Get the free Accepts Deposits (revenue) - finance fiu

Show details

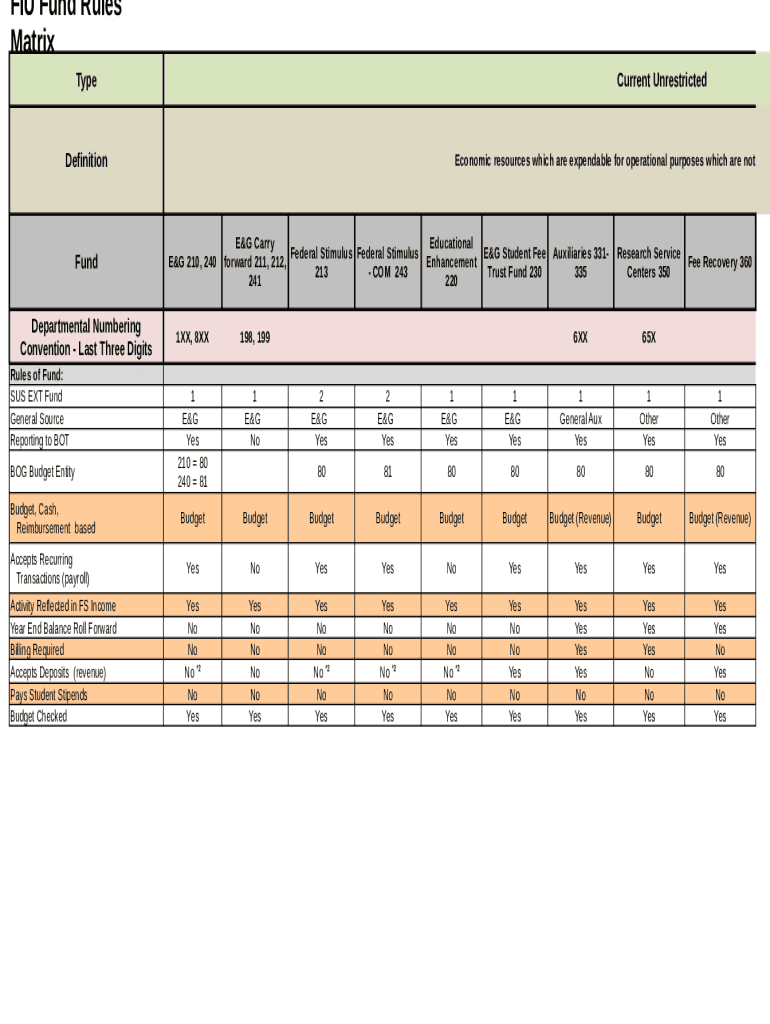

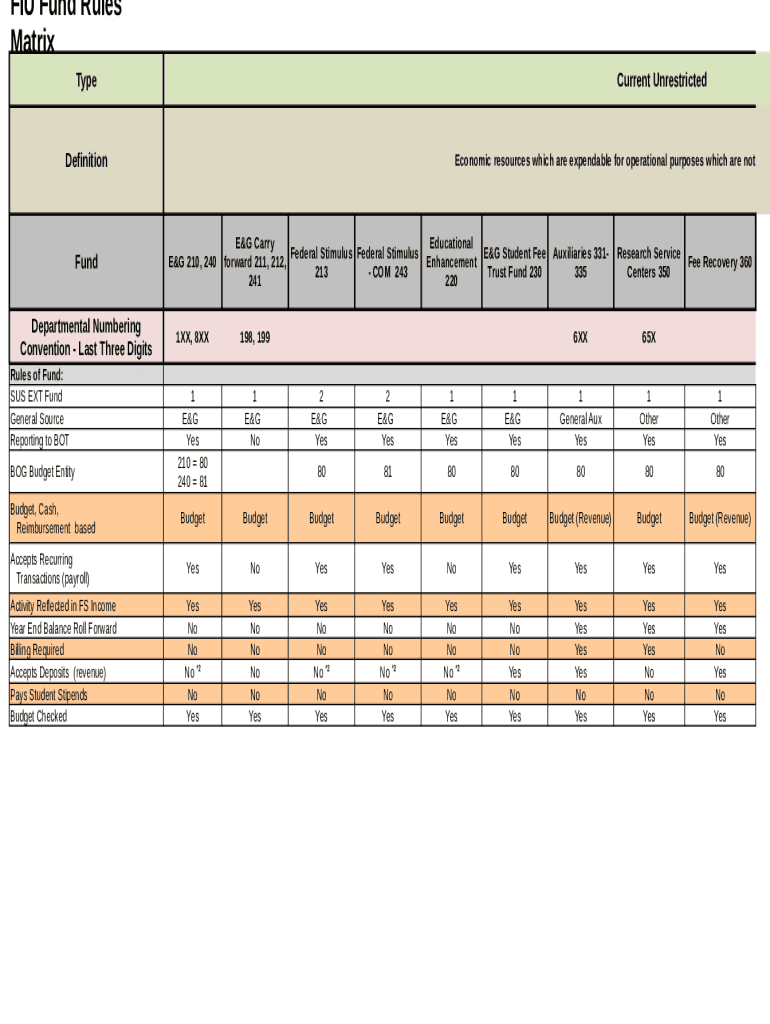

FIU Fund Rules Matrix 02/23/202118:50:45TypeCurrent UnrestrictedDefinitionFund Departmental Numbering Convention Last Three DigitsEconomic resources which are expendable for operational purposes which

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accepts deposits revenue

Edit your accepts deposits revenue form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accepts deposits revenue form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accepts deposits revenue online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit accepts deposits revenue. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

With pdfFiller, it's always easy to deal with documents. Try it right now

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accepts deposits revenue

How to fill out accepts deposits revenue

01

Gather all necessary financial information, including the amounts of deposits and the sources of revenue.

02

Determine the appropriate accounting method for recording deposits and revenue. This may involve using cash basis accounting or accrual basis accounting.

03

Create a journal entry to record the deposits received. Debit the cash account to reflect the increase in assets and credit the deposit account to show the liability owed to the customers.

04

Record the revenue earned from the deposits. Debit the deposit account to reduce the liability and credit the revenue account to recognize the increase in income.

05

Review and reconcile the deposit and revenue accounts regularly to ensure accuracy and make any necessary adjustments.

06

Prepare financial statements and reports that include the deposits received and the related revenue.

07

Follow any applicable legal and regulatory requirements for reporting deposits and revenue, such as those set forth by the International Financial Reporting Standards (IFRS) or Generally Accepted Accounting Principles (GAAP).

Who needs accepts deposits revenue?

01

Businesses that accept deposits from customers or clients need to record and track the revenue generated from those deposits.

02

Financial institutions, such as banks or credit unions, that receive deposits from account holders also need to track the revenue earned from those deposits.

03

Government agencies or organizations that collect deposits as part of their operations, such as security deposits from tenants or service fees, also need to account for the revenue generated from those deposits.

04

Non-profit organizations that receive donations or grants in the form of deposits may also need to record and report the related revenue.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I make edits in accepts deposits revenue without leaving Chrome?

Download and install the pdfFiller Google Chrome Extension to your browser to edit, fill out, and eSign your accepts deposits revenue, which you can open in the editor with a single click from a Google search page. Fillable documents may be executed from any internet-connected device without leaving Chrome.

Can I edit accepts deposits revenue on an iOS device?

No, you can't. With the pdfFiller app for iOS, you can edit, share, and sign accepts deposits revenue right away. At the Apple Store, you can buy and install it in a matter of seconds. The app is free, but you will need to set up an account if you want to buy a subscription or start a free trial.

How can I fill out accepts deposits revenue on an iOS device?

Install the pdfFiller app on your iOS device to fill out papers. If you have a subscription to the service, create an account or log in to an existing one. After completing the registration process, upload your accepts deposits revenue. You may now use pdfFiller's advanced features, such as adding fillable fields and eSigning documents, and accessing them from any device, wherever you are.

What is accepts deposits revenue?

Accepts deposits revenue refers to the income generated by financial institutions through accepting deposits from customers. This includes interest earned on deposits and any applicable fees.

Who is required to file accepts deposits revenue?

Financial institutions such as banks, credit unions, and other entities that accept deposits are required to file accepts deposits revenue.

How to fill out accepts deposits revenue?

To fill out accepts deposits revenue, institutions must gather their total deposit income, deduct any necessary expenses, and report the net revenue on the appropriate financial forms or tax filings.

What is the purpose of accepts deposits revenue?

The purpose of accepts deposits revenue is to provide a clear understanding of the income generated from deposits for financial reporting, taxation, and performance evaluation purposes.

What information must be reported on accepts deposits revenue?

Institutions must report total deposits accepted, interest earned, fees charged, and net revenue from these activities on the accepts deposits revenue form.

Fill out your accepts deposits revenue online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accepts Deposits Revenue is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.