Get the free Invoice Date & Tax Point:

Show details

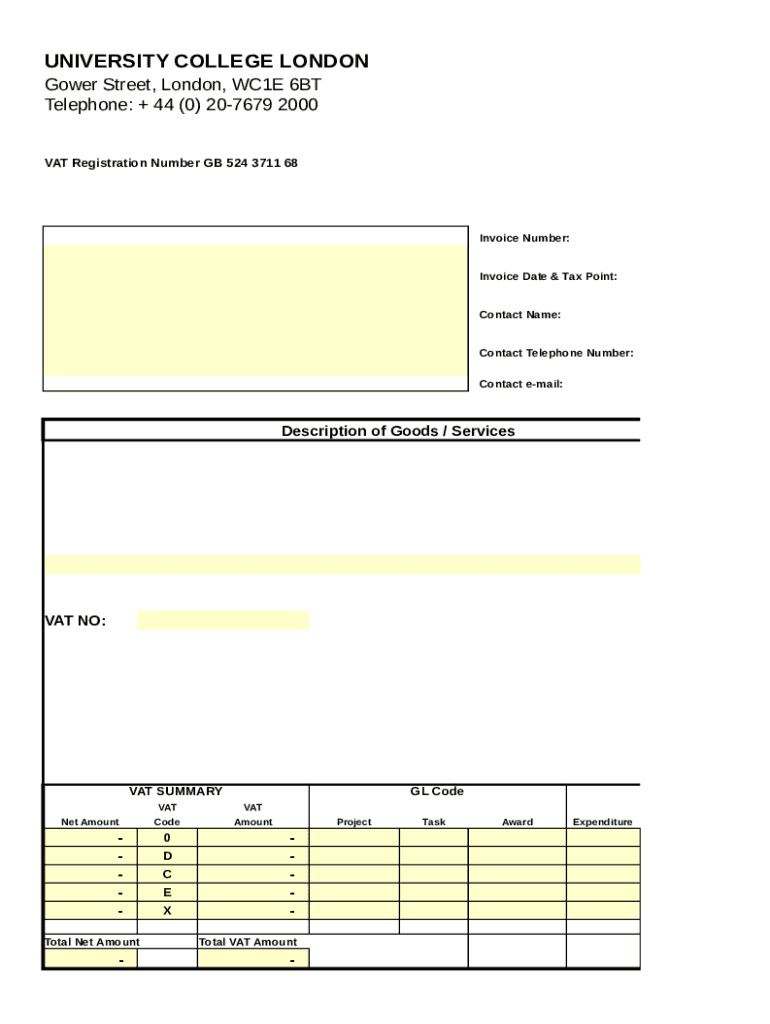

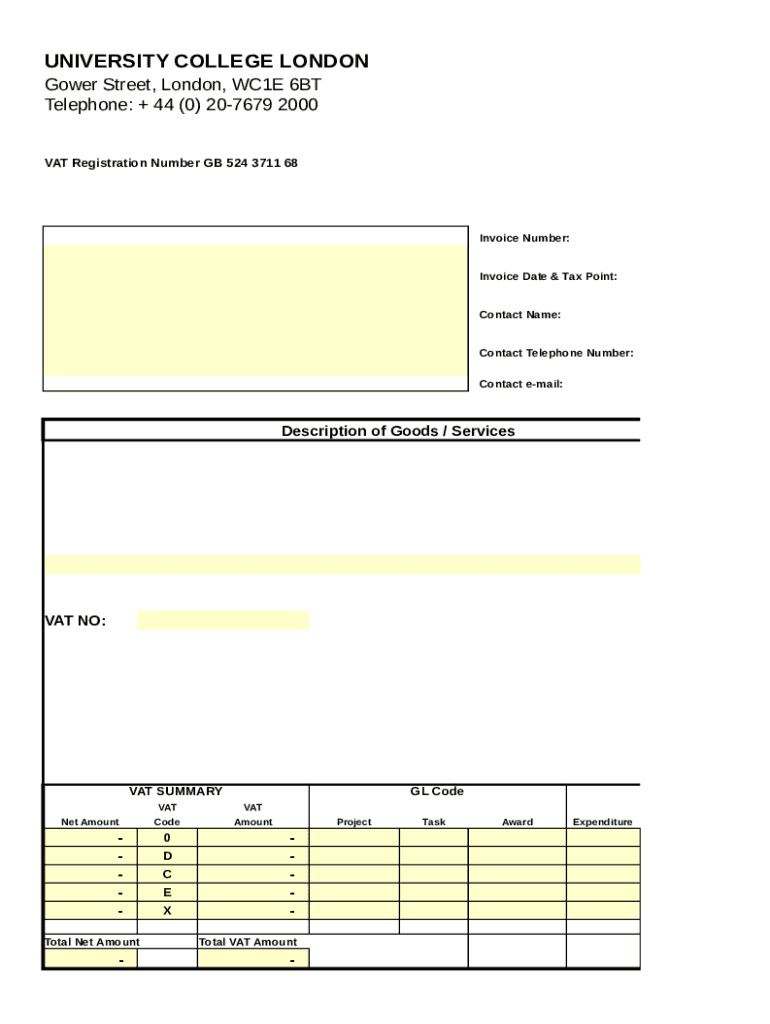

UNIVERSITY COLLEGE LONDON Power Street, London, WC1E 6BT Telephone: + 44 (0) 207679 2000 VAT Registration Number GB 524 3711 68Invoice Number: Invoice Date & Tax Point: Contact Name: Contact Telephone

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign invoice date amp tax

Edit your invoice date amp tax form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your invoice date amp tax form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit invoice date amp tax online

Use the instructions below to start using our professional PDF editor:

1

Log in to account. Start Free Trial and register a profile if you don't have one.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit invoice date amp tax. Replace text, adding objects, rearranging pages, and more. Then select the Documents tab to combine, divide, lock or unlock the file.

4

Save your file. Select it from your list of records. Then, move your cursor to the right toolbar and choose one of the exporting options. You can save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud, among other things.

It's easier to work with documents with pdfFiller than you could have ever thought. Sign up for a free account to view.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out invoice date amp tax

How to fill out invoice date amp tax

01

Start by finding the invoice template or form that you will be using. This can be a printable form or an online template.

02

Locate the fields designated for 'Invoice Date' and 'Tax'. These fields are usually found near the top of the invoice form.

03

For the 'Invoice Date' field, enter the date on which the invoice is issued. This is usually the current date unless you are backdating the invoice for some reason.

04

For the 'Tax' field, enter the applicable tax rate or amount. Make sure to specify whether it is a percentage or a fixed amount.

05

Some invoice templates may have additional instructions or guidelines for filling out the 'Invoice Date' and 'Tax' fields. If so, follow those instructions accordingly.

06

Double-check the accuracy of the filled-out information before finalizing the invoice. Ensure that the 'Invoice Date' is correct and that the 'Tax' amount is accurate.

07

Save or print the completed invoice as necessary.

08

If you need to send the invoice electronically, consider saving it as a PDF or other compatible file format.

Who needs invoice date amp tax?

01

Anyone or any business entity that provides goods or services and expects payment for them needs to include the 'Invoice Date' and 'Tax' on their invoices.

02

This includes freelancers, small business owners, service providers, retailers, wholesalers, and virtually any individual or organization engaged in commercial transactions.

03

Including the 'Invoice Date' helps both the seller and the buyer keep track of when the transaction took place and when payment is due.

04

Including the 'Tax' information is crucial for tax compliance purposes, as it ensures that the appropriate taxes are levied and collected on the transaction.

05

Overall, including the 'Invoice Date' and 'Tax' on invoices is essential for accurate record-keeping, legal compliance, and proper financial management.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I complete invoice date amp tax online?

Easy online invoice date amp tax completion using pdfFiller. Also, it allows you to legally eSign your form and change original PDF material. Create a free account and manage documents online.

How do I edit invoice date amp tax in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing invoice date amp tax and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

How do I complete invoice date amp tax on an Android device?

Use the pdfFiller app for Android to finish your invoice date amp tax. The application lets you do all the things you need to do with documents, like add, edit, and remove text, sign, annotate, and more. There is nothing else you need except your smartphone and an internet connection to do this.

What is invoice date amp tax?

The invoice date is the date when a sales invoice is issued, and tax refers to the mandatory financial charge imposed by the government on goods and services. It is essential for accounting and tax reporting.

Who is required to file invoice date amp tax?

Businesses and individuals that engage in taxable transactions or sales are required to file invoice date and related taxes in accordance with local tax laws.

How to fill out invoice date amp tax?

To fill out invoice date and tax, include the invoice date, a description of the goods/services provided, the total amount charged, and the applicable sales tax or VAT, as required by local regulations.

What is the purpose of invoice date amp tax?

The purpose of invoice date and tax is to record sales transactions for accounting purposes, help businesses manage their income and expenses, and ensure compliance with tax regulations.

What information must be reported on invoice date amp tax?

Information that must be reported includes the seller's and buyer's details, invoice number, date of sale, description of products/services, total amount, and calculated taxes.

Fill out your invoice date amp tax online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Invoice Date Amp Tax is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.