Get the free Market Tax Credits (LMI Areas)

Show details

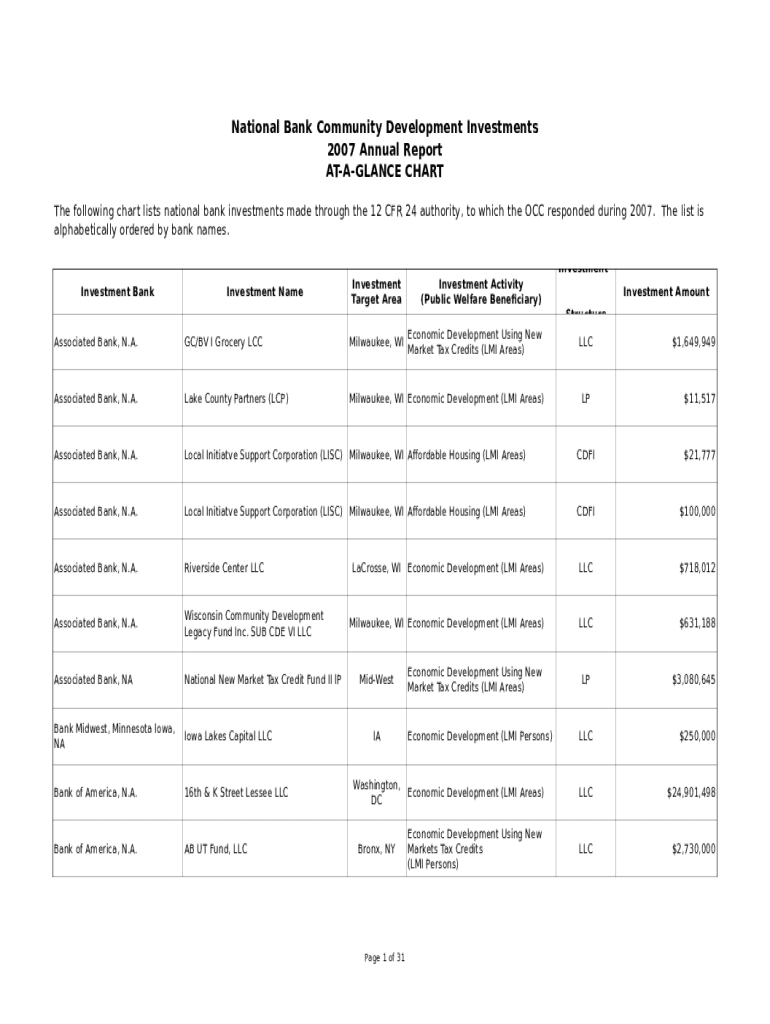

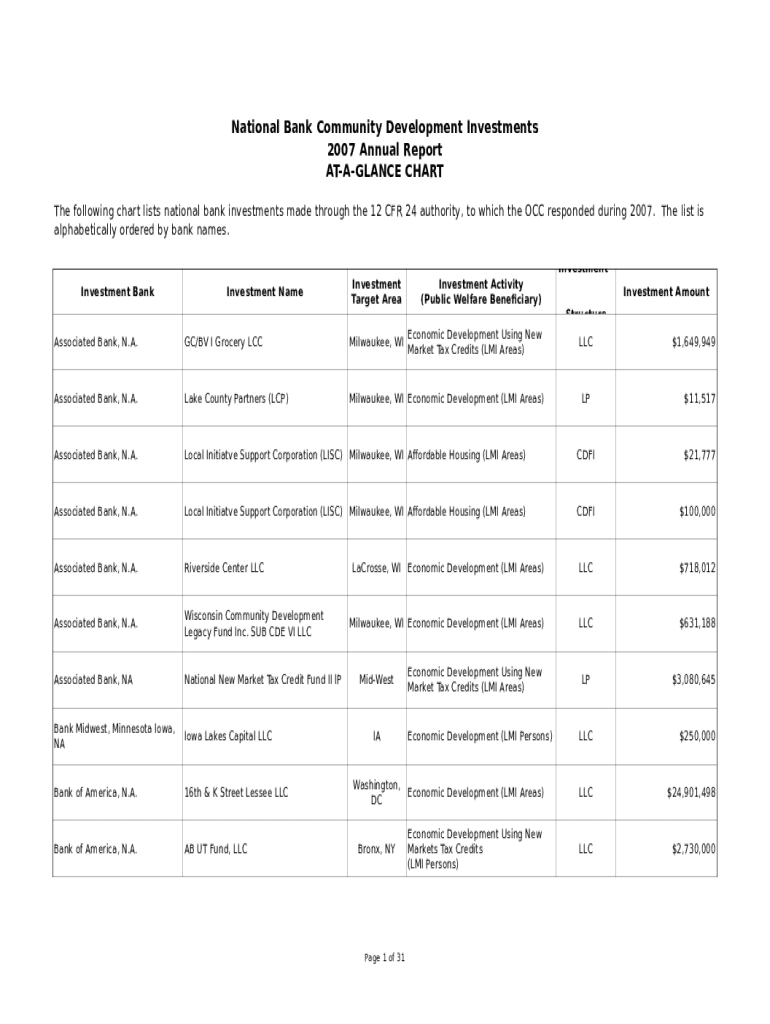

National Bank Community Development Investments

2007 Annual Report

BALANCE CHART

The following chart lists national bank investments made through the 12 CFR 24 authority, to which the OCC responded

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign market tax credits lmi

Edit your market tax credits lmi form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your market tax credits lmi form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit market tax credits lmi online

To use our professional PDF editor, follow these steps:

1

Log in to account. Click Start Free Trial and register a profile if you don't have one yet.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit market tax credits lmi. Add and replace text, insert new objects, rearrange pages, add watermarks and page numbers, and more. Click Done when you are finished editing and go to the Documents tab to merge, split, lock or unlock the file.

4

Get your file. Select your file from the documents list and pick your export method. You may save it as a PDF, email it, or upload it to the cloud.

With pdfFiller, it's always easy to deal with documents.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out market tax credits lmi

How to fill out market tax credits lmi

01

To fill out market tax credits LMI, follow these steps:

1. Obtain the necessary forms and documents from your local tax authority or online.

02

Gather all required information and supporting documents, such as proof of income and residency.

03

Carefully read through the instructions and guidelines provided with the forms to ensure you understand the eligibility criteria and requirements.

04

Fill out the forms accurately and completely, providing all requested information.

05

Double-check all the information before submitting the forms to avoid any mistakes or omissions.

06

Attach the supporting documents as specified in the instructions.

07

Submit the completed forms and documents to the designated tax authority.

08

Wait for the tax authority to review your application and process your market tax credits LMI.

09

If approved, you may receive the tax credits as financial assistance or reduced tax liability.

10

Follow up with the tax authority if you have any questions or concerns regarding your application status or benefits.

Who needs market tax credits lmi?

01

Individuals or families with low to moderate income (LMI) who meet the eligibility criteria can benefit from market tax credits LMI.

02

These credits are designed to provide financial assistance or reduce tax liability for individuals or households struggling with limited income.

03

People who qualify for market tax credits LMI can use them to offset their tax burden or receive direct financial aid.

04

The eligibility requirements and income thresholds vary by jurisdiction, so it is important to check the specific guidelines provided by your local tax authority.

05

Overall, market tax credits LMI aim to support those who have lower incomes and make it easier for them to meet their financial obligations.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit market tax credits lmi in Chrome?

Add pdfFiller Google Chrome Extension to your web browser to start editing market tax credits lmi and other documents directly from a Google search page. The service allows you to make changes in your documents when viewing them in Chrome. Create fillable documents and edit existing PDFs from any internet-connected device with pdfFiller.

How do I edit market tax credits lmi on an iOS device?

You certainly can. You can quickly edit, distribute, and sign market tax credits lmi on your iOS device with the pdfFiller mobile app. Purchase it from the Apple Store and install it in seconds. The program is free, but in order to purchase a subscription or activate a free trial, you must first establish an account.

Can I edit market tax credits lmi on an Android device?

You can. With the pdfFiller Android app, you can edit, sign, and distribute market tax credits lmi from anywhere with an internet connection. Take use of the app's mobile capabilities.

What is market tax credits lmi?

Market tax credits LMI refers to the Low-Income Housing Tax Credit program, which provides tax incentives for investments in affordable housing projects in low-income areas.

Who is required to file market tax credits lmi?

Entities that receive Low-Income Housing Tax Credits and wish to claim tax benefits must file the appropriate forms related to market tax credits LMI.

How to fill out market tax credits lmi?

Filling out market tax credits LMI typically involves submitting specific IRS forms, providing detailed project information, and ensuring all eligibility criteria are met.

What is the purpose of market tax credits lmi?

The purpose of market tax credits LMI is to promote investment in affordable housing projects, helping to stimulate economic growth and improve living conditions in low-income neighborhoods.

What information must be reported on market tax credits lmi?

Information such as project details, cost breakdown, compliance with income restrictions, and tenant eligibility must be reported on market tax credits LMI.

Fill out your market tax credits lmi online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Market Tax Credits Lmi is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.