Get the free Quarterly Income & Expense Statement (Cash Basis) - dhcd maryland

Show details

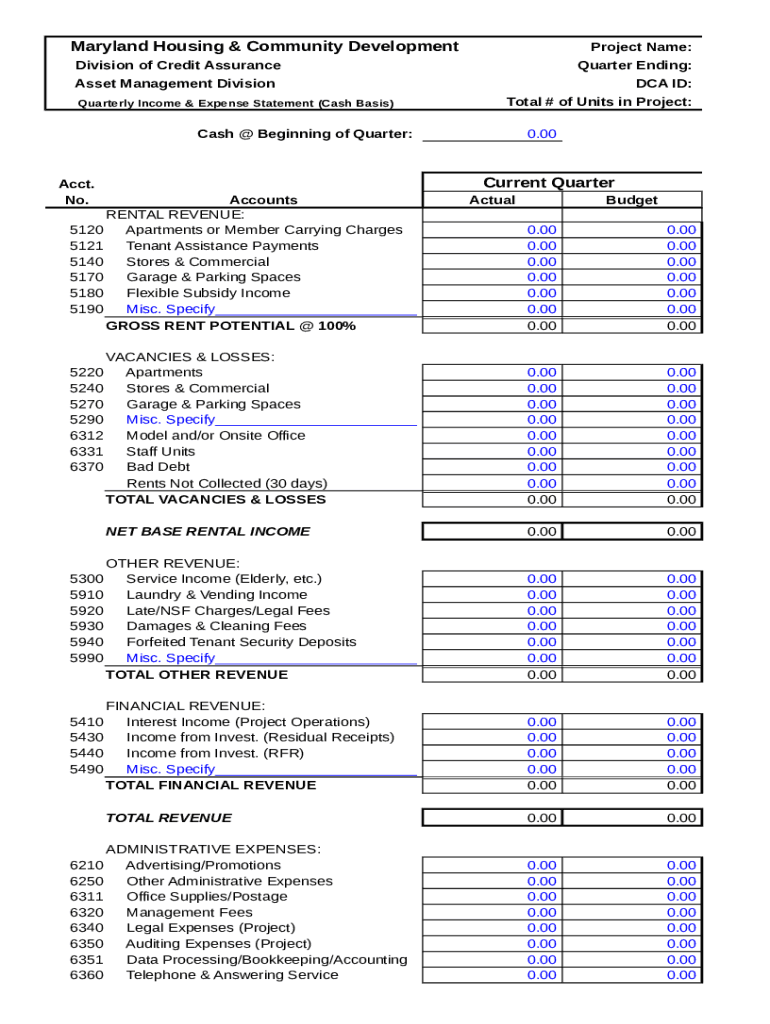

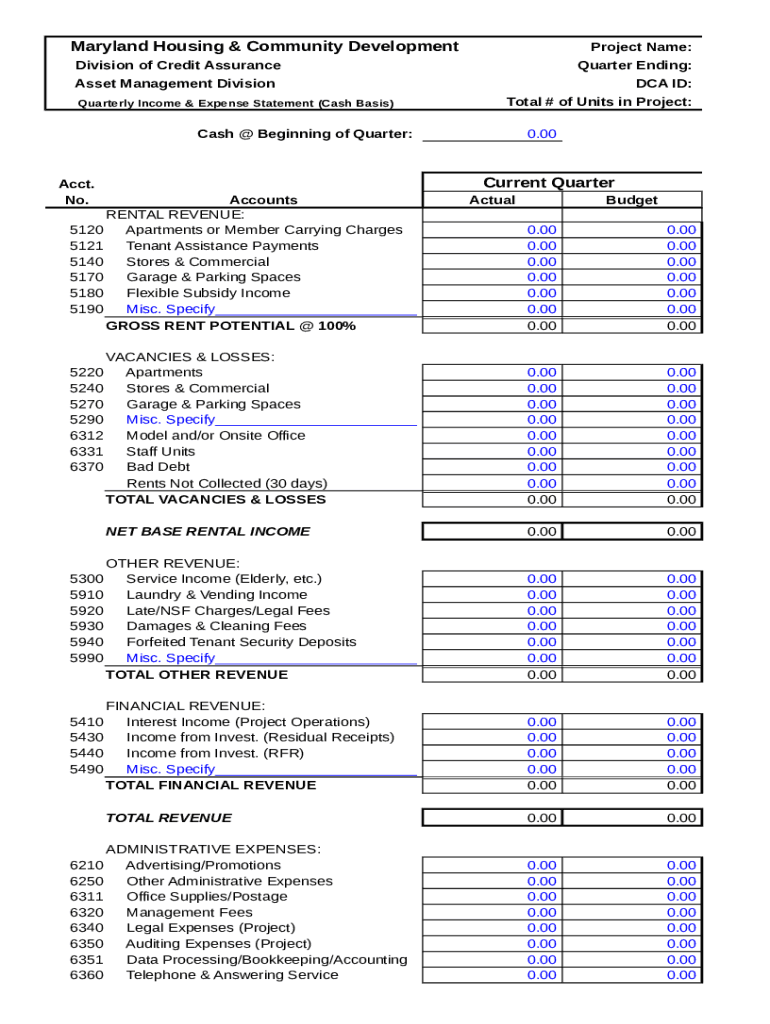

Maryland Housing & Community Development Division of Credit Assurance Asset Management Division Quarterly Income & Expense Statement (Cash Basis)Project Name: Quarter Ending: DCA ID: Total # of Units

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign quarterly income amp expense

Edit your quarterly income amp expense form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your quarterly income amp expense form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing quarterly income amp expense online

Here are the steps you need to follow to get started with our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit quarterly income amp expense. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is simple using pdfFiller. Try it right now!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out quarterly income amp expense

How to fill out quarterly income amp expense

01

To fill out the quarterly income and expense report, follow these steps:

02

Gather all financial documents such as bank statements, invoices, receipts, and any other relevant records.

03

Separate your income and expenses into different categories, such as sales, rent, utilities, office supplies, etc.

04

Calculate the total income for the quarter by adding up all the revenue generated during that period.

05

Calculate the total expenses for the quarter by adding up all the costs incurred, including fixed expenses like rent and variable expenses like supplies.

06

Subtract the total expenses from the total income to determine the net profit (or loss) for the quarter.

07

Ensure that all the calculations are accurate and supported by the relevant documents.

08

Fill out the income and expense report form, including all the necessary details such as the date, categories, amounts, and any additional information required.

09

Double-check the completed form for any errors or omissions.

10

Submit the filled-out report to the appropriate department or entity within the specified deadline.

Who needs quarterly income amp expense?

01

The quarterly income and expense report is needed by various individuals and entities, including:

02

- Businesses and corporations: They need this report to analyze their financial performance and make informed decisions about their operations.

03

- Small business owners: This report helps them track their income and expenses, identify areas of improvement, and evaluate the financial health of their business.

04

- Independent contractors and freelancers: They may need this report to provide evidence of their income and expenses for tax purposes or when applying for financial assistance.

05

- Accounting professionals and financial advisors: They use this report to assist their clients in managing their finances, creating budgets, and preparing tax returns.

06

- Government agencies and regulatory bodies: They require this report for compliance and oversight purposes to ensure businesses are operating within the law and paying the appropriate taxes.

07

- Lenders and investors: They may request this report to assess the financial stability and profitability of a business before providing loans or making investment decisions.

Fill

form

: Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How can I send quarterly income amp expense to be eSigned by others?

Once your quarterly income amp expense is ready, you can securely share it with recipients and collect eSignatures in a few clicks with pdfFiller. You can send a PDF by email, text message, fax, USPS mail, or notarize it online - right from your account. Create an account now and try it yourself.

How do I complete quarterly income amp expense online?

With pdfFiller, you may easily complete and sign quarterly income amp expense online. It lets you modify original PDF material, highlight, blackout, erase, and write text anywhere on a page, legally eSign your document, and do a lot more. Create a free account to handle professional papers online.

Can I sign the quarterly income amp expense electronically in Chrome?

Yes. By adding the solution to your Chrome browser, you may use pdfFiller to eSign documents while also enjoying all of the PDF editor's capabilities in one spot. Create a legally enforceable eSignature by sketching, typing, or uploading a photo of your handwritten signature using the extension. Whatever option you select, you'll be able to eSign your quarterly income amp expense in seconds.

What is quarterly income amp expense?

Quarterly income and expense refers to the financial reporting of an entity's income and expenses for a three-month period, typically used to assess financial performance and health.

Who is required to file quarterly income amp expense?

Businesses, self-employed individuals, and certain organizations that are obligated to report their financial activities to tax authorities are required to file quarterly income and expense.

How to fill out quarterly income amp expense?

To fill out quarterly income and expense, gather all relevant financial documents, list all sources of income, list all expenses incurred, and then calculate total income and total expenses for the quarter, ensuring accuracy in reporting.

What is the purpose of quarterly income amp expense?

The purpose of quarterly income and expense reporting is to provide a clear and structured overview of an entity's financial performance, assist in budget management, and compliance with tax obligations.

What information must be reported on quarterly income amp expense?

Information that must be reported includes total income, total expenses, profit or loss for the period, and potentially itemized details of specific revenue sources and expenditures.

Fill out your quarterly income amp expense online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Quarterly Income Amp Expense is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.