Get the free Accounting Services

Show details

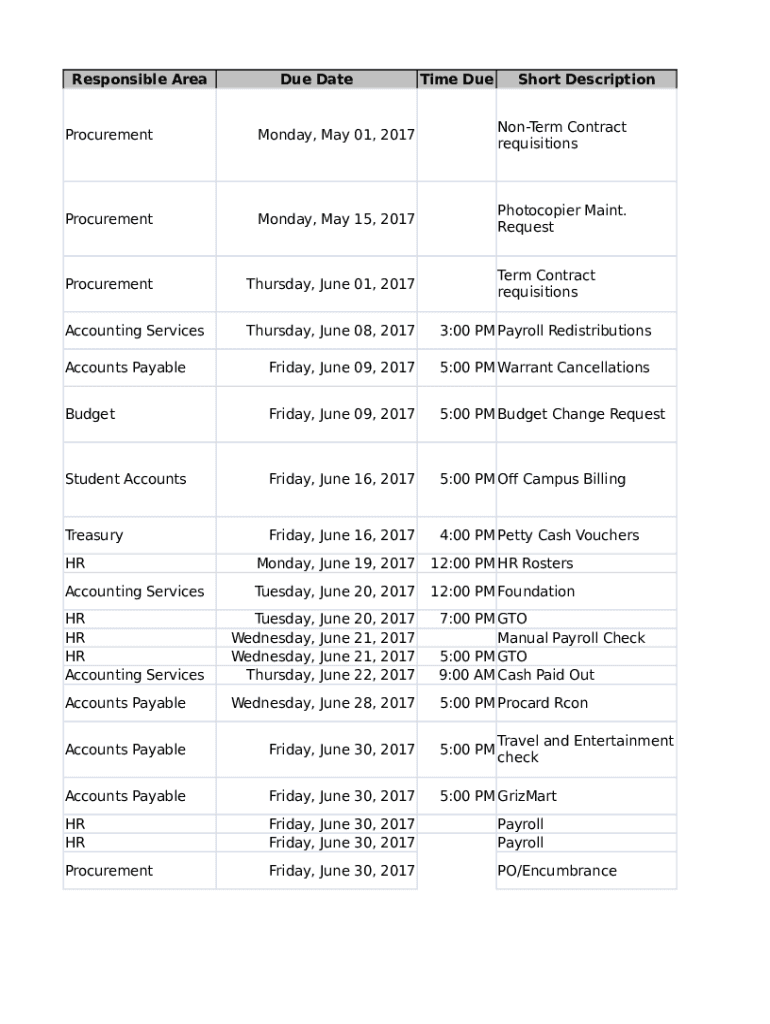

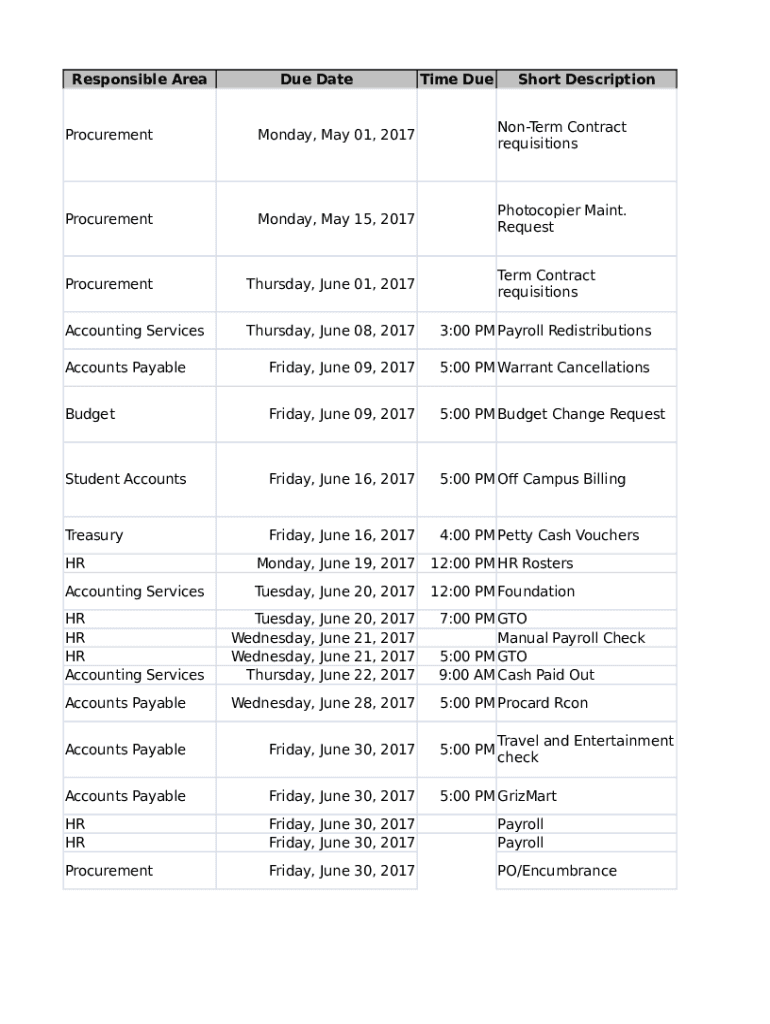

Responsible Arcade Daytime Due Short DescriptionProcurementMonday, May 01, 2017NonTerm Contract

requisitionsProcurementMonday, May 15, 2017Photocopier Main.

RequestProcurementThursday, June 01, 2017Term

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign accounting services

Edit your accounting services form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your accounting services form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing accounting services online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Upload a file. Select Add New on your Dashboard and upload a file from your device or import it from the cloud, online, or internal mail. Then click Edit.

3

Edit accounting services. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Select it in the list of your records. Then, move the cursor to the right toolbar and choose one of the available exporting methods: save it in multiple formats, download it as a PDF, send it by email, or store it in the cloud.

pdfFiller makes dealing with documents a breeze. Create an account to find out!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out accounting services

How to fill out accounting services

01

Gather all the necessary financial documents such as income statements, balance sheets, and cash flow statements.

02

Identify and record all financial transactions accurately, including revenues, expenses, assets, and liabilities.

03

Organize and maintain proper documentation of all financial records and supporting documents.

04

Use accounting software or spreadsheets to enter and track financial data.

05

Reconcile bank statements and other financial statements to ensure accuracy and identify any discrepancies.

06

Prepare financial reports such as profit and loss statements, tax returns, and financial forecasts.

07

Analyze and interpret financial data to provide insights and recommendations for improving financial performance.

08

Follow all relevant accounting principles and regulations to ensure compliance with legal and regulatory requirements.

09

Consult with a professional accountant or bookkeeper if needed for complex or specialized accounting tasks.

10

Review and verify all financial information before submitting it to stakeholders or authorities.

Who needs accounting services?

01

Businesses of all sizes require accounting services to accurately record and manage their financial transactions.

02

Individuals who have complex financial situations or investments may also need accounting services to ensure proper tax planning and compliance.

03

Non-profit organizations and government agencies need accounting services to track and report their financial activities.

04

Startups and entrepreneurs often lack the expertise or time to handle their own accounting and rely on professional services.

05

Companies seeking investment or financing rely on accounting services to provide accurate and transparent financial information to potential investors or lenders.

06

Any individual or organization that wants to maintain a clear and organized record of their financial activities can benefit from accounting services.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit accounting services in Chrome?

Install the pdfFiller Google Chrome Extension in your web browser to begin editing accounting services and other documents right from a Google search page. When you examine your documents in Chrome, you may make changes to them. With pdfFiller, you can create fillable documents and update existing PDFs from any internet-connected device.

Can I create an electronic signature for signing my accounting services in Gmail?

With pdfFiller's add-on, you may upload, type, or draw a signature in Gmail. You can eSign your accounting services and other papers directly in your mailbox with pdfFiller. To preserve signed papers and your personal signatures, create an account.

How do I fill out accounting services using my mobile device?

Use the pdfFiller mobile app to fill out and sign accounting services. Visit our website (https://edit-pdf-ios-android.pdffiller.com/) to learn more about our mobile applications, their features, and how to get started.

What is accounting services?

Accounting services refer to the systematic recording, reporting, and analysis of financial transactions of a business or organization. These services help in tracking income and expenses, ensuring compliance with regulations, and providing insights for financial decision-making.

Who is required to file accounting services?

Typically, businesses and organizations that generate income or have expenses are required to file accounting services. This includes sole proprietors, partnerships, corporations, and non-profit organizations.

How to fill out accounting services?

To fill out accounting services, one must gather all financial records, categorize transactions, prepare financial statements like income statements and balance sheets, and report them according to the required regulatory framework, such as GAAP or IFRS.

What is the purpose of accounting services?

The purpose of accounting services is to provide a clear picture of the financial health of an organization, facilitate informed decision-making, ensure compliance with laws and regulations, enhance accountability, and manage financial risks.

What information must be reported on accounting services?

Information that must be reported includes revenue, expenses, assets, liabilities, equity, cash flows, and any other significant financial transactions that occurred during the reporting period.

Fill out your accounting services online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Accounting Services is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.