risk management measures.

05

Portfolio managers: Modeling asymmetric volatility can help portfolio managers optimize their portfolio allocations and manage their risk-adjusted returns by considering the non-linear and asymmetric nature of volatility.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit modeling asymmetric volatility in in Chrome?

Get and add pdfFiller Google Chrome Extension to your browser to edit, fill out and eSign your modeling asymmetric volatility in, which you can open in the editor directly from a Google search page in just one click. Execute your fillable documents from any internet-connected device without leaving Chrome.

Can I create an eSignature for the modeling asymmetric volatility in in Gmail?

Create your eSignature using pdfFiller and then eSign your modeling asymmetric volatility in immediately from your email with pdfFiller's Gmail add-on. To keep your signatures and signed papers, you must create an account.

How do I edit modeling asymmetric volatility in on an iOS device?

Use the pdfFiller mobile app to create, edit, and share modeling asymmetric volatility in from your iOS device. Install it from the Apple Store in seconds. You can benefit from a free trial and choose a subscription that suits your needs.

What is modeling asymmetric volatility in?

Modeling asymmetric volatility involves analyzing financial instruments where the volatility varies in response to market movements, typically exhibiting more pronounced volatility during downturns compared to upturns.

Who is required to file modeling asymmetric volatility in?

Entities that engage in trading or holding financial instruments subject to asymmetric volatility must file these models, including hedge funds, investment firms, and asset managers.

How to fill out modeling asymmetric volatility in?

To fill out modeling asymmetric volatility, firms must gather relevant market data, use statistical models to assess volatility patterns, and complete the designated forms detailing their findings and methodologies.

What is the purpose of modeling asymmetric volatility in?

The purpose is to provide insights into risk management and pricing strategies by understanding how volatility behaves in different market conditions.

What information must be reported on modeling asymmetric volatility in?

Firms must report model assumptions, methodologies used, empirical data analyzed, results of the volatility assessments, and potential impacts on risk exposure.

Fill out your modeling asymmetric volatility in online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Modeling Asymmetric Volatility In is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.