Get the free FRM vs. CFAEverything You Need to KnowKaplan Schweser - download bse-sofia

Show details

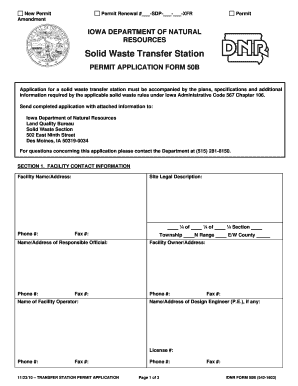

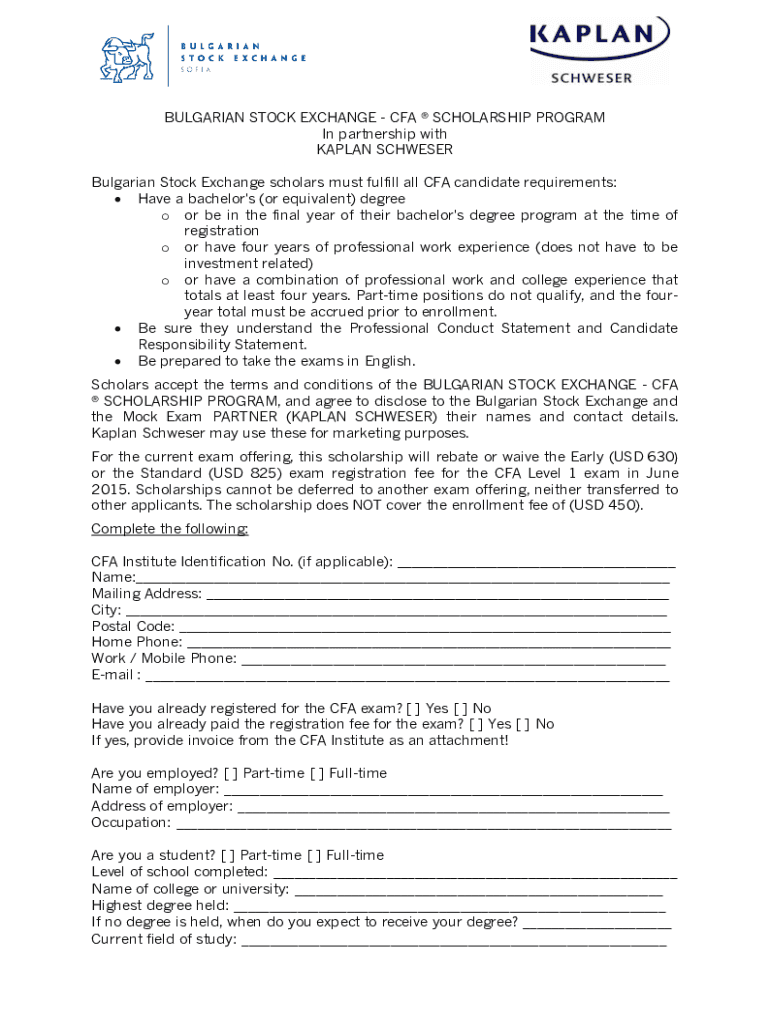

BULGARIAN STOCK EXCHANGE CFA SCHOLARSHIP PROGRAM In partnership with KAPLAN SCHEMER Bulgarian Stock Exchange scholars must fulfill all CFA candidate requirements: Have a bachelor's (or equivalent)

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign frm vs cfaeverything you

Edit your frm vs cfaeverything you form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your frm vs cfaeverything you form via URL. You can also download, print, or export forms to your preferred cloud storage service.

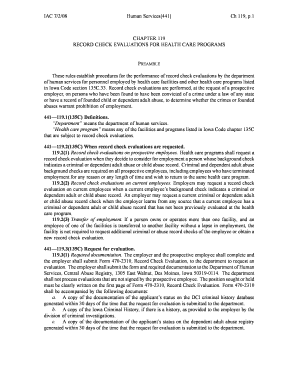

Editing frm vs cfaeverything you online

To use our professional PDF editor, follow these steps:

1

Log into your account. If you don't have a profile yet, click Start Free Trial and sign up for one.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit frm vs cfaeverything you. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

The use of pdfFiller makes dealing with documents straightforward. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out frm vs cfaeverything you

How to fill out frm vs cfaeverything you

01

To fill out frm vs cfaeverything, follow these steps:

02

Begin by gathering all the necessary documents and information. This could include personal information, financial records, and any other relevant data.

03

Review the form and understand the different sections and requirements. Pay attention to any instructions or guidelines provided.

04

Start filling out the form systematically, section by section. Enter the required details accurately and ensure all information is complete.

05

Double-check your entries to avoid any mistakes or omissions. It's important to provide accurate information for a successful completion.

06

If there are any specific instructions or additional documents needed, make sure to include them accordingly.

07

Once you have completed filling out the form, review it one final time to make sure everything is accurate and complete.

08

Submit the filled-out form as per the instructions provided. This could be done online or by mail, depending on the requirements.

09

Keep a copy of the filled-out form for your records.

10

Remember to consult any specific guidelines or seek professional advice if you have any doubts or questions while filling out the form.

Who needs frm vs cfaeverything you?

01

Anyone who wants to pursue a career in finance or investment management can benefit from understanding the difference between FRM (Financial Risk Manager) and CFA (Chartered Financial Analyst).

02

FRM is a specialized certification focused on risk management, while CFA is a broader certification covering various aspects of finance and investment analysis.

03

Individuals who are interested in risk management roles, such as risk analysts, risk consultants, or risk managers, may find the FRM certification more suitable for their career goals.

04

On the other hand, professionals aiming for roles like investment analysts, portfolio managers, or research analysts may opt for the CFA certification.

05

Ultimately, the choice between FRM and CFA depends on the specific career path and interests of the individual. Some individuals may even pursue both certifications to enhance their knowledge and marketability in the finance industry.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I get frm vs cfaeverything you?

It's simple with pdfFiller, a full online document management tool. Access our huge online form collection (over 25M fillable forms are accessible) and find the frm vs cfaeverything you in seconds. Open it immediately and begin modifying it with powerful editing options.

How do I edit frm vs cfaeverything you online?

The editing procedure is simple with pdfFiller. Open your frm vs cfaeverything you in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out frm vs cfaeverything you using my mobile device?

The pdfFiller mobile app makes it simple to design and fill out legal paperwork. Complete and sign frm vs cfaeverything you and other papers using the app. Visit pdfFiller's website to learn more about the PDF editor's features.

What is frm vs cfaeverything you?

FRM (Financial Risk Manager) is a certification that focuses on risk management, while CFA (Chartered Financial Analyst) involves a broader study of investment analysis and portfolio management.

Who is required to file frm vs cfaeverything you?

The FRM is primarily for professionals in risk management, while the CFA is intended for investment professionals. Filing requirements may vary based on regulatory obligations and career goals.

How to fill out frm vs cfaeverything you?

Filling out an FRM application typically involves providing personal information, proof of education, and work experience in finance. For the CFA, candidates must register online, submit required documents, and select exam dates.

What is the purpose of frm vs cfaeverything you?

The purpose of FRM is to provide expertise in risk management practices, while the CFA aims to develop a deep understanding of investment analysis and financial market operations.

What information must be reported on frm vs cfaeverything you?

On the FRM application, candidates must report education history, work experience in risk management, and any relevant professional certifications. The CFA requires reporting of academic qualifications and employment history.

Fill out your frm vs cfaeverything you online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Frm Vs Cfaeverything You is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.