Get the free Cost Accounting Policies & Procedures

Show details

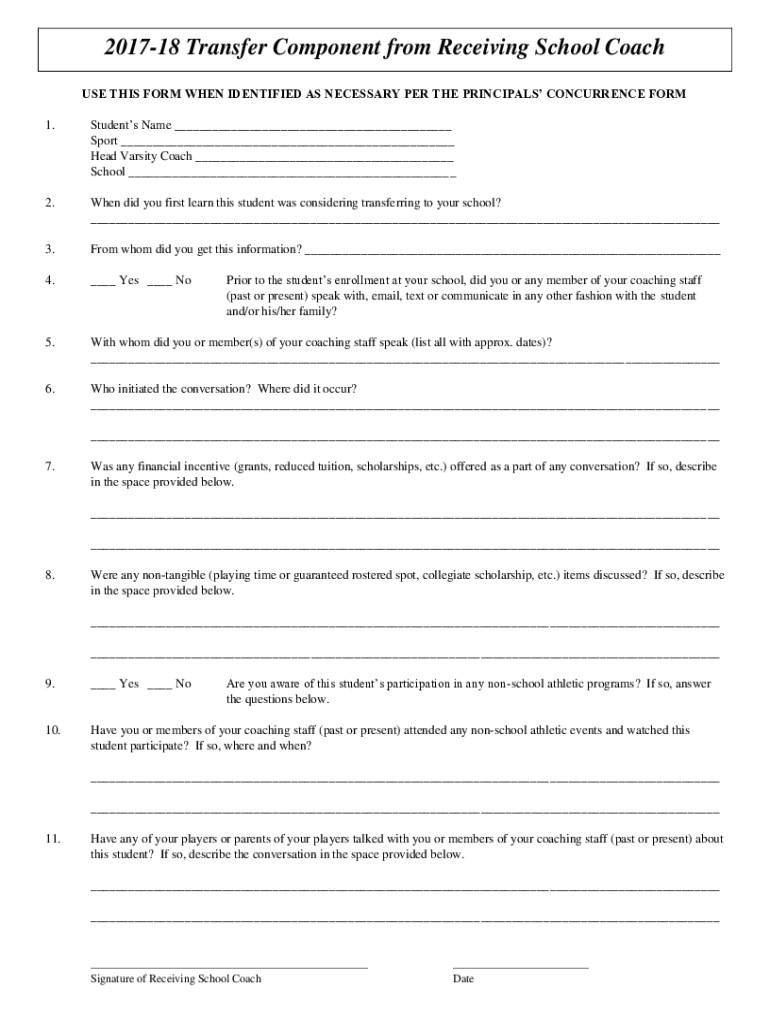

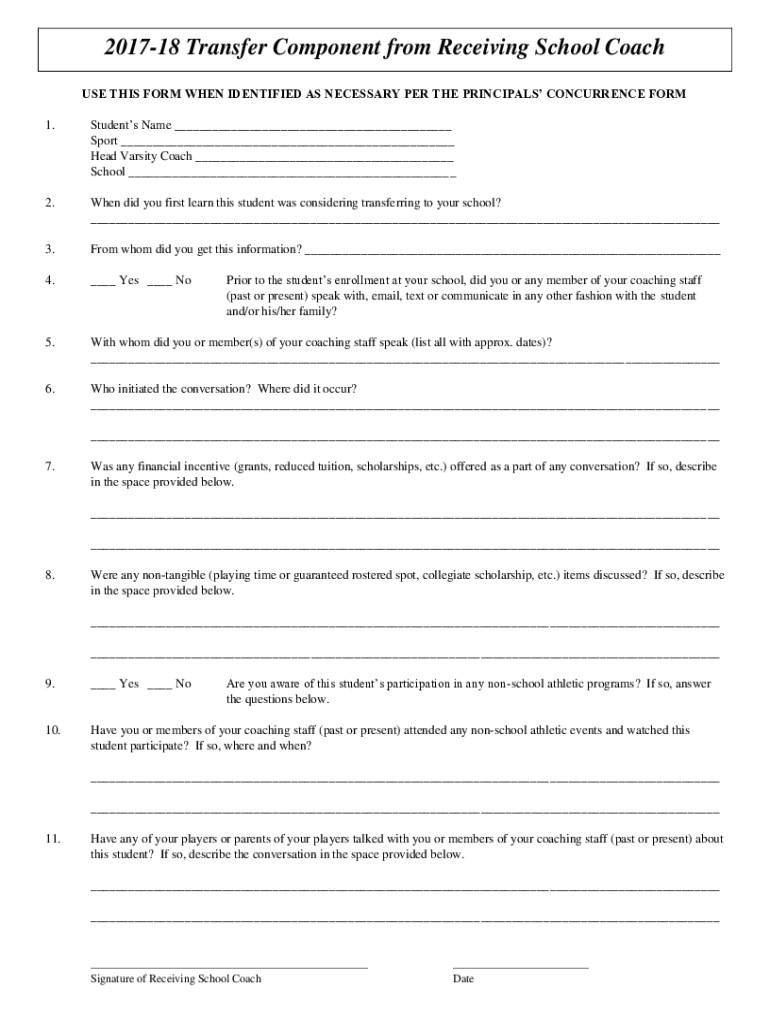

201718 Transfer Component from Receiving School Coach USE THIS FORM WHEN IDENTIFIED AS NECESSARY PER THE PRINCIPALS CONCURRENCE FORM 1. Students Name Sport Head Varsity Coach School 2. When did you

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign cost accounting policies ampampamp

Edit your cost accounting policies ampampamp form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your cost accounting policies ampampamp form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit cost accounting policies ampampamp online

To use the services of a skilled PDF editor, follow these steps:

1

Create an account. Begin by choosing Start Free Trial and, if you are a new user, establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit cost accounting policies ampampamp. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out cost accounting policies ampampamp

How to fill out cost accounting policies ampampamp

01

To fill out cost accounting policies:

02

Start by identifying the purpose of the cost accounting policies. Determine what specific information you want to capture and why it is important for your organization.

03

Define the cost elements that need to be accounted for. This includes direct costs (such as materials and labor) as well as indirect costs (such as overhead expenses).

04

Develop a methodology for allocating costs to different cost centers or cost objects. This could involve using cost drivers or cost allocation bases.

05

Document the procedures and guidelines for recording and tracking costs. Specify the methods and tools to be used, as well as any relevant codes or classifications.

06

Establish reporting requirements. Determine the format and frequency of cost reports, and specify the key performance indicators or metrics to be included.

07

Implement the cost accounting policies by communicating them to relevant stakeholders and providing training if necessary.

08

Regularly review and update the cost accounting policies to ensure they remain relevant and aligned with the organization's goals and objectives.

Who needs cost accounting policies ampampamp?

01

Cost accounting policies are needed by any organization that wants to accurately track and analyze its costs. This includes businesses of all sizes, as well as non-profit organizations and government agencies.

02

Specifically, cost accounting policies are important for:

03

- Management: Cost accounting policies provide valuable information for decision-making, budgeting, and performance evaluation.

04

- Accounting and finance departments: Cost accounting policies help in preparing financial statements, calculating product costs, and assessing profitability.

05

- Regulatory compliance: Some industries have specific regulations or accounting standards that require cost accounting policies to be in place.

06

- Investors and creditors: Cost accounting policies provide transparency and demonstrate the organization's ability to control costs and generate profits.

07

- Internal and external auditors: Cost accounting policies help auditors verify the accuracy and reliability of financial information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I edit cost accounting policies ampampamp from Google Drive?

By integrating pdfFiller with Google Docs, you can streamline your document workflows and produce fillable forms that can be stored directly in Google Drive. Using the connection, you will be able to create, change, and eSign documents, including cost accounting policies ampampamp, all without having to leave Google Drive. Add pdfFiller's features to Google Drive and you'll be able to handle your documents more effectively from any device with an internet connection.

How do I make edits in cost accounting policies ampampamp without leaving Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing cost accounting policies ampampamp and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I edit cost accounting policies ampampamp straight from my smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing cost accounting policies ampampamp.

What is cost accounting policies?

Cost accounting policies are guidelines and procedures that organizations establish to measure, analyze, and report cost data for management decision-making. They help in budgeting, controlling costs, and determining profitability.

Who is required to file cost accounting policies?

Entities that are required to file cost accounting policies typically include government contractors, organizations receiving federal funds, and larger corporations subject to specific regulatory requirements.

How to fill out cost accounting policies?

Filling out cost accounting policies involves compiling relevant financial data, documenting cost allocation methods, detailing accounting practices, and ensuring compliance with regulatory standards before submission to the appropriate authority.

What is the purpose of cost accounting policies?

The purpose of cost accounting policies is to provide a consistent framework for tracking and managing costs, ensuring accurate reporting, and promoting better financial decision-making within an organization.

What information must be reported on cost accounting policies?

Information required in cost accounting policies typically includes cost allocation methods, direct and indirect costs, overhead rates, compliance with regulatory standards, and explanations for changes in accounting practices.

Fill out your cost accounting policies ampampamp online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Cost Accounting Policies Ampampamp is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.