Get the free Oil and Gas Royalty StatementsUnderstand Statement ...

Show details

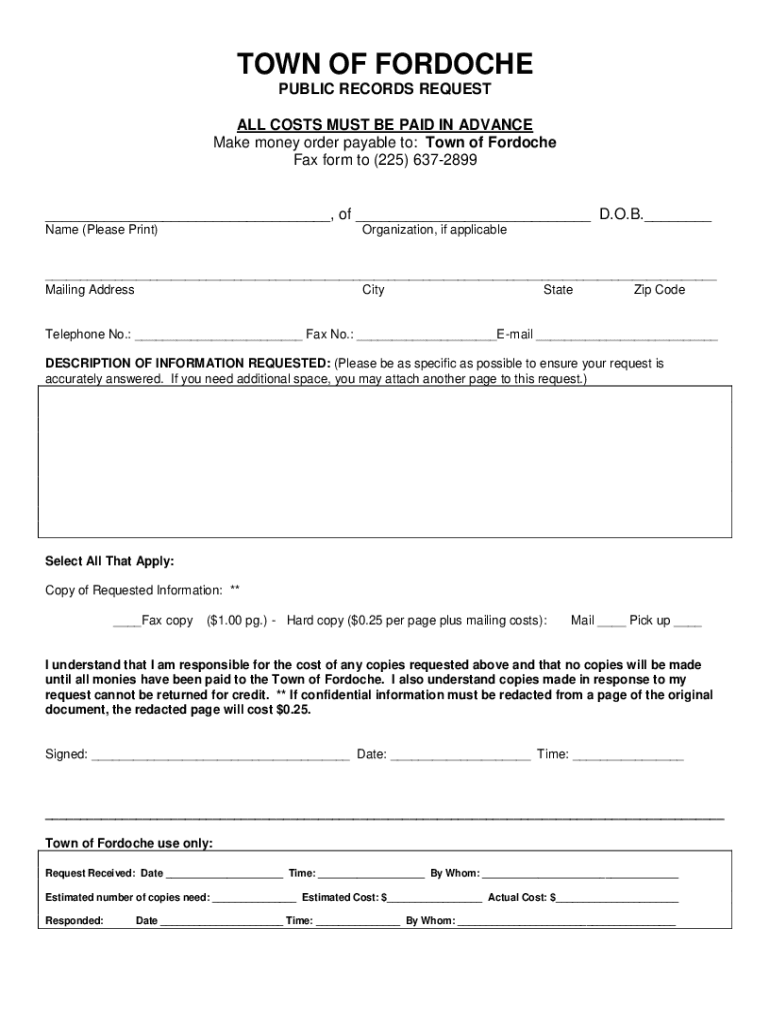

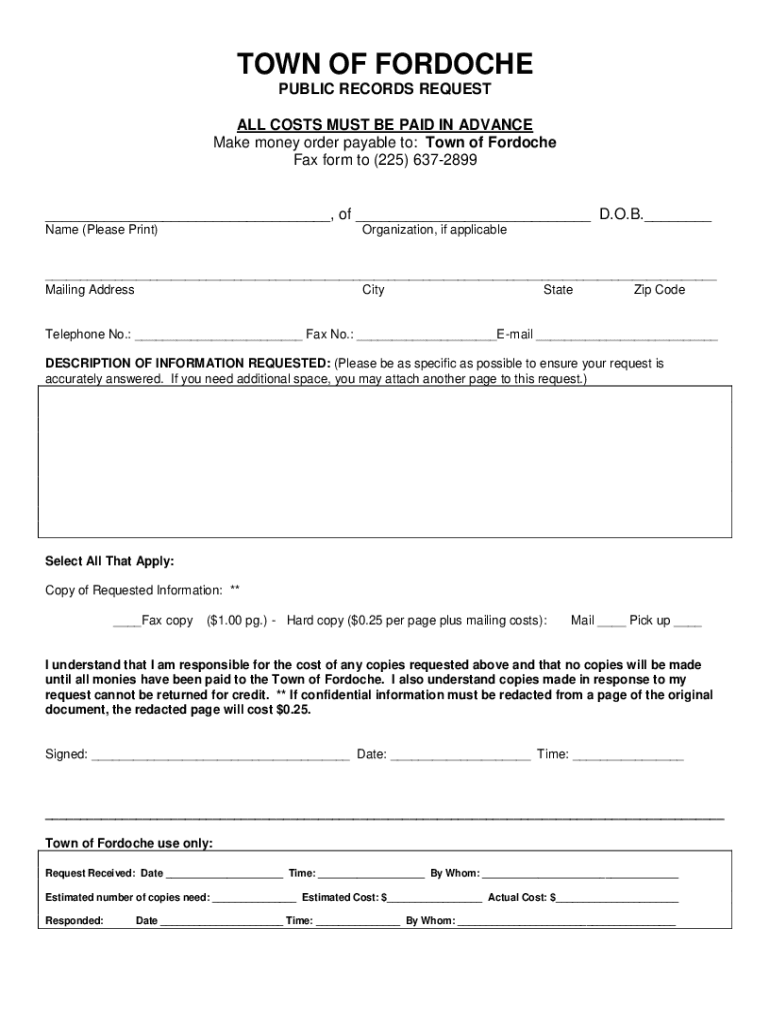

TOWN OF FORCE PUBLIC RECORDS REQUEST ALL COSTS MUST BE PAID IN ADVANCE Make money order payable to: Town of Force Fax form to (225) 6372899, of D.O.B. Name (Please Print)Organization, if applicable

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign oil and gas royalty

Edit your oil and gas royalty form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your oil and gas royalty form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit oil and gas royalty online

Follow the steps below to benefit from the PDF editor's expertise:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit oil and gas royalty. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

With pdfFiller, it's always easy to work with documents. Check it out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out oil and gas royalty

How to fill out oil and gas royalty

01

To fill out oil and gas royalty, follow these steps:

02

Obtain the necessary documents: You will need the lease agreement or contract specifying the terms and conditions of the royalty payment.

03

Gather information: Collect all relevant information, such as the date range for which royalty is being calculated, production volume, and pricing details.

04

Calculate the royalty: Use the formula provided in the lease agreement to calculate the royalty amount based on the production volume and pricing.

05

Fill out the royalty form: Use the provided form or template to enter the calculated royalty amount, lease details, and any additional required information.

06

Review and verify: Double-check all the entered information to ensure accuracy and completeness.

07

Submit the form: File the completed royalty form according to the specified procedure or submit it to the designated authority or company responsible for royalty payments.

08

Maintain records: Keep copies of all documents and records related to the royalty payments for future reference or auditing purposes.

Who needs oil and gas royalty?

01

Oil and gas royalty is beneficial for the following individuals, companies, or entities:

02

- Landowners: If you own land with oil and gas reserves, you are entitled to receive royalty payments as compensation for the extraction and use of these resources.

03

- Mineral rights owners: Individuals or entities that own mineral rights over oil and gas deposits can receive royalty payments.

04

- Investors: People who invest in oil and gas ventures or lease their land for exploration and production purposes may receive royalty payments as part of their investment returns.

05

- Governments: National or regional governments often impose royalties on oil and gas extraction to generate revenue and fund public services.

06

- Energy companies: Oil and gas companies that lease or extract resources from land owned by others need to pay royalty as per the agreed terms and conditions.

07

- Leaseholders: Individuals or entities who hold leasing rights for oil and gas exploration and production on certain land may receive royalty payments from energy companies that extract resources from their leased areas.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify oil and gas royalty without leaving Google Drive?

People who need to keep track of documents and fill out forms quickly can connect PDF Filler to their Google Docs account. This means that they can make, edit, and sign documents right from their Google Drive. Make your oil and gas royalty into a fillable form that you can manage and sign from any internet-connected device with this add-on.

How can I edit oil and gas royalty on a smartphone?

You may do so effortlessly with pdfFiller's iOS and Android apps, which are available in the Apple Store and Google Play Store, respectively. You may also obtain the program from our website: https://edit-pdf-ios-android.pdffiller.com/. Open the application, sign in, and begin editing oil and gas royalty right away.

How do I edit oil and gas royalty on an Android device?

With the pdfFiller Android app, you can edit, sign, and share oil and gas royalty on your mobile device from any place. All you need is an internet connection to do this. Keep your documents in order from anywhere with the help of the app!

What is oil and gas royalty?

Oil and gas royalty refers to the payment made to the owner of natural resources (like oil or natural gas) by the producer for the extraction of those resources. It is typically a percentage of the revenue generated from the sale of the oil or gas.

Who is required to file oil and gas royalty?

Typically, the producers or operators of oil and gas wells are required to file oil and gas royalties. This includes companies and individuals who extract or produce oil and gas resources and are obligated to report their production and pay royalties to the resource owners.

How to fill out oil and gas royalty?

To fill out oil and gas royalty, gather required production information, calculate revenue generated from sales, determine the royalty percentage, and complete the relevant forms provided by the state or governing authority for reporting. Ensure all fields are accurately filled and reviewed before submission.

What is the purpose of oil and gas royalty?

The purpose of oil and gas royalty is to compensate resource owners for the extraction of their minerals and to ensure they receive a fair share of the revenue generated from the production of those resources.

What information must be reported on oil and gas royalty?

The information that must be reported typically includes production volumes, sales revenues, royalty calculations, and any other relevant data as required by local regulations. This may also include the type of product extracted and the dates of the reporting period.

Fill out your oil and gas royalty online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Oil And Gas Royalty is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.