Get the free Accounting Services for Research Sponsored Programs

Show details

Charging Sponsored Projects Allow ability GuideAccounting Services for Research Sponsored ProgramsWhen charging Federal sponsored projects, the costs must meet the criteria from the Uniform Guidance

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounting services for research

Edit your accounting services for research form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounting services for research form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit accounting services for research online

To use our professional PDF editor, follow these steps:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit accounting services for research. Add and change text, add new objects, move pages, add watermarks and page numbers, and more. Then click Done when you're done editing and go to the Documents tab to merge or split the file. If you want to lock or unlock the file, click the lock or unlock button.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounting services for research

How to fill out accounting services for research

01

Gather all the necessary financial documents related to the research project, such as receipts, invoices, and purchase orders.

02

Organize the documents by category and create a filing system for easy retrieval and reference.

03

Record all the financial transactions related to the research project in a comprehensive accounting software or spreadsheet.

04

Classify the expenses according to the relevant accounting codes and categories.

05

Reconcile the financial records with bank statements and other financial documents to ensure accuracy.

06

Prepare financial reports, such as income statements and balance sheets, specifically for the research project.

07

Perform regular audits and reviews of the financial records to identify any discrepancies or errors.

08

Ensure compliance with relevant tax laws and regulations pertaining to research expenses.

09

Seek professional advice or consult with a certified accountant specializing in research accounting if needed.

Who needs accounting services for research?

01

Academic institutions and universities conducting research projects funded by grants or other funding sources.

02

Research organizations and institutes involved in scientific or technological studies.

03

Private companies or startups engaged in research and development activities.

04

Non-profit organizations conducting research for social or humanitarian purposes.

05

Government agencies or departments involved in research initiatives.

06

Individuals or groups undertaking personal research projects that require financial tracking and reporting.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit accounting services for research in Chrome?

accounting services for research can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

Can I create an eSignature for the accounting services for research in Gmail?

When you use pdfFiller's add-on for Gmail, you can add or type a signature. You can also draw a signature. pdfFiller lets you eSign your accounting services for research and other documents right from your email. In order to keep signed documents and your own signatures, you need to sign up for an account.

How do I fill out the accounting services for research form on my smartphone?

You can easily create and fill out legal forms with the help of the pdfFiller mobile app. Complete and sign accounting services for research and other documents on your mobile device using the application. Visit pdfFiller’s webpage to learn more about the functionalities of the PDF editor.

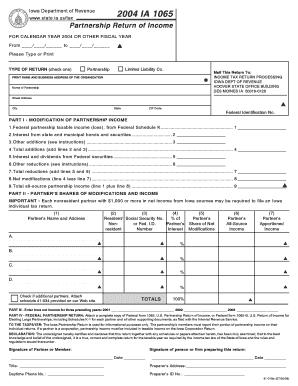

What is accounting services for research?

Accounting services for research refer to the financial management and reporting practices associated with research projects, ensuring that funding is properly allocated, expenses are tracked, and compliance with financial regulations is maintained.

Who is required to file accounting services for research?

Researchers, academic institutions, and organizations that receive funding for research projects are typically required to file accounting services for research to demonstrate proper use of funds and compliance with funding agreements.

How to fill out accounting services for research?

Filling out accounting services for research usually involves collecting financial data related to the project, categorizing expenses, completing necessary forms as per funding agency guidelines, and submitting supporting documentation, such as invoices and receipts.

What is the purpose of accounting services for research?

The purpose of accounting services for research is to ensure transparency and accountability in the use of research funds, facilitate accurate financial reporting, and comply with both internal and external regulatory requirements.

What information must be reported on accounting services for research?

Information that must be reported typically includes budget expenditures, funding sources, project-related income, any financial discrepancies, and compliance with grant or contract terms.

Fill out your accounting services for research online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounting Services For Research is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.