Get the free Financial Statements

Show details

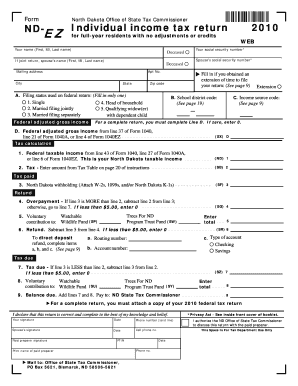

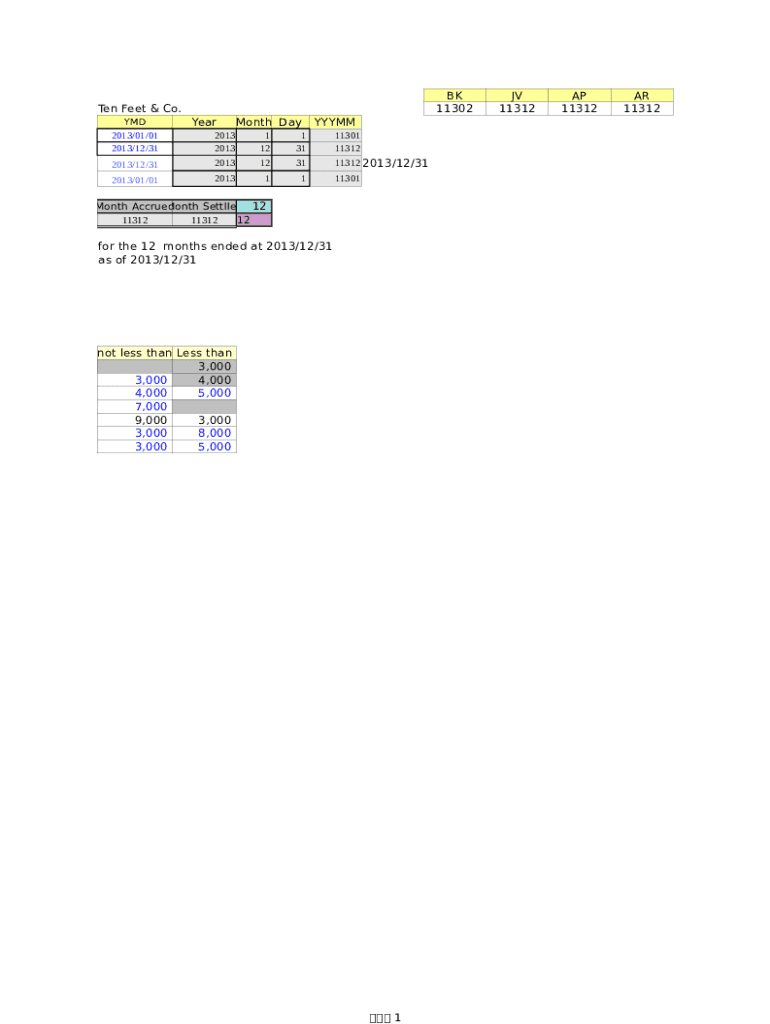

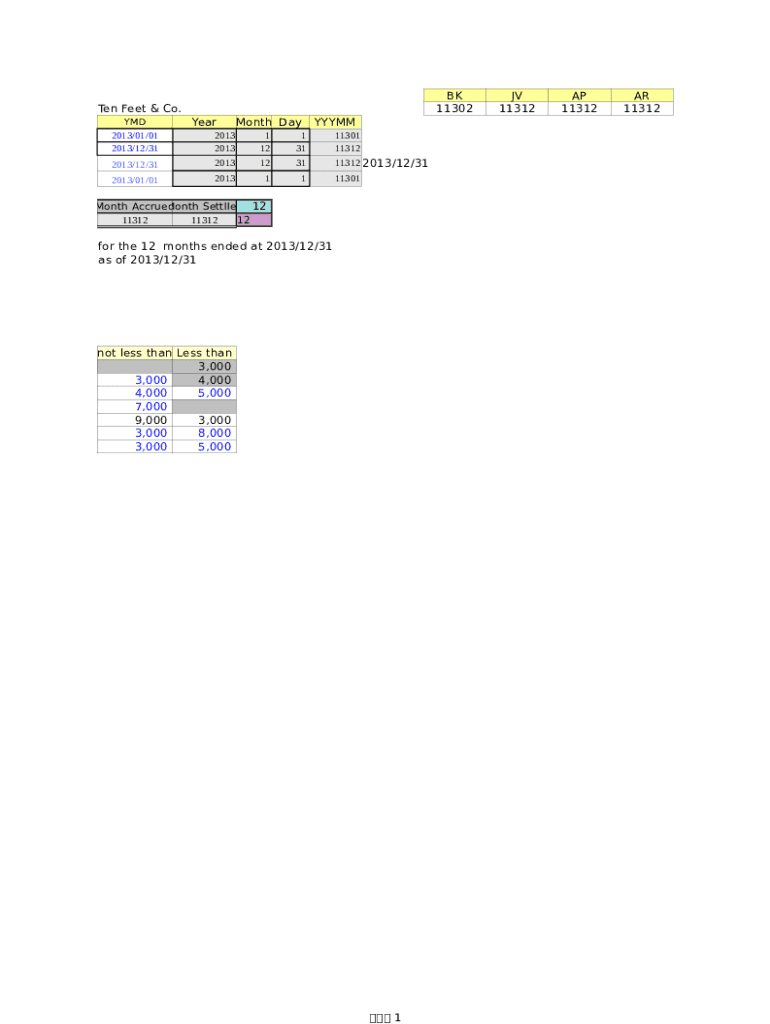

BK 11302Ten Feet & Co. YMDYearMonth DayYYYMM2013/01/01 2013/12/312013 20131 121 3111301 113122013/12/312013123111312 2013/12/312013/01/0120131111301Month Accrued Month Settled 12 11312 11312 12for

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign financial statements

Edit your financial statements form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your financial statements form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing financial statements online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit financial statements. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out financial statements

How to fill out financial statements

01

To fill out financial statements, follow these steps:

02

Start by gathering all relevant financial documents, such as bank statements, invoices, bills, and receipts.

03

Identify the different sections of the financial statement, which typically include the balance sheet, income statement, and cash flow statement.

04

Begin with the balance sheet, which provides a snapshot of the company's financial position at a specific point in time. Enter the assets, liabilities, and equity values carefully.

05

Proceed to the income statement, which shows the company's revenues, expenses, and net income or loss over a specific period. Enter the revenue and expense figures accurately.

06

Finally, complete the cash flow statement, which highlights the cash inflows and outflows during a given period. Record the cash from operating activities, investing activities, and financing activities accordingly.

07

Double-check the accuracy of all entries and calculations in the financial statements.

08

Review the completed financial statements for any inconsistencies or errors.

09

Consider seeking assistance from a professional accountant or financial advisor to ensure the accuracy and compliance of the financial statements.

10

Once satisfied with the accuracy, save and store the financial statements for future reference and reporting requirements.

Who needs financial statements?

01

Financial statements are essential for various individuals and entities, including:

02

- Business owners and managers who need to assess the financial performance and health of their company.

03

- Investors who are interested in evaluating the profitability and potential risks of investing in a particular company.

04

- Lenders and creditors who require financial statements to determine the creditworthiness of a business before extending loans or credit.

05

- Government agencies and regulatory bodies that use financial statements to ensure compliance with financial reporting standards and taxation requirements.

06

- Potential business partners or buyers who need to evaluate the financial stability and viability of a company before entering into a partnership or acquisition.

07

- Analysts and financial professionals who analyze financial statements to provide insights, recommendations, and forecasts for decision-making.

08

In summary, financial statements are crucial for making informed business decisions, attracting investments and loans, complying with regulations, and facilitating financial analysis.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify financial statements without leaving Google Drive?

By combining pdfFiller with Google Docs, you can generate fillable forms directly in Google Drive. No need to leave Google Drive to make edits or sign documents, including financial statements. Use pdfFiller's features in Google Drive to handle documents on any internet-connected device.

Can I create an electronic signature for signing my financial statements in Gmail?

You can easily create your eSignature with pdfFiller and then eSign your financial statements directly from your inbox with the help of pdfFiller’s add-on for Gmail. Please note that you must register for an account in order to save your signatures and signed documents.

How do I edit financial statements on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign financial statements right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

What is financial statements?

Financial statements are formal records of the financial activities and position of a business, organization, or individual. They provide a summary of the financial performance and the financial position at a specific point in time.

Who is required to file financial statements?

Corporations, limited liability companies (LLCs), and partnerships are typically required to file financial statements, particularly if they are publicly traded or have significant revenue. Nonprofit organizations also need to file financial statements.

How to fill out financial statements?

To fill out financial statements, gather all necessary financial data, categorize revenues and expenses, and ensure accurate calculations. Use standard formats such as the balance sheet, income statement, and cash flow statement, following applicable accounting standards.

What is the purpose of financial statements?

The purpose of financial statements is to provide stakeholders (including management, investors, creditors, and regulatory authorities) with a clear view of the entity's financial performance and position to facilitate informed decision-making.

What information must be reported on financial statements?

Financial statements must report key information such as assets, liabilities, equity, revenues, expenses, and cash flows. They often include notes that provide additional context and detail regarding accounting policies and specific line items.

Fill out your financial statements online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Financial Statements is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.