Get the free Tax Credit Projects

Show details

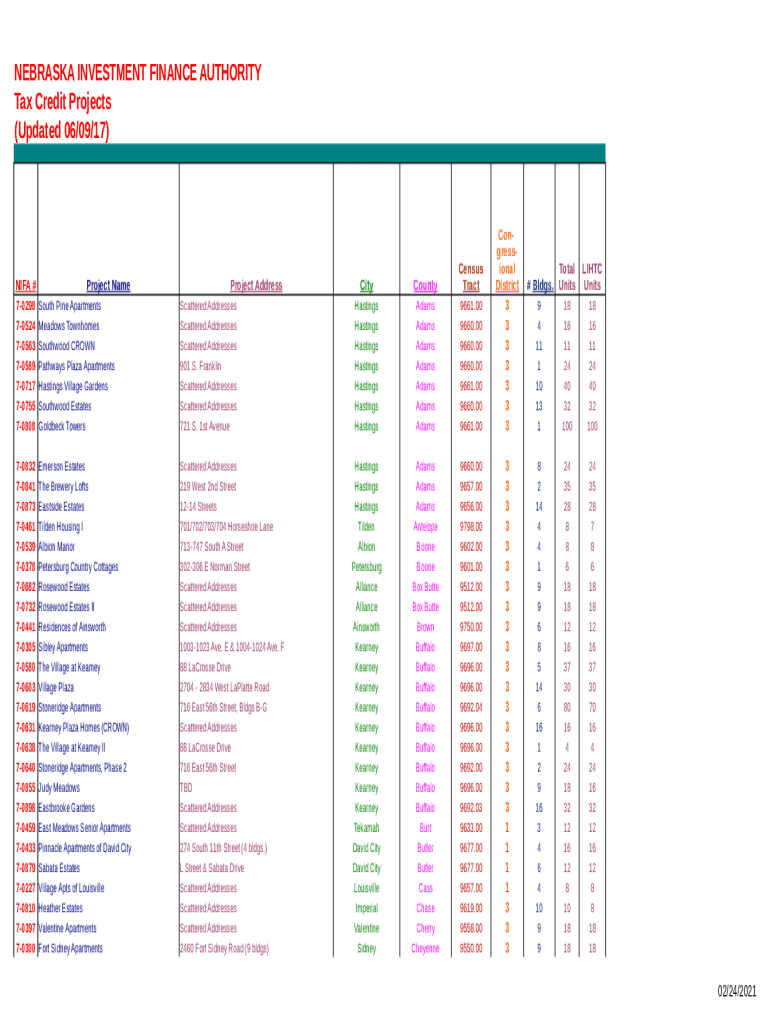

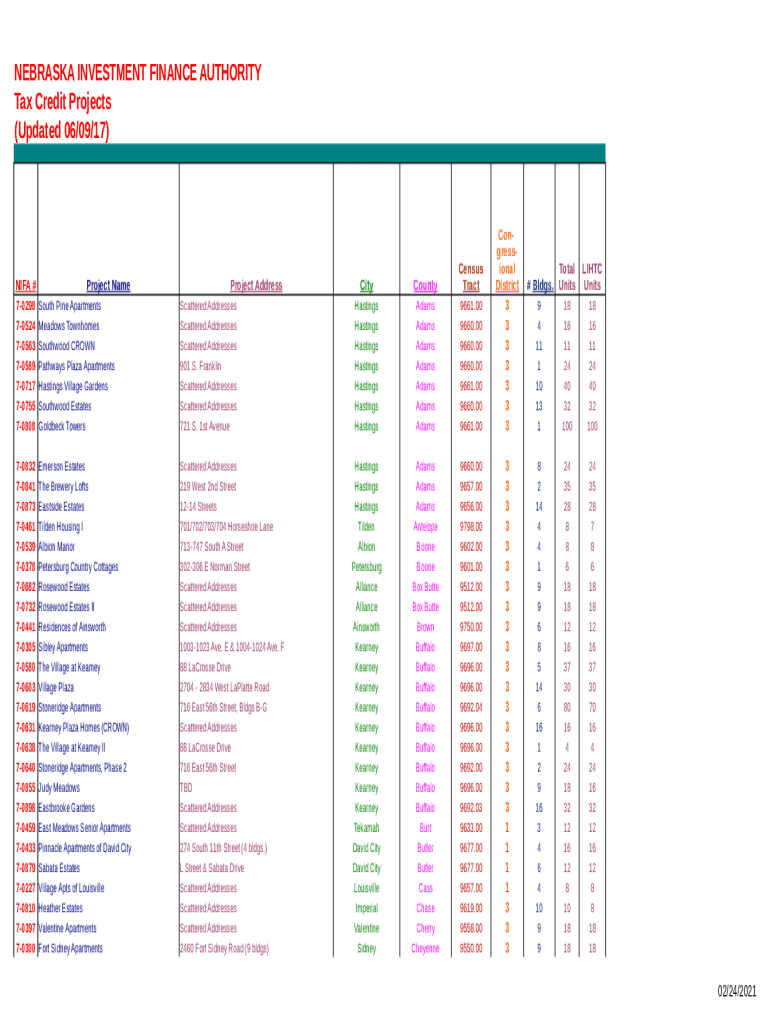

NEBRASKA INVESTMENT FINANCE AUTHORITY

Tax Credit Projects

(Updated 06/09/17)FIFA #Project NameProject Address70298

70524

70563

70589

70717

70755

70808South Pine Apartments

Meadows Town homes

South

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign tax credit projects

Edit your tax credit projects form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your tax credit projects form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit tax credit projects online

Use the instructions below to start using our professional PDF editor:

1

Log in. Click Start Free Trial and create a profile if necessary.

2

Upload a document. Select Add New on your Dashboard and transfer a file into the system in one of the following ways: by uploading it from your device or importing from the cloud, web, or internal mail. Then, click Start editing.

3

Edit tax credit projects. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. You can sign up for an account to see for yourself.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out tax credit projects

How to fill out tax credit projects

01

To fill out tax credit projects, follow these steps:

02

Gather all the necessary documents and information such as income statements, expenses, and any applicable tax credits.

03

Understand the requirements and eligibility criteria for the specific tax credit project you are applying for.

04

Complete the application form accurately and provide all requested information.

05

Double-check all the information and calculations to ensure accuracy.

06

Attach any required supporting documents and ensure they are properly organized.

07

Submit the completed tax credit project application along with all the required documents according to the designated submission method.

08

Keep copies of all the submitted documents for your records.

09

Follow up with any additional requests or inquiries from the tax credit project administrators.

10

Wait for the review and evaluation process to be completed.

11

If approved, make sure to comply with any further obligations or reporting requirements outlined by the tax credit project.

Who needs tax credit projects?

01

Tax credit projects are beneficial for various individuals and entities, including:

02

- Businesses seeking to reduce their tax liability and increase profitability.

03

- Non-profit organizations looking for incentives to support their projects or activities.

04

- Individuals or families with specific circumstances that qualify them for tax credits, such as low-income households or those with certain expenses (e.g., education, healthcare, energy-related).

05

- Real estate developers or investors interested in affordable housing or historic preservation projects.

06

- State or local governments aiming to promote economic development or stimulate specific industries.

07

- Renewable energy companies seeking financial support and incentives for clean energy projects.

08

Overall, tax credit projects are designed to provide incentives for specific activities or investments that contribute to economic growth, social welfare, or environmental sustainability.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I manage my tax credit projects directly from Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your tax credit projects as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How do I edit tax credit projects in Chrome?

tax credit projects can be edited, filled out, and signed with the pdfFiller Google Chrome Extension. You can open the editor right from a Google search page with just one click. Fillable documents can be done on any web-connected device without leaving Chrome.

How can I edit tax credit projects on a smartphone?

Using pdfFiller's mobile-native applications for iOS and Android is the simplest method to edit documents on a mobile device. You may get them from the Apple App Store and Google Play, respectively. More information on the apps may be found here. Install the program and log in to begin editing tax credit projects.

What is tax credit projects?

Tax credit projects are initiatives or investments that qualify for tax credits, which reduce the tax liability of individuals or businesses by the amount of the credit received.

Who is required to file tax credit projects?

Individuals or businesses that participate in qualifying projects or programs that offer tax credits must file tax credit projects to claim the credits.

How to fill out tax credit projects?

To fill out tax credit projects, participants should gather necessary documentation, follow the guidelines provided for the specific tax credit program, and complete the required forms accurately, ensuring all information is correct.

What is the purpose of tax credit projects?

The purpose of tax credit projects is to incentivize certain behaviors or investments, such as those related to environmental sustainability, affordable housing, or economic development, by providing tax relief to participants.

What information must be reported on tax credit projects?

Information that must be reported includes the nature of the project, expenses incurred, income generated, and any other relevant details that demonstrate compliance with the tax credit program requirements.

Fill out your tax credit projects online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Tax Credit Projects is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.