OH KR-1040 - Kettering City 2020 free printable template

Show details

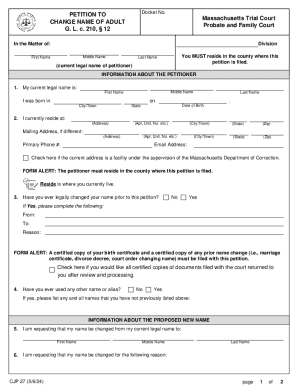

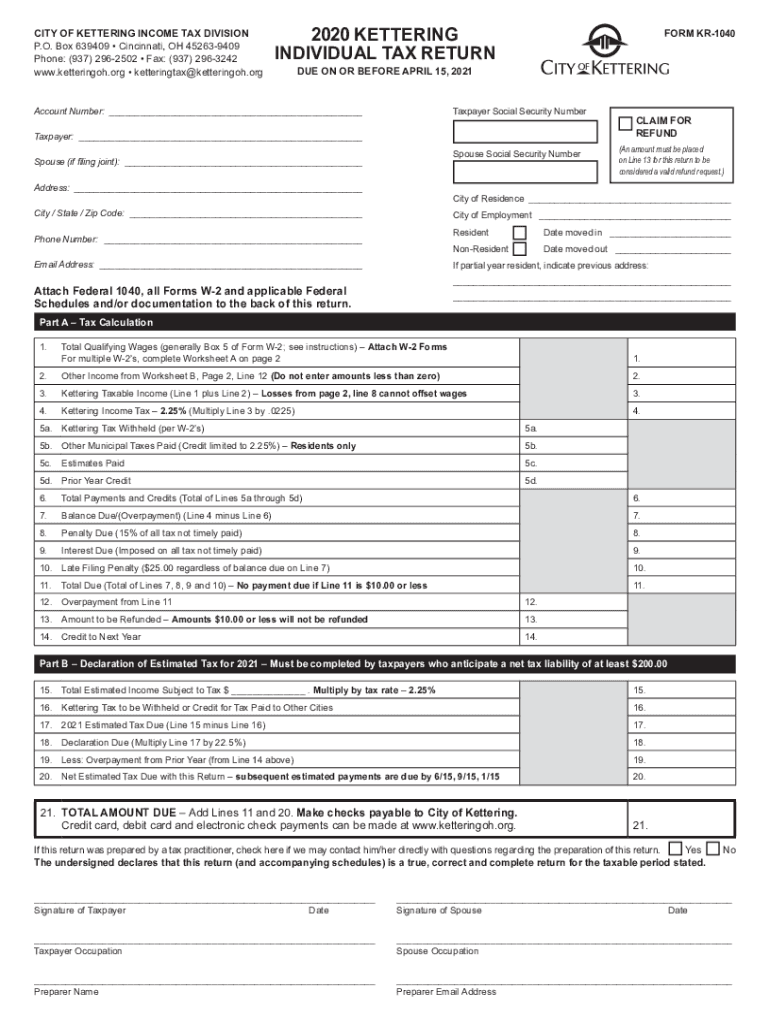

CITY OF KETTERING INCOME TAX DIVISION P.O. Box 639409 Cincinnati, OH 452639409 Phone: (937) 2962502 Fax: (937) 2963242 www.ketteringoh.org Kettering.org2020 KETTERING INDIVIDUAL TAX RETURNER KR1040DUE

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign OH KR-1040 - Kettering City

Edit your OH KR-1040 - Kettering City form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your OH KR-1040 - Kettering City form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing OH KR-1040 - Kettering City online

To use our professional PDF editor, follow these steps:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit OH KR-1040 - Kettering City. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

OH KR-1040 - Kettering City Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out OH KR-1040 - Kettering City

How to fill out OH KR-1040 - Kettering City

01

Obtain the OH KR-1040 form from the Kettering City website or local tax office.

02

Gather all necessary financial documents, including W-2s, 1099s, and any other income records.

03

Fill out the personal information section, including your name, address, and Social Security number.

04

Report your total income in the designated section, ensuring all sources are included.

05

Calculate your Kettering City taxable income by subtracting any allowable deductions from your total income.

06

Determine your tax liability based on Kettering City's tax rates.

07

Complete the payment section if you owe any taxes, and provide your preferred payment method.

08

Sign and date the form to certify that the information provided is accurate.

09

Submit the completed form either online, by mail, or in person, according to Kettering City guidelines.

Who needs OH KR-1040 - Kettering City?

01

Residents of Kettering City who earn income and are required to file a local income tax return.

02

Individuals who work in Kettering City but reside elsewhere and need to report their earnings for local tax purposes.

03

Business owners operating within Kettering City that must report their income for local taxation.

Fill

form

: Try Risk Free

People Also Ask about

Does Centerville Ohio have a City tax?

All residents of Centerville who are 18 or older are required to pay City income tax. College students are taxed based on legal residence.

Can I print income tax forms?

Download Income Tax Forms You can e-file directly to the IRS and download or print a copy of your tax return. Federal tax filing is free for everyone with no limitations, and state filing is only $14.99.

Does Dayton Ohio have a city income tax?

Residents of Dayton pay a flat city income tax of 2.25% on earned income, in addition to the Ohio income tax and the Federal income tax. Nonresidents who work in Dayton also pay a local income tax of 2.25%, the same as the local income tax paid by residents.

What cities in Ohio have a City income tax?

Regional Income Tax Agency (RITA) - About half of Ohio's municipalities that have an income tax use RITA for tax collection services.Ohio Municipality Taxes City of Akron. City of Canton. City of Carlisle. City of Cincinnati. City of Columbus. City of Dayton. City of Middletown. City of St. Marys.

Can you print tax forms front and back?

Print Tax Return Double-Sided Forms with Caution While each form can be double-sided, different forms cannot share the same page – so for example, each page of a Form 1040 can be double-sided. But part of the Form 1040 cannot share a page with a Form 7004.

Can I print my own w2 for taxes?

You can use a printed one. It doesn't matter since the IRS receives the same information.

Does Centerville Ohio have a city tax?

All residents of Centerville who are 18 or older are required to pay City income tax. College students are taxed based on legal residence.

Can you file Ohio city taxes online?

Ohio income tax forms— Online services is a free, secure electronic portal where you can file returns, make payments, and view additional information regarding your Ohio individual and school district income taxes.

Does Kettering have city tax?

The minimum combined 2022 sales tax rate for Kettering, Ohio is 7.5%. This is the total of state, county and city sales tax rates. The Ohio sales tax rate is currently 5.75%. The County sales tax rate is 1.75%.

How do I file Kettering city taxes?

Forms may be obtained by calling our office at (937) 296-2502 or go directly to the forms page. The City of Kettering Income Tax Division now accepts credit card and debit card payments.

Do I need to pay City taxes in Ohio?

Depending on where you live in Ohio, you may have to pay municipal income taxes. Your municipality determines your local income tax rate. These rates may range from 0.5% to 3%, with Ohio's three largest municipalities — Cincinnati, Cleveland and Columbus — charging more than 2%.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify OH KR-1040 - Kettering City without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your OH KR-1040 - Kettering City into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How do I edit OH KR-1040 - Kettering City online?

The editing procedure is simple with pdfFiller. Open your OH KR-1040 - Kettering City in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I complete OH KR-1040 - Kettering City on an Android device?

On Android, use the pdfFiller mobile app to finish your OH KR-1040 - Kettering City. Adding, editing, deleting text, signing, annotating, and more are all available with the app. All you need is a smartphone and internet.

What is OH KR-1040 - Kettering City?

OH KR-1040 is a local income tax return form specifically for residents and non-residents who earn income in Kettering City, Ohio, used to report and pay local income taxes.

Who is required to file OH KR-1040 - Kettering City?

All residents of Kettering City and non-residents who have earned income in the city are required to file OH KR-1040.

How to fill out OH KR-1040 - Kettering City?

To fill out OH KR-1040, you need to provide personal information, report your income, calculate any deductions, and determine the amount of tax owed or refund due. Instructions are included with the form.

What is the purpose of OH KR-1040 - Kettering City?

The purpose of OH KR-1040 is to assess and collect local income tax from individuals who reside in or earn income in Kettering City.

What information must be reported on OH KR-1040 - Kettering City?

The information that must be reported on OH KR-1040 includes personal identification details, total income earned, any tax deductions, credits claimed, and the final tax liability or refund amount.

Fill out your OH KR-1040 - Kettering City online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

OH KR-1040 - Kettering City is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.