Get the free Revenue Accounting - comptroller nyc

Show details

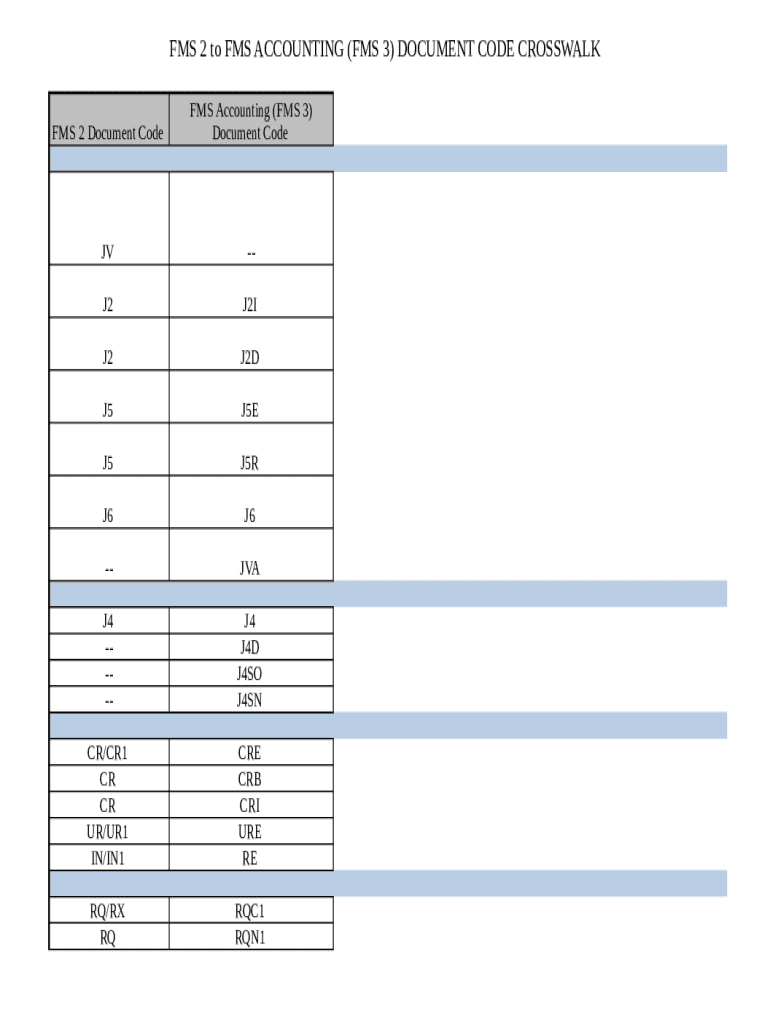

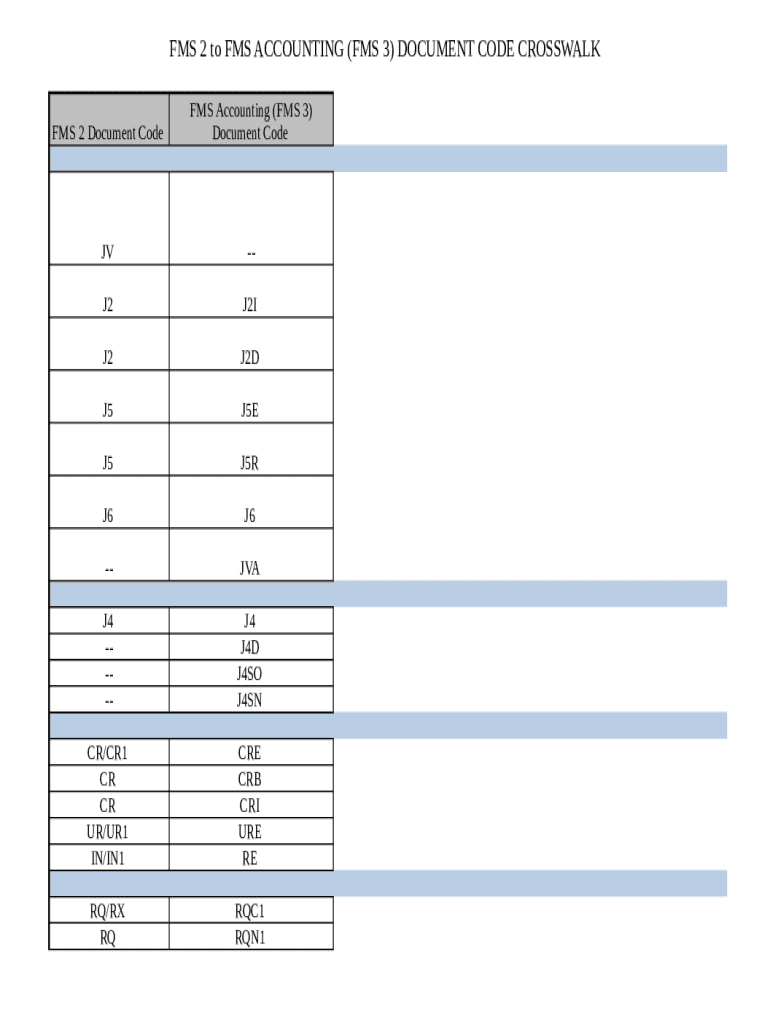

FMS 2 to FMS ACCOUNTING (FMS 3) DOCUMENT CODE CROSSWALK FMS 2 Document Code FMS Accounting (FMS 3)

Document Code

Non Payroll Journal VouchersJVJ2J2IJ2J2DJ5J5EJ5J5RJ6J6JVA

Payroll Journal VouchersJ4

J4

J4D

J4SO

J4SN

Revenue

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign revenue accounting - comptroller

Edit your revenue accounting - comptroller form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your revenue accounting - comptroller form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit revenue accounting - comptroller online

Use the instructions below to start using our professional PDF editor:

1

Sign into your account. It's time to start your free trial.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit revenue accounting - comptroller. Rearrange and rotate pages, add and edit text, and use additional tools. To save changes and return to your Dashboard, click Done. The Documents tab allows you to merge, divide, lock, or unlock files.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

It's easier to work with documents with pdfFiller than you could have believed. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out revenue accounting - comptroller

How to fill out revenue accounting

01

Gather all relevant financial data, such as sales records, invoices, and receipts.

02

Identify the different revenue streams, such as product sales, service sales, and rental income.

03

Classify each revenue transaction according to the appropriate accounting standards and guidelines.

04

Record the revenue transactions in the appropriate accounts, such as sales revenue, rental revenue, or service revenue.

05

Calculate any applicable taxes or fees that need to be included in the revenue accounting.

06

Verify the accuracy and completeness of the revenue accounting records.

07

Prepare financial statements, such as the income statement, that reflect the revenue earned during a specific period.

08

Perform regular reconciliations to ensure that the revenue recorded in the accounting system matches with the actual revenue received.

09

Keep track of any adjustments or corrections that need to be made to the revenue accounting records.

10

Stay updated with the latest accounting regulations and practices related to revenue recognition.

Who needs revenue accounting?

01

Revenue accounting is needed by businesses of all sizes and industries.

02

It is particularly important for companies that generate revenue from sales of products, provision of services, or rental of assets.

03

Accountants and financial professionals within an organization are primarily responsible for revenue accounting.

04

Revenue accounting is vital for proper financial reporting, tax compliance, and decision-making.

05

External stakeholders, such as investors, lenders, and regulatory bodies, also rely on accurate revenue accounting information.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I modify revenue accounting - comptroller without leaving Google Drive?

Using pdfFiller with Google Docs allows you to create, amend, and sign documents straight from your Google Drive. The add-on turns your revenue accounting - comptroller into a dynamic fillable form that you can manage and eSign from anywhere.

How do I edit revenue accounting - comptroller online?

The editing procedure is simple with pdfFiller. Open your revenue accounting - comptroller in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

How do I fill out revenue accounting - comptroller using my mobile device?

Use the pdfFiller mobile app to fill out and sign revenue accounting - comptroller. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is revenue accounting?

Revenue accounting is the process of recording, classifying, and reporting revenue transactions to ensure that an organization's revenue is accurately represented in its financial statements.

Who is required to file revenue accounting?

Typically, businesses and organizations that generate revenue must file revenue accounting to comply with legal and tax obligations. This includes corporations, partnerships, and self-employed individuals.

How to fill out revenue accounting?

Filling out revenue accounting involves gathering all revenue transactions, categorizing them according to the relevant accounting standards, and reporting them on the designated forms or financial statements.

What is the purpose of revenue accounting?

The purpose of revenue accounting is to accurately reflect the revenue earned by an organization, ensure compliance with financial reporting standards, and support decision-making processes by providing stakeholders with relevant financial information.

What information must be reported on revenue accounting?

Revenue accounting must report total revenue earned, types of revenue (e.g., sales, services), date of transactions, and any discounts or allowances applied. It should also detail payment terms and the method of revenue recognition.

Fill out your revenue accounting - comptroller online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Revenue Accounting - Comptroller is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.